$1 trillion in checks and 5% inflation. Worth it!

2021 began with economists arguing about $1,400 stimulus checks. Americans got them, but they got higher inflation too. Even so, the checks were very good policy.

Congress had a choice to make during the Covid crisis: Get some money to families like we did during the Great Recession. Or go big and get a lot of money out.

They went big, really big.

In 2008, Congress enacted one round of stimulus checks, totaling about $110 billion. During the first year of Covid, it sent out three rounds at close to $1 trillion dollars. A family of four got $11,400, which is about 20% of median family income. Wow!

IT WAS WORTH IT

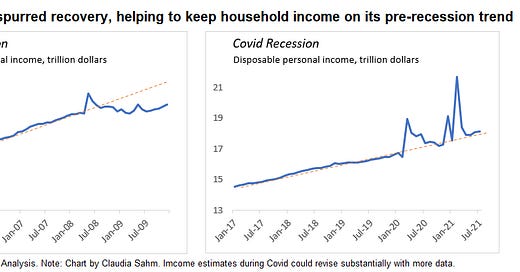

Take the win! Coming out of an economic disaster and deadly pandemic, aggregate disposable income in the United States is on its pre-recession trend. That was absolutely not true after the Great Recession. It lagged behind for years. Yes, the two recessions were fundamentally different. The policy responses were also. $5 trillion dollars from Congress within a year this time is real money.

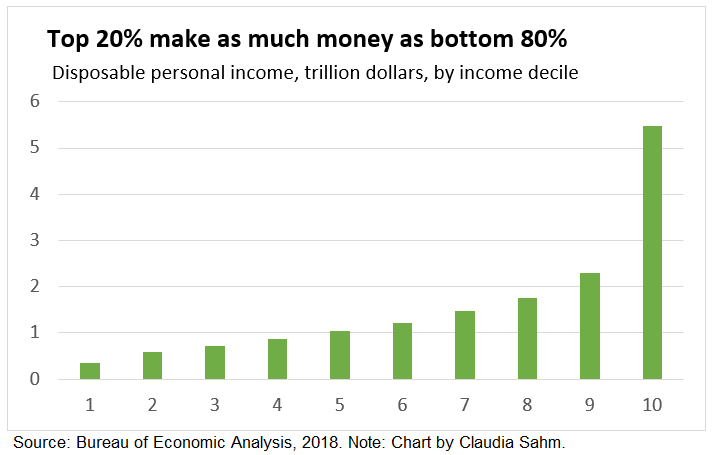

Some economists look at the totals this time, and say we did “too much.” That the checks were overkill. Be wary, Aggregate numbers mask huge inequalities in the United States. As one example, before Covid, the top 20% of households by income—same ones who did not get the full stimulus checks—made as much money after taxes and transfers as the bottom 80%. Jeff Bezos looms very large in the totals. His warehouse workers, combined? Hardly at all. Welcome to America.

Remember that when you hear an elite economist cry that the $1,400 checks had “no good economic argument” behind them. What’s the good argument behind our unequal, unjust, racist economy? Yeah, that’s what I thought, dude.

Now, the big relief programs from Congress during this crisis are not enough to get us a better economy. This is not a one and done, Congress. Even $1 trillion in checks spread out over the bottom 80% hardly makes a dent in the inequality, especially when we consider that income losses during Covid were much more likely among the poor and middle-class families.

Research and data back it up

I am not here with a bunch of ‘pretty charts’ and low blows. I bring research. I bring people’s lived experiences. Before the checks passed, I wrote research brief :

This brief provides extensive evidence on how the checks benefit people and help spur an economic recovery for all. Drawing on over a decade of rigorous research, I argue that checks should be in the next relief package and that everyone who received a $600 check should receive a $1,400 check.

Then I fielded a survey on the $1,400 checks and wrote another report:

The checks provided a sizable boost to overall spending this spring and helped millions of families in need. In short, stimulus checks worked. Nearly one quarter of families said they “mostly” used their checks to increase their spending, and many other families spent some portion of their checks. Taken together, more than half of the $400 billion disbursed was spent within a few months of receipt. Families who did not use this assistance to increase their spending instead used it mostly to pay down debt (45%) or increase their savings (31%). While those latter two uses did not directly boost the aggregate demand, they did create a financial buffer and reduced debt burdens.

Why do I tell policymakers to send out checks in economic crises? Over a decade of analysis—my research, others. research, real-time forecasting at the Fed, and surveying households—I know that it’s good policy. Families need help and the recovery needs to be as fast as safely possible. It’s not the only relief necessary in recession and it may not be the most important (jobless benefits likely are), but it is right up their near the top of smart policy.

Why? The three rounds of stimulus checks provided both relief to the families whose lives Covid disrupted (everyone) and helped bolster the economic recovery (jobs). Relief pays the bills. Stimulus brings back paychecks. Win, win.

Checks made an awful year more bearable

People largely make money to spend money. With the inability to make money during the crisis, Americans faced a dramatic cut in their spending. It takes money to feed the kids, pay the bills, keep a home, and afford medical care. Plus big cutbacks in spending—in an economy driven by consumers—leads to big layoffs. Keeping money in people’s bank accounts was key to keeping the recession as short-lived as possible.

