Anger about the economy is everywhere

Inflation is out of control, the US is in a recession, and unemployment is high--at least that's what "the survey says." Or is it?

Heartfelt gratitude to every man and woman who is serving or is a US military veteran. This year, we lost the last member of our immediate family who served. RIP, Uncle John.

We have much more work to “form a more perfect Union,” and, at the same time, we have much to be thankful for. I am thankful for our rapid, strong recovery from the Covid recession. That’s my opinion, and it’s clear many Americans do not share it.

In today’s post, I again try to unpack the anger about “the” economy.

A wave of new surveys shows that most Americans say the economy is awful. I have argued that the extra gloominess is due to the trauma of Covid and the disruptions it caused to our lives. I have also discussed the way social media is amplifying what had always been the media’s bias to the negative. I have also taken a different angle and shared what people say about their lives. Most Americans are better off financially than before the pandemic. Here we go again.

Words matter.

This weekend, Felix Salmon at Axios published a piece on what people mean when they say inflation.

The meaning of the word "inflation" has changed. It used to mean rising prices; now it means high prices.

Why it matters: Pedants, economists, and style-guide editors might not like it, but if you want to understand what people mean when they complain about inflation, you need to understand how the vernacular has evolved over the past couple of years.

No. Words have meaning. Here is the definition of inflation:

We can discuss whether people care more about the increase in prices (inflation) or the level of prices, but the level of prices is NOT inflation.

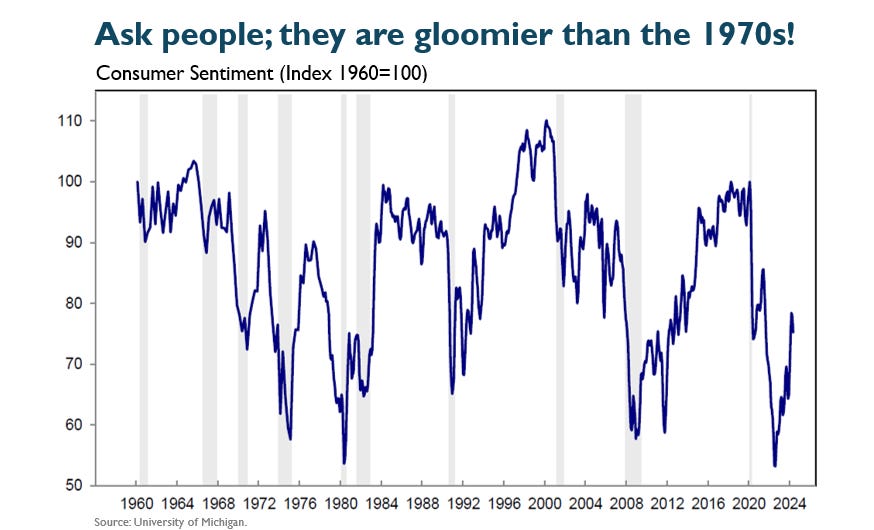

Inflation has been notably higher during the past three years than in several decades. That, all else equal, would weigh down sentiment in normal times. However, all else is not equal, and an extremely strong labor market and record-setting stock market would push up sentiment in normal times. We are not living in normal times. Consumer sentiment has been awful.

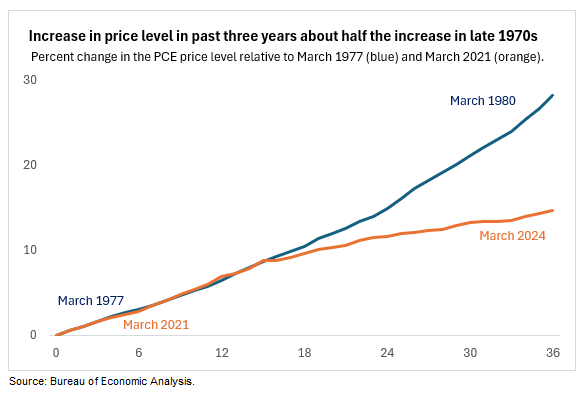

Wait, what’s that you say? It’s not inflation. It’s the level of prices that people are about. Let’s look at the price level, comparing now to the 1970s. And as Felix Salmon said, let’s look at the price rise not just one year but since inflation picked up in 2021.

