Let's get real: the American Rescue Plan was the best economic policy in forty years

Nearly a year and a half into the recovery from the Covid recession, it's indisputable that fiscal relief was a success. Not so, after the Great Recession. It fell far short.

It’s time to set the record straight.

The recovery is moving fast, and the American Rescue Plan is integral to that fact.

Inflation hawks will tell you the Rescue Plan was a massive failure, citing only higher inflation. They are wrong, and we cannot allow them to write the Covid history book. Yes, inflation’s been higher and for longer than expected by proponents of the more relief like myself. Put inflation in CONTEXT, and the hawk’s case falls apart.

If you look broadly at what’s happening in the U.S. economy—inflation-adjusted consumer spending, jobs, business investment, and household balance sheets—it’s clear that Americans are winning. That was not the case after the Great Recession when some of today’s hawks led policy.

Here are the facts:

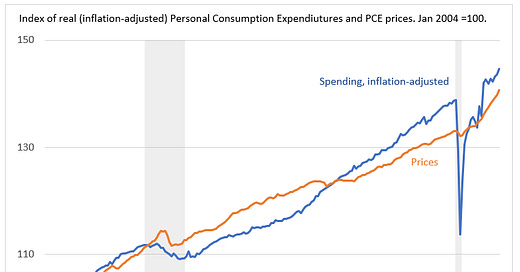

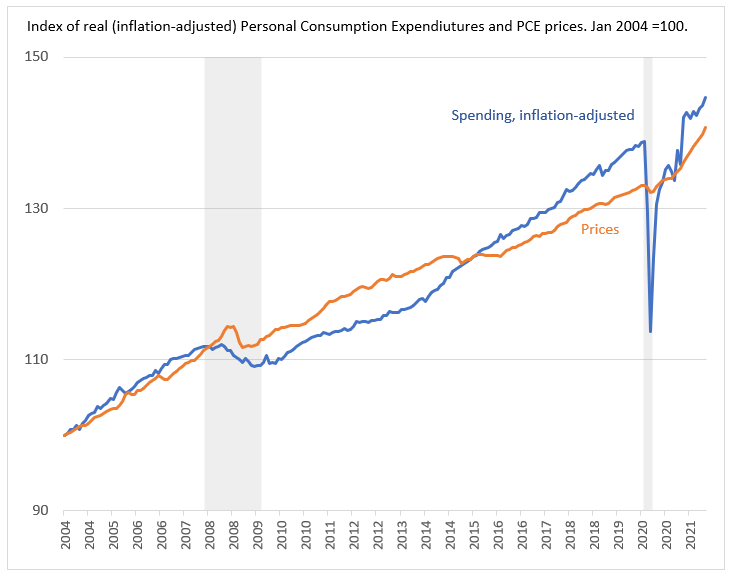

Consumers are getting more, even with the higher prices!

Source Bureau of Economic Analysis. NoteL Shaded areas are NBER recession dates. Chart by Claudia Sahm.

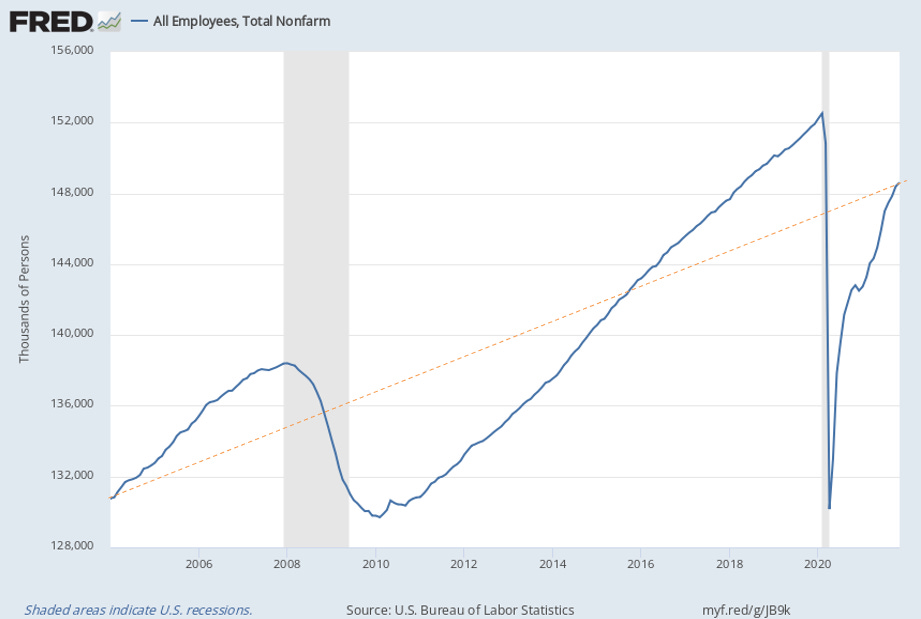

Jobs! Jobs! Jobs! 1/2+ million per month in 2021!!!!!!!