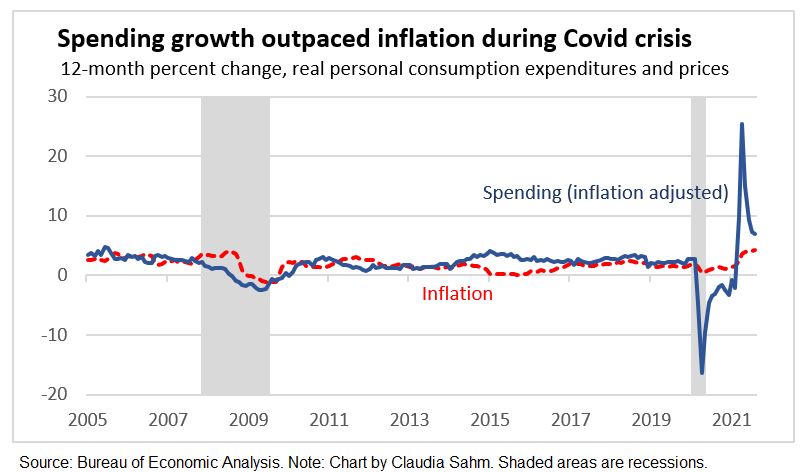

Clearly, a fast recovery came at a cost. No free lunches. In fact, lunch costs more now than two years ago. But don’t let the hawks fool you, consumer spending, even after we take inflation into account kept increasing even as the pandemic raged and millions were out of work. That’s good, very good.

THAT IS A REALLY REALLY BIG DEAL. It is crushing to see the pundits move along to the next crisis now. As I wrote on my macromom blog, the recovery from the Great Recession was horrible, even worse than the meltdown in 2008.

Fast forward three years to 2011. We had gotten past the financial crisis, coffee no longer ran out in our cafeteria before 9 am, and the stress of work was less acute. The recovery was moving along but not as expected. That was the hardest time at work for me. (Yes, I added a broken heart to this forecast-evolution chart.)

Not, everyone had a ‘monetary-policy induced’ mental health crisis (Fed dork to the core), but the pain millions of families lived through was even more intense.

Yes, today, we are paying more. We are getting so much more stuff. AND millions of jobs have come back (millions more to go). The speed of this recovery is not normal. The recession was not a mild one, It was the deepest since the Great Depression. DO YOU REMEMBER 2020? AAARRRRGGGGHHHH. We are not back to normal yet, but compared to last time, policy is fighting for us.

Lessons for the next recession?

Source: film clip from "Jerry Maguire."

Ok, seriously there are lessons. The big one is that the timing and size of the checks should be tied to economic conditions during the recession and recovery. Then build the administrative systems to ensure that everyone gets the money quickly. (I am not convinced that more targeting is feasible or desirable, but that’s a question to investigate.) Above all, Congress needs to agree to a plan before the next recession and put the extra relief on autopilot. WE CAN DO IT. YES, WE CAN.

Wrapping up

Stimulus checks during Covid were really good policy. The money went out more quickly and to more people than any other economic relief program. It made a huge difference in this crisis. Next time, let’s do more of a good thing. To prepare, policymakers should commit now to send out checks in the next crisis.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economics here, and you will receive some paid-subscriber-only posts.

Not knowing how our money works was the cause of failing to act rapidly & correctly in 2020

Those who knew how money operates knew that when our USA-FED-GOV needs a country which is free of people infected by a communicable airborne disease that need then becomes a provision which our country’s USA-FED-GOV can pay to acquire

Our USA-FED-GOV could have afforded the immediate hiring of every citizen & of every person visiting (by invitation or misadventure) as Emergency Public Health Employees

Our USA-FED-GOV could have afforded the immediate paying of each EPH employee a weekly amount of money of $25 an hour for each of the 24 hours in a day (keeping distant to prevent disease transmission is 24-Hour work) for a weekly salary of $25 x 24 hours x 7 days

Our USA-FED-GOV could have afforded paying EPH employees for 42 days of country-wide isolation which is an amount of time of disruption of non-emergency commerce far less than has occurred.

When one knows how money operates solutions appear to so many problems that stump the unknowing.

note: The people who know how money operates are alive. You can ask them.

Plain and simple about 15+/- yrs ago a single family on 1 construction workers income could afford AT LEAST TWICE what they can now. I make the a few $ more than my dad was pre Obama (pre his forced retirement), but my wife has to work too so we can afford about what my family did growing up……math is math, Anyone that can’t see the fact that maybe family’s income did go up during the Obama welfare state, and maybe some ppl are getting paid more now after these INSANE stimulus checks that only like 10% of the money went to covid…. (but anyway) HAS BEEN AND IS A HORRIBLE THING FOR THIS COUNTRY AND ECONOMY in the long run is just ignorant of how economics work. Yea pay went up, BUT NOT AS MUCH AS THE COST OF LIVING DID….it’s simple math In 2021 so far inflation is up 6% (or maybe that was 2020, but either way)!!! In a single year…..!!!??? Hey I made $20k more but hey that house I wanted costs $50k more or that car cost $15k more, or that bottle of coke is $3 instead of $1.75 and milk is $4 instead of $2……gas was half the price it is now only 1-1/2 yes ago! If we don’t fix this mess that Congress and Obama created this country will be totally bankrupt in a matter of years and that’s when the Socialists will REALLY push for socialism and people that don’t remember PRE OBAMA days (good American days) will fall for it too. Just think most jobs USED to do a 3% inflation pay raise every year, now your real real lucky to get 2% but inflation went up 6%. MATH IS MATH