How good is the economics in Bidenomics?

Last week, President Biden laid out his thinking on economic policy, so how does it line up with the thinking of economists?

Resilience versus efficiency.

Resilience versus efficiency is causing ‘a tug of war’ among economics, and it’s clear that Bidenomics puts an emphasis on resilience.

Efficiency has long been a key criterion that ‘mainstream’ economists use to evaluate policy. The reason for that efficiency reduces prices. The quest for efficiency led to just-in-time supply chains, underpaid service workers, and the deregulation of the markets. The pandemic revealed the true costs of the focus on efficiency.

What does resilience mean? Here is a definition from Markus Brunnermeier, an economics professor at Princeton:

… the concept of resilience leads us to emphasize “a just in case” approach, which gives us the ability to recover quickly after a shock … For that to occur, we must prioritize resilience, which turns redundancies into a virtue rather than a vice. Safety buffers are useful because they allow us to absorb shocks.

That’s a snippet from Brunnermeier’s excellent book, The Resilient Society. His book lays out the argument for resilience and gives examples of how attention to resilience can change how we judge policies. Note efficiency is not always bad, and resilience can go too far. As complements, not substitutes, they would strengthen the policy.

Bidenomics gives some priority to resilience, to the frustration of many economists who reflexively see it as inefficient and wasteful. CHIPS Act, as one example, incentivizes companies to produce semiconductors in the United States instead of importing most of them abroad. It is a direct response to the semiconductor shortage during the pandemic that depressed the production of consumer goods, leading to higher inflation. Through an efficiency-only lens, CHIPS is questionable. Subsidies may go to firms that would invest anyway, and it’s costlier to produce here. But through the lens of resilience, CHIPS scores well.

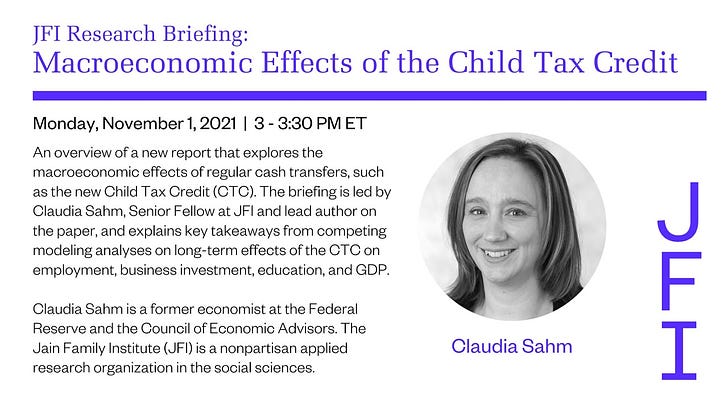

People are not bridges and roads, but investing in them can have similar, big payoffs. As with physical infrastructure, investments in people can take several years to bear fruit in the overall economy, so we often don’t see the full benefits right away; of course, the benefits for the people who receive the support are immediate: and sizable, child poverty fell in 2021. In other words, the 2021 Child Tax Credit worked.

Child poverty, calculated by the Supplemental Poverty Measure (SPM), fell to its lowest recorded level in 2021, declining 46% from 9.7% in 2020 to 5.2% in 2021, according to U.S. Census Bureau data released today.

Child poverty is a huge social problem. Here’s one account of how poverty harms children.

Poverty, for children, is not simply a matter of getting by with less of the essentials of life. Particularly at its extremes, poverty can negatively affect how the body and mind develop, and can alter the fundamental architecture of the brain. Children who experience poverty have an increased likelihood, extending into adulthood, for numerous chronic illnesses, and for a shortened life expectancy.

Investing in people, what the administration called human infrastructure, pays off.

Bidenomics tried to elevate investments in people to the same level of importance as investing in physical infrastructure. One example was the 2021 Child Tax Credit, part of the American Rescue Plan, which slashed child poverty. Frustratingly, it ended after one year due mainly to unfounded jitters over inflation and work disincentives. Even if that program is no more, we now have a proof of concept. It can be done.

