The Sahm rule: step by step

Tomorrow is Job's Day, and we will learn what the unemployment rate was in November. So, it'll also be time to update the Sahm rule, my recession indicator.

Today’s post is a how-to on calculating the Sahm rule. It’s for anyone who wants to apply it themselves or apply the logic to other data. Alternatively, you can follow the monthly updates on FRED—that’s what I do.

Start with the unemployment rate data.

The Sahm rule is based on the U.S. unemployment rate (U-3). You can download the data from FRED—a national treasure—here.

The unemployment rate was 3.9% in October and has been below 4% for the longest stretch since the 1960s. (Use the one-decimal rounded estimate in the release.) No matter the inflation, we should never take the recovery from the Covid recession for granted. We fought hard for it.

Smooth out the monthly ‘bumps and wiggles.’

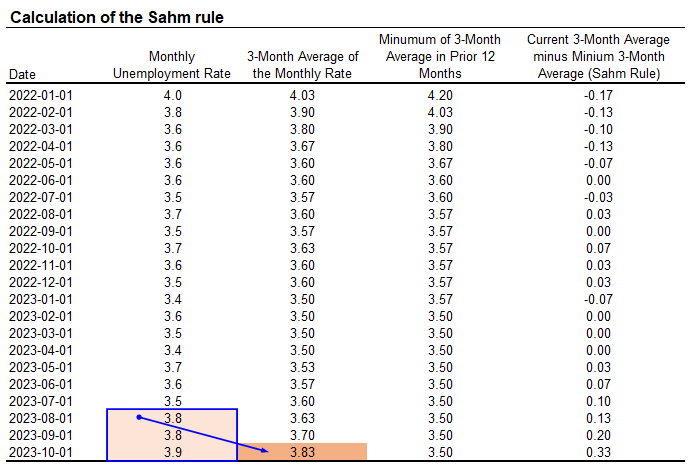

It is important to never overreact to the latest numbers about the economy, regardless of what data series we’re talking about. Being data-driven is good, but being data-ridden is not. So, the Sahm rule uses the 3-month average of the monthly unemployment rate, not the monthly rate. Calculate that average in each month and create a new series, “3-Month Average of the Monthly Rate.” That new series is what we will use in the next step.

For example, the average of the August, September, and October unemployment rates (light orange) in the second column is 3.83%, so that is the October value of the 3-month average (dark orange) in the third column.

Look back over the prior year.

The logic of the Sahm rule is that when the unemployment rate starts rising, it often picks up steam, and we end up in a recession. A key input to the rule is the lowest value of the 3-month average (dark yellow) in the prior 12 months (light yellow). Note the 12-month look-back does not include the current month.

Currently, the lowest value of the 3-month average of the unemployment rate is 3.50%. We held at that low from January through April 2023. That’s truly remarkable. The Fed’s estimate of the long-run, sustainable unemployment rate is 4.0%. A low unemployment rate is good for more than people looking for a job.

Put it all together.

The most important part of the Sahm rule is the change. Take the current value of the 3-month average (dark orange) and subtract the 12-month low (dark yellow), and if the difference (green) is 0.50 percentage point or more, then we have historically been in a recession. We are not now.

In October 2023, the Sahm rule was 0.33 percentage point. That’s below the trigger but also up notably from its values earlier this year. The 3-month average would need to be 4.0% for the Sahm rule to trigger. So, at a minimum, the monthly unemployment rate would need to rise to 4% for 3 months. At an extreme, if the November unemployment rate came in at 4.3%, the 3-month average would be 4.0%, and the Sahm rule would trigger. That’s highly unlikely.

But remember, even if it does trigger, a recession is not a done deal. The Sahm rule is a historical pattern, and this time could easily be different.

In closing.

I created the Sahm rule, and it’s on me to communicate it well. I try. If you have any questions, please add them to the comments.

Good statistical insight!

The 3 month average (equally weighted) will introduce sampling artifacts into the result. A weighted average will give a clearer signal.....try weights of 0.0909, 0.36363, 0.5454 or perhaps a wider window....the sum of weights should equal one whatever the ramp looks like.

Have you tried Sahm rule on European states? It would be interesting to see how Sahm rule weighs on those economies. I know they are different from US but still have many similarities.