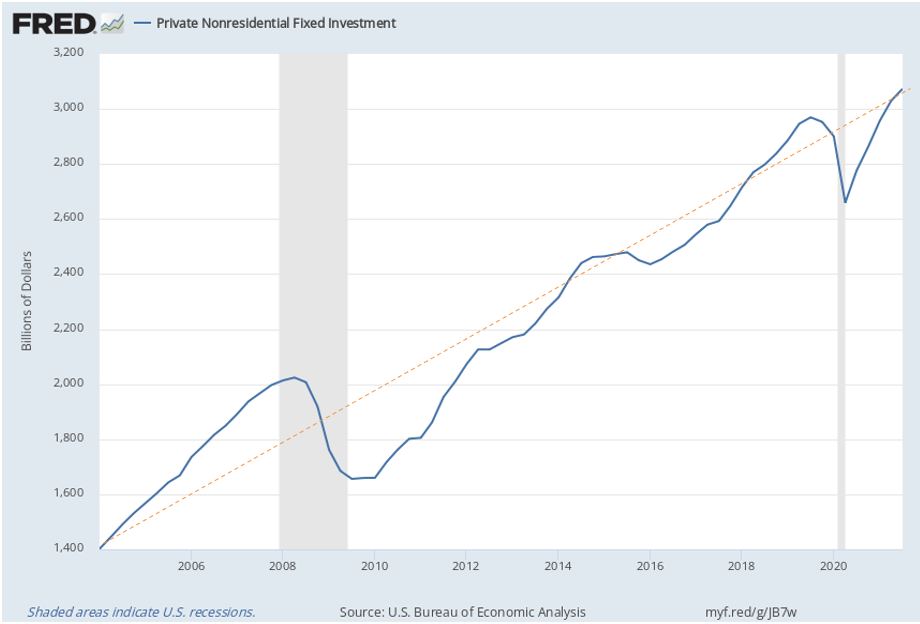

Business investment is back on track!

Note: Business fixed investment includes: non-residential structures, equipment, intellectual property, and residential housing.

