No, you didn't invent the Sahm rule and that's ok, we need more tools!

The Sahm rule has gotten more attention recently and predictably that has come with questions about who created it. I did. Now is a good opportunity to talk about on macro tools in general.

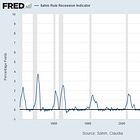

Main takeaway: The Sahm rule indicates that the U.S. economy is in the early months of a recession. It is not a forecast. Any rule for forecasting or anything other than the U.S. (national) economy is not the Sahm rule.

Today’s post goes back to the basics of the Sahm rule—a recession indicator that I developed in 2019. You can read more about me and my work, including on the Sahm rule, in a recent profile piece by Greg Robb at Marketwatch:

Sahm knows a thing or two about how recessions begin. The economist and former Fed staffer created the Sahm rule, a popular indicator that is considered the best — and earliest — warning system for recessions.

She noticed that recessions, both severe and mild, shared one characteristic: They started when the three-month average of the unemployment rate rose by at least half a percentage point from the minimum three-month average of the previous 12 months.

Here, I explain how the Sahm rule differs from others that people have shared with me or are using. I am thrilled to see many tools—new and old—to help us avoid or fight recessions. But it’s important to understand the differences.

Goals and metrics for success.

Tools help us achieve our goals. A good tool is specific to the goal and meets the criteria that define success. The Sahm rule is a good tool.

Sahm Rule’s Goal:

A rule to automatically send out stimulus checks as early as possible in a recession—economic conditions, not politics, determine the timing of the relief.

Sahm Rule’s Criteria:

Uses a widely-followed economic statistic.

Simple formula.

Highly accurate.

Triggers as early in a recession as possible.

Goal: Check. The Sahm rule indicates that we are in the early months of a recession. It is not a forecasting tool. Several others at the Fed and on Wall Street have created forecasting tools. The Sahm rule was novel because its goal was novel: a tool to start relief such as stimulus checks automatically.

Criteria 1: Check. The unemployment rate is the most closely followed and important economic statistic. (It may seem that the CPI is, but that will pass.) In addition, the unemployment rate comes directly from a monthly survey of Americans. A big increase in the unemployment rate means that millions of workers are losing their jobs, and tens of millions more workers are losing raises and job opportunities. That’s why we fight recessions. The Sahm rule exists to help fight recessions.

Criteria 2: Check. The current three-month average of the US unemployment rate minus the low of the three-month average in the prior twelve months. What could be more simple? (Note: monthlies are always a bad idea due to the noise.)

Criteria 3: Check. The 0.5 percentage point or more trigger is highly accurate. Since the 1970s, it has always been triggered in the early months of a recession and never outside of one. (Note: In 1976, it got very close to a false positive in the real-time data, but it did round down; however, it is truncated at two decimal places as 0.50 in FRED.) The Sahm rule is a tool to send hundreds of billions of dollars of fiscal relief, so I set a very high bar on accuracy—more below on how other rules, especially for forecasting, do not and thus are different.

Criteria 4: Check. I spent several weekends fiddling around with an Excel spreadsheet, trying to find the best formula and the smallest possible value that triggered as early as possible in a recession but not outside one. I tried 0.3 percentage point and 0.4 percentage point. Both were triggered in 1976 and 2003 (in the real-time data), which were outside a recession. If they had worked perfectly, I would have used them. They did not; 0.5 percentage point did.

It is important to use real-time data—the data we had at the time before any revisions. ALFRED is the source I used. Why use real-time data? We make policy or investment decisions in real-time. So, it’s best to test our tools in the conditions in which they would have been used.

With the unemployment rate, only the seasonal factors are revised, but that can still make a difference. It did in 1976. More recently, the ‘alarm bells’ rang (not by me) in October 2023—when the unemployment rate hit 3.9%, and the Sahm rule was 0.33 percentage point. Both have since been revised down. In general, the real-time and current data Sahm rules are similar, but the trigger was set off the former.

Sahm rule vs forecasting rules.

I will compare one example of the Sahm rule to a rule from Goldman. (Other individuals have sent me different examples of rules.) These are not the same rules as the Sahm rule, but they are good teachable moments.

Again, a key criterion of the Sahm rule is accurately indicating that the US economy is in a recession. The Sahm rule is not a forecast. Traditional forecasting tools, like an inverted yield curve, low consumer and business sentiment, or the 1970s, have failed in the past few years to call for a recession. I have pushed back on that call, but my forecasting tools were not the Sahm rule.

Why is an indicator versus forecast distinction so important? A high degree of accuracy or precision is generally not required or possible when forecasting recessions. See the yield curve’s popularity. One rule for forecasting a recession—in many circles, including the Fed and Wall Street—is an increase in the unemployment rate that is more than one-third of a percentage point. Here is a Goldman Sachs research note from 2000 that Bill Dudley sent me:

Even when the note was written, that rule was not a “surefire sign” to predict a recession. In September 1976, the increase in the 3-month average (using real-time data) was more than one-third, and no recession followed. Then later after the note was published, in June 2003, there was a false positive again. That might be good enough for forecasters on Wall Street but not for fiscal policy.

The goals are different, but the principle of the labor market is the same. As I said,

The labor market’s bottom [won’t] fall out all of a sudden,” [Sahm] said. “But if the bad momentum gets going and you wait to see it clearly in the data, you’ve probably waited too long. Because once that snowball gets going downhill, nobody can stop it.

Goals matter; details matter for macroeconomic tools. The Sahm rule is distinct from the Goldman one or any I have received for forecasting. I love a good tool; let a thousand flowers bloom, but the Sahm rule is distinct.

Wrapping up.

Tools are important, but how we use them is most important. The Sahm rule—whatever we call it—has always been a supporting actress. The star of the show is automatic stimulus checks. We need more reliable tools and macroeconomists in the policy world and academia who think hard about real-world fiscal policy.

Other posts on the Sahm rule:

I love your work! Thank you for continuing to be you.

Another clear and useful column. I agree that the focus of your tool is and should be on directly moving fiscal policy, for the express purpose of triggering government support for workers suffering, or at risk of suffering, unemployment due to recession.

Also, I'm sorry you get trolled and smeared. I'm glad that Dudley credits you for creating the SAHM rule.