The clock is running out on the support for kids

Families will receive their last monthly check from the new Child Tax Credit a few weeks before Christmas unless Congress acts soon. Extend it into the New Year.

My new opinion piece at the Washington Post is an evidence-based plea to Senator Joe Manchin and other members of Congress to extend the Child Tax Credit immediately.

The new monthly credit is a lifeline to families, especially now as they face higher costs at the grocery and the gas pump. Our seniors will get a 6% cost-of-living increase in their Social Security benefits in January. Likewise, we should not pull the rug out from under our kids, by cutting off the monthly credit.

In my piece, I also explain why it’s important that Congress should NOT change the eligibility as suggested here:

Sen. Joe Manchin III (D-W.Va.) has raised two concerns. First, he says, “There’s no work requirements whatsoever. . . . Don’t you think, if we’re going to help the children, that the people should make some effort?” Second, he would like to restrict the program to help only families with incomes of about $60,000 or less.

No income minimum or work requirement

The economic case against requiring parents to have money to get money is simple.

Child poverty in the United States—the richest country in the world—is unacceptably high. Poverty is a policy choice and it’s time to choose to fight child poverty.

Moreover, the previous safety net programs have NOT worked, especially for children living in deep poverty. The new Child Tax Credit could work really well to lower child poverty or it might do less well. BUT IT WILL DO SOMETHING. And it does the most good if we get money to the lowest-income families.

I am happy to crunch the numbers and evaluate the research all day long, that’s my job as an economist. But, let’s get real about income requirements:

No child chooses their parents; no child decides if a parent works. And this is a child tax credit, not a parental workforce credit. It is policymakers who face a choice: Do you stand by and let roughly one-quarter of Black and Hispanic children continue to live in poverty?

It was a huge win for our children and our future when the new Child Tax Credit in the American Rescue Plan—I told you that package rocked—dropped the income minimum for the credit. HUGE WIN! Do not, I repeat, do not bring it back.

Do not lower the income maximum

The Child Tax Credit supports all children, except those from families in the top fifth by income.1 The credit’s more than a way to fight poverty. It’s also a way to support working and middle-class families. It’s expensive to raise kids, and the extra $300 for kids under 6 and $250 for older kids each month would help.

Moreover, we all benefit from a more vibrant, productive economy. Guess what? Today’s children are the ones who will make that happen.

So why is lowering the income maximum to $60,000 for the full credit a bad idea? It would punish the working parents who are trying hard to get ahead. Our social safety net already does that, since as employment income rises families lose public assistance, what’s referred to as a “benefits cliff.”

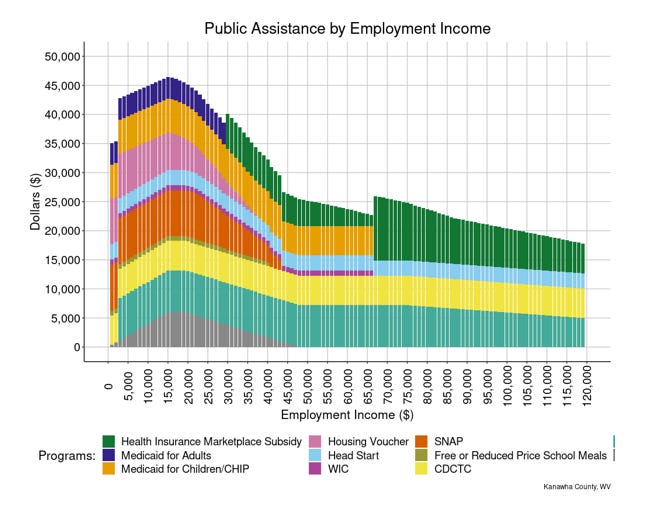

Example: A single mother of two young children in West Virginia, whose earnings from work increase from $55,000 to $65,000, would lose some health insurance subsidies. So, while her paycheck goes up $10,000, the lost benefits mean that her family’s income increases by only $8,000. That’s an implicit tax of 20 percent on her promotion. Lowering the income maximum for the child tax credit to $60,000, as Manchin suggested, would cut another $500 — a further challenge to rising into the middle class.

I used a new tool from the Atlanta Fed to calculate the benefits cliff she already faces. Here’s the full set of cliffs at different levels of employment income. Talk about work disincentives!!!

Our support to families is incredibly badly designed. That chart shows vividly that the prior approach by both Democrats and Republicans is broken. Do not add the Child Tax Credit to the pile of policy mistakes.

Another argument reflects the wide differences in the cost of living:

And $60,000 doesn’t go as far in some places as it might in West Virginia. That income in Arizona, Florida and Virginia buys about 10 to 15 percent less than it does in West Virginia. In California and New York, it buys about one-third less. Manchin’s idea of a reasonable ceiling should be better aligned with cost of living, which varies from place to place. Is it good policy to base our help for the neediest cases on prices in states with the lowest cost of living?

Families trying to raise children in high-cost areas are often the teachers, nurses’ assistants and service workers who are the backbone of local economies. They deserve our support, too.

High-cost areas are already tough on parents. It makes no sense to exclude their children from the program based on where they live. Again, children do not choose where their families live. The credit is for the kids.

Wrapping Up

The new Child Tax Credit was enacted this year to support nearly all children, regardless of whether their parents work or are working their way up into the middle class or chose to live in Florida rather than West Virginia. The new credit is the best long-term investment in the ‘kids, care, climate’ legislation in the Senate, and is the most straightforward program to administer. Do not mess with a good thing. Make sure the money does, in fact, get to every child. Extend it now!!

A near-universal child tax credit, as is currently in place, is money well spent on lifting children out of poverty and supporting working parents. It is a smart investment in our current workforce — and in the next generation.

Finally, I am an economist, and I am a mom. I try hard to ground my policy advice in data, research, and expert judgment. And I know, especially with a program for kids, that I bring some of the emotions of being a mom. I had my daughter in grad school, not a time when I was rolling in cash. It would have helped.

I also know that kids are expensive. Every parent wants to provide the very best life, a better life than they had, for their kids. Millions simply don’t have the money to do it or have to work hours to make ends meet that they miss many of the special moments. $300 a month is not going to transform our world but it helps. Even the small stuff like a road trip to see family or a toy under the Christmas tree helps.

It matters. Years before I had my kids I met a family in Washington D.C. At the time, the brother and sister were ages three and five. I watched them grow up in a family with a lot of love but not much money. The child tax credit would have helped.

Every time I have a big policy talk, like in 2011 an important meeting with Bernanke and Yellen or my Hill testimony this year, I tuck a few photos of this brother and sister in my briefing folder. I do my work for them and for all the people who are not in the room. I hope the policymakers who have the privilege to make the decisions that affect our lives think about the kids too.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economic policy. You will also receive some paid-only posts.

Currently, two parents with joint income under $150,000 or single parents with income under $112,500, receive the full amount of the monthly credit.