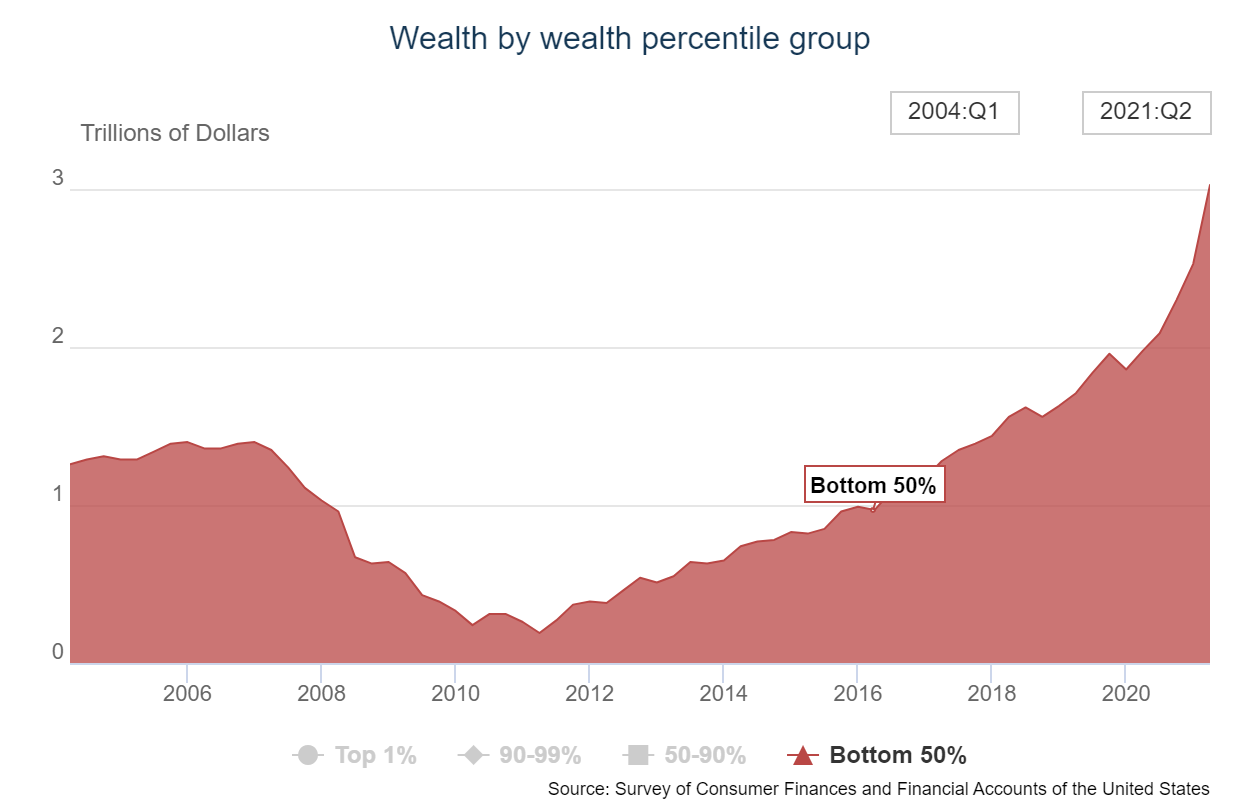

More people have more wealth: a very good thing!

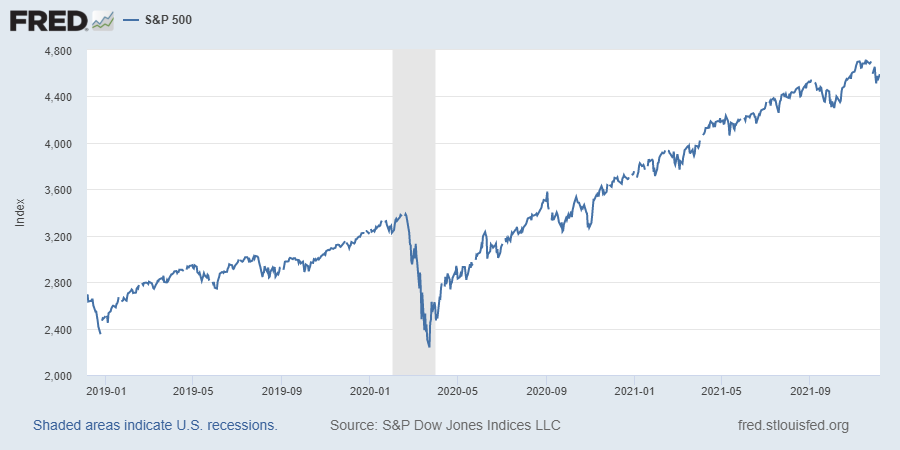

Wealthy are raking it in. (If that’s what you care about.)

Wow. Now that’s what I call a recovery.

Yes, the two recessions are fundamentally different. This time we have a deadly, global pandemic—that is still not under control—last time, it was a housing market meltdown during which millions lost their homes.

Yes, aggregate data often mask the experiences of most Americans. I made that point in an earlier post on who’s hurting from inflation now. When the spending-by-income data come out for 2021, I will analyze them. In the meantime, the best approach is to look at many different series. (Note well, the distributional wealth accounts and employment data represent individuals better.) No single data point tells the whole story. That’s why we must anchor economic policy debates in a wide range of them.

The data above are not exhaustive. We learn something about the U.S. economy and the financial lives of families and businesses every day. Our country is dynamic, and it is going through significant upheaval now. It’s essential to look at the big picture.

Sadly, not everyone embraces my approach.

Be wary of Larry.

If you can look at all that we know about the economy right now and say with a straight face that the American Rescue Plan was a failure, I have no idea what you define as success. To get more specific, I have NO IDEA what Larry Summers defines as success, other than bolstering his ego.

It’s not personal. I wish Larry well in his life. I’m sure he lives a comfortable one. Our mutual friends assure me he’s a great guy. My problem with Larry and his elite hangers-on is their destructive economic policy advice.