.

Beware of …

This last section outlines possible mistakes that Bidenomics should avoid. Or at least know that they are likely to cause headaches.

Christmas trees.

A multitude of goals—as with Bidenomics—has upsides and downsides. Trying to do everything at once is a potential downside. Here’s a metaphor: Often, we start with a lovely Christmas tree (enacted policy), and then we put more and more ornaments on it (non-enacted policies). Eventually, the tree falls over, and the ornaments get smashed.

It’s easy to see how this might happen, especially when it’s difficult (or impossible) to get some economic policies through Congress. In response, policies that did get passed act as the ‘host’ for policies that did not, My Bloomberg piece is my critical reaction to the administration adding child care as a consideration for receiving federal grants for chip production.

One should temper expectations about the benefits of tying childcare to receiving Chips Act subsidies. An argument could be made that if the government is investing in a firm, then the firm should be required to invest in its workers, including parents. But to claim that the requirement is a path to bring more women into the workforce is unfounded and distracts from the programs that might.

Industrial policy is hard to do well; the same is true for universal child care. Doing them together could undermine both efforts. Nearly all ‘mainstream’ economists would criticize any form of industrial policy, and many feel the same about child care.

Angry macroeconomists.

It’s not hard to find an angry macroeconomist. At this point, every macroeconomist, including myself, has made mistakes in assessing the upside-down-and-backward economy. No one likes to be wrong, and that’s part of the anger. Also, some anger comes from those trying to carve out a space for themselves in the coming professional debate over what the heck just happened. Finally, some ‘mainstream’ macroeconomists get angry if ‘heterodox’ economists also get a seat at the table. Not much of that anger has to do with policy. If you find a macroeconomist who isn’t angry about anything, be doubly wary.

Chasing credit for the economy.

Biden has an impossible task in selling Bidenomics. Even if inflation were to drop to 2% tomorrow and the unemployment rate was at a fifty-year low, Biden would not get credit outside his base. Plus, polls nearly always show that people view Republicans, not Democrats, as more responsible for the economy. That’s at odds with reality:

The US economy has performed better when the president of the United States is a Democrat rather than a Republican, almost regardless of how one measures performance.

According to a Gallup poll last month, Biden's worsening job approval corresponds with Americans' increasingly negative economic views of the economy. It found that 16% rate the economy as excellent or good; 37% rate it as "only fair,"; and 47% describe it as poor, an increase from 43% who said the same in March.

Politics affect sentiment about the economy. For example, when the president is a Democrat, the sentiment of Republicans is low, and that of Democrats is high. This divergence is not new, but it increased notably under Trump and remains wide.

These differences largely wash out when averaging across all respondents, but it does show that the economy, while important, is not the only thing affecting sentiment.

In closing

The economics of Bidenomics draws on many strains of economic thinking; that’s a good thing, but it makes it impossible to ‘score’ the economics. Plus, Biden is not using the past playbook, which is risky, but with four major pieces of economic legislation enacted within two years in office are impressive.

If theres one thing that continues to bother me is the constant obsession with rate hikes. Today, the US had a strong ADP jobs report more than twice the expected amount and yet, there is a 90 percent chance of rate hikes in the next FOMC meeting this month. Its also sad, that too many economists who want these rate hikes, don't get that the aggressive hikes have forced the fed gov to pump more interest income to bondholders and acts as another layer of gov spending. Inflation as we all know, has come off its peak primarily due to improved supply chains and lower energy prices. Outdated macro thinking won't get us anywhere.

There was a recent article featuring G7 economies and the US out of those nations in the G7 has the highest growth and the lowest inflation. To me, the media I think has to bear responsibility for so much of the negative sentiment on the economy. There is obviously nothing perfect but it has more than held its own.