'Twas the night before Fed Day

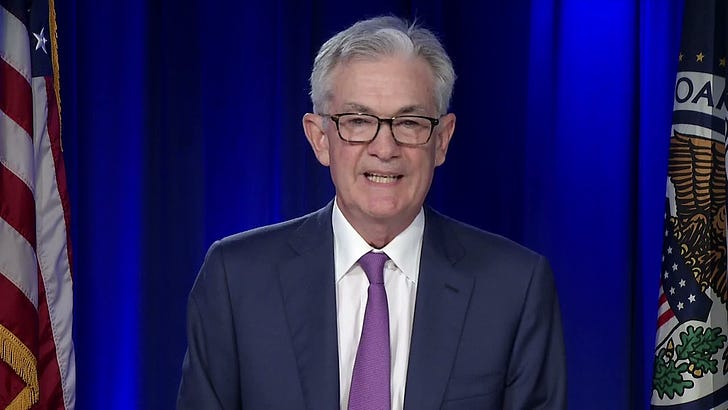

Tomorrow Fed officials vote. It's a biggie. They'll likely say it's time to support the recovery a bit less. It's then up to Jolly Old Jay to explain why and assure us the Fed ain't going Grinch.

As with Christmas, Wall Street is really excited about tomorrow. It’s finally “taper time.” What the hell is that you ask? It’s when the Fed starts buying fewer Treasuries and mortgage-backed securities. Come again? It’s one way that the Fed has helped push down on interest rates and lower borrowing costs for consumers and businesses. More spending and more investment means a more rapid, equitable recovery.

Tapering will be under the tree

The recovery is progressing. The recession ended in spring 2020 and even though the pandemic remains, we are pointed in the right direction. As the economy strengthens, it needs the Fed less. Jay Powell prepped us in September for tapering:

The Fed’s policy actions have been guided by our mandate to promote maximum employment and stable prices for the American people, along with our responsibilities to promote the stability of the financial system. Our asset purchases have been a critical tool. They helped preserve financial stability and market functioning early in the pandemic and since then have helped foster accommodative financial conditions to support the economy.

At our meeting that concluded earlier today, the Committee continued to discuss the progress made toward our goals since the Committee adopted its asset purchase guidance. Since then, the economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.

The gains in employment and wages since that FOMC meeting are almost certainly enough to ‘check the box’ on “substantial further progress” and kick off tapering.

Grinch that stole from Main Street

Of course, tapering is not enough for the inflation hawks and much of Wall Street. They will not stop until the Fed raises rates a lot. They are getting louder and louder.

Why? Because wealthy people—those who have tons of savings and money to lend out—get hosed by low interest rates. Inflation is even worse. Who benefits from low rates and some moderate inflation? Main Street, especially anyone with debt.

Top 1% live in a different world, one with trillions in wealth and low debts. The rest of us live in a different crueler world. Guess who’s side elite macro is on? Not ours.

Sadly, reality and humanity are not constraints for hawks. There’s whole army of them. Standbys like John Taylor are out in force:

The Fed is behind the curve, according to John Taylor of Stanford University and the creator of an eponymous rule for monetary policy.

In a presentation circulated by JPMorgan Chase, Taylor argued the Fed’s policy is now looser than it should be.

If it was up to him, he would have the Fed’s key rate on a path to 1% by the end of this year, from the range of zero to 0.25% now. And he would have it well on the way to 3% by the end of 2022.

“The Taylor rule implies that even if the inflation rate falls to 2% by the end of this year, well below most forecasts, and economic output reaches potential, the federal funds rate should still be 3%,” JPMorgan’s economists said in a report.

John Taylor is a professor at Stanford and a fellow at the Hoover Institutions, two bastions of ‘stick it to the people’ economics. He is also a giant in monetary policy of yesteryear. He created the “Taylor Rule” in 1992 at age of 46. (Note, the Sahm Rule born when I was age 43 and is more accurate.) His rule has been workhorse for monetary policymakers for decades. But it fell flat on its face after the Great Recession.

At first, the Fed used a watered-down, less aggressive version (Taylor ‘99 with Inertia). Even that one failed the Fed and led to raising rates too soon in 2015. Chastened by failing at both sides of its dual mandate, the Fed launched a multi-year introspection, resulting in a new “average inflation targeting” framework. It kicked the Taylor Rule with its forward-looking mumbo jumbo (technical macro term) to the curb. Good.

Give hawks lumps of coal

Taylor is not alone in his hawkish squawking now. Wealthy elite in macro like Larry Summers who have pretended to care about people are showing their true colors:

"We have a generation of central bankers who are defining themselves by their ‘wokeness,’" Summers said. "They’re defining themselves by how socially concerned they are."

"We’re in more danger than we’ve been during my career of losing control of inflation in the U.S.," Summers, a Harvard University professor, said. "We’ve gone even further towards losing it in Britain and I think we’re at some risk in Europe."

I call out Larry’s disastrously bad economic advice often.1 I do not enjoy it. I am a nice person, but someone has to combat his bad economics and defend reality. My recent post, "$1 trillion in checks and 5% inflation. Worth it!" is one example. Clearly the American Rescue Plan was a tremendous lifeline. It kept income growing in a crisis.

It accomplished its aim to help people through the pandemic. Congress and the White House had the foresight to provide a buffer through messy reopening this spring, which came with a jump in prices, as well as the harm from delta variant. Consumer spending—paying the bills, keeping a roof over our heads, and putting food on the table—continues to increase, even after taking the higher prices into account.

That shitty recovery from the Great Recession when inflation-adjusted spending stalled? Thank Larry. He was a top official at the White House in 2009 and said Americans weren’t worth even $1 trillion in relief.

You would think after all his stupid, harmful advice that Larry and his crew would have no influence at the Biden White House. Guess again. Instead of sending Larry lumps of coal, they touted him this week in a press release. AAARRRGGGHHHH.

Thankfully, John and Larry and their fanboys do NOT have votes at the Fed. Most of the people with votes are the same ones who created the Fed’s new framework. To help the Fed help the people, Biden MUST IMMEDIATELY appoint a Fed Chair, Vice Chair, Vice Chair of Supervision, and new Board member who will all bring the leadership necessary to see the new framework through.

Wrapping up

The old guard of elite macroeconomics are dangerous. They have failed Americans and people around the globe for decades. Enough is enough. We have the data, the research, and the common sense to see their advice for what it is: Bad.

It could be a close vote among the FOMC on when to raise interest rates next year. Inflation hawks are hard to reform, and the FOMC has some. They still believe in the ‘brilliance’ John Taylor and Larry Summers. Yikes.

Of course, higher interest rates could be the right thing to do next year. I hope so, because it would mean that we have a kickass recovery from now until then. A recovery that gives us some million-month payrolls. Then we have ‘mission accomplished’ on the dual mandate. We will get there, but I am impatient. Until then I will keep screaming at the hawks and cheering for the Fed and the people.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economics here, and you will receive some paid-subscriber-only posts.

Sometimes I think I am being too hard on Larry, but then I see him weaponize a word like “woke” from Black Lives Matter. A word that has been a rallying cry for a long-overdue reckoning with racism. It’s inexcusable and so Larry like.

Summers' was a political view about how he thinks the Fed sill behave in the future. Nothing to do with economics.

Taylor is superseded (assuming it really is) by a Fed policy that does not target ST rates at all, but average inflation.