Larry did more than anyone in the Obama White House to undermine the recovery from the Great Recession. Obama and Dems in Congress enacted less than a trillion dollars in stimulus, with hardly anything during the recovery. The jobless got a measly $25 extra a week. (Note, well, work disincentives were all the rage then too. According to the establishment, any dollar to the unemployed is a dollar too much.)

Then after his policy failure became painfully apparent, Larry engineered a “secular stagnation” narrative to blame the shit-ass (technical macro term) recovery on forces beyond anyone’s control. It wasn’t his fault. It was everyone else’s. As my earlier post on Larry’s research discusses, he would have been a natural cheerleader for the massive fiscal response during the Covid crisis. Want demand? You got it.

But, here’s what he had to say about the American Rescue Plan in March.

In his latest attack on the recent rush of stimulus, Summers [said] “what was kindling, is now igniting” given the recovery from Covid will stoke demand pressure at the same time as fiscal policy has been aggressively eased and the Federal Reserve has “stuck to its guns” in committing to loose monetary policy.

“These are the least responsible fiscal macroeconomic policy we’ve have had for the last 40 years,” Summers said.

Give me a break. In the last forty years, the least responsible fiscal macroeconomic policy was the American Recovery and Reinvestment Act in 2009. He knows it. Or he should. And that’s why he has fought so hard to undermine the American Rescue Plan. It would prove that the previous recovery WAS a policy mistake.

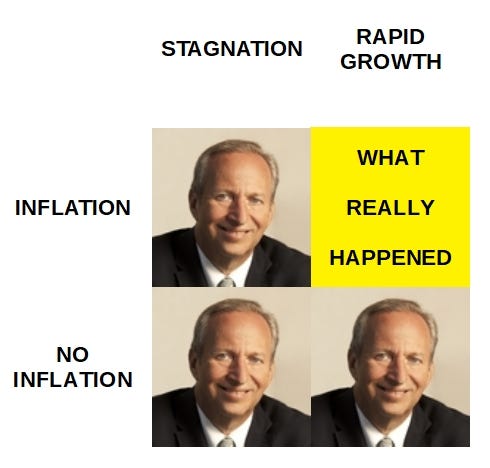

Larry’s motives have been clear for a while. Do you see something odd in his now infamous 1/3-1/3-1/3 forecast?

[Larry Summers'] said he believes there's "a one-third chance that inflation will significantly accelerate over the next several years.

There's a one-third chance that we won't see inflation, but that the reason we won't see it is that the Fed hits the brakes hard, markets get very unstable, and the economy skids closer down to a recession," he said.

"I think there's about a one third chance that the Fed and the Treasury will get what they're hoping for and we'll get rapid growth that will moderate in a non-inflationary way."

He’s missing what has happened!! Higher than normal inflation AND faster than normal growth, even after adjusting for inflation.

The meme on Twitter this week captures it beautifully.

So is Larry admitting he made a mistake? Hell, no. He continues to loudly and obnoxiously berate the Biden Admin and the Fed, trying to pump up his ego.

I honestly don’t care as long as no one takes his views of the American Rescue Plan when designing the next response to a recession. The relief was not perfect, and next time we should tie its size and timing to economic conditions. HOWEVER, no one should question the “Go big, Go broad, Go fast” approach during Covid. It’s okay to be wrong, Larry. I’m too sometimes. We all make mistakes. I’m not wrong now.

Wrapping Up

Big picture: the economic recovery is going very well, and fiscal relief played a significant role. We are headed toward the finish line, albeit a bumpy ride. Above all else, we must get the pandemic under control, or it will take far too long to bring everyone back financially. Most tragically are the loved ones we are losing forever.

Don’t listen to the pundits, especially those with an agenda. Listen to the data. They are the way people speak to economists. Listen to the people.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economic policy. You will also receive some paid-only posts.

American Rescue Plan:

Pro-Real output, Jobs, Wages, Profits, Stock Market, Household Balance Sheets

Con-Inflation

I think the corporate media is playing up "INFLATION,INFLATION,INFLATION!" because they represent the creditor class. Creditors are the big losers in an inflationary environment. Debtors are the big winners. Things really haven't changed that much since WJ Bryan said "You shall not crucify mankind upon a cross of gold"

Thank you for adding to the let’s ignore Larry chorus. I sing the hymn in sprkinkled comments whenever I can. I actually think he’s a deep plant by the GOP.