Prices rose 15% from March 2021 to March 2024—about half the increase from March 1977 to March 1980 .1 Sentiment is not half as bad as then. It’s as bad.

Moreover, inflation stayed high for several years in the 1970s. The rate at which prices are increasing (inflation) has slowed a lot in the past year. Notice how the orange line is flattening out, and the blue keeps moving up.

The labor market in the late 1970s was worse than now: the unemployment rate averaged over 6% from 1977 to 1979. (Other periods were even worse.) In contrast, the unemployment rate averaged 4% during the last three years. (The last two of those were well below 3.6%.) A smaller increase in the price level with a much lower unemployment led to the awful sentiment. What?

It’s not “the” economy, stupid.

Even if they have precise definitions, concepts like inflation, a recession, or the economy are somewhat abstract. It would be understandable for people to project their views, concerns, and feelings onto them. The sentiment surveys provide evidence of that behavior.

Since 2017, roughly three-quarters of adults have described their own finances as “doing okay” or “living comfortably” in the Survey of Household Economics and Decisionmaking. In 2022 and 2023, this fraction was somewhat below the pre-pandemic levels, but the share was still a resounding majority of Americans.

However, as we zoom out, people are not as upbeat. Before the pandemic, about two-thirds of people said their local economy was “good” or “excellent.” It took a marked turn down in 2020 with the pandemic's start and has hovered around 40% since then.

Views on the national economy are bleak. About half of people in the two years before the pandemic said the national economy was “good” or “excellent.” In 2020, it nose-dived to about one-quarter of the people and remains depressed. That’s a 50 percentage-point gap in 2023 between own finances and the national economy. The survey is nationally representative of US adults; these assessments should align somewhat. They do not. Not at all.

When you look at the chart, what’s the first thing you see? I see Covid. The big divergence in these assessments came in 2020, well before inflation shot up. You can see the imprint of inflation, but relatively speaking, the big hit to our optimism came in 2020. The pandemic was a huge blow, and we are still working through it.

You can have your own opinions but not your own facts.

The pessimism about the national economy shows up in many surveys, including ones that ask about specific concepts like a recession, the stock market, and unemployment. Here is a description of a Harris poll for the Guardian:

55% believe the economy is shrinking, and 56% think the US is experiencing a recession, though the broadest measure of the economy, gross domestic product (GDP), has been growing.

49% believe the S&P 500 stock market index is down for the year, though the index went up about 24% in 2023 and is up more than 12% this year.

49% believe that unemployment is at a 50-year high, though the unemployment rate has been under 4%, a near 50-year low.

The gap between people’s assessments and reality is huge. Do not dismiss aggregate statistics as not capturing people’s lived experiences. For example, the national unemployment rate estimates come from the Current Population Survey, a large survey of people. Every person counts the same, and it adds up. Less than 4% of people tell us they are looking for work and cannot find any. That’s very low, thankfully.

The best I can do here is say that people are angry and scared of what’s around the corner. They are constantly told that they should be angry and scared. When asked about basic economic facts, they blast all that anger and fear at the questions.

In closing.

Surveys bring the voices of regular people into the study of the economy and economic policymaking. They are essential for capturing the range of Americans’ experiences. It is as valid to ask someone whether they are unemployed as it is to ask them how many other people they think are unemployed. Even so, it’s important not to pretend that everything people tell us about the economy is about the economy.

I use the Personal Consumption Expenditure prices because, unlike the CPI, they are methodologically consistent over time, including the treatment of Owners’ Equivalent Rent. The basic point would be the same with the CPI, though the values differ.

As a non-economist 70 year old who started an entry level computer programmer job in 1973 making 20k per year (with great benefits and a pension plan to boot) I think people are rightfully angry even though economists say the economy is good. If salaries had kept pace with my entry level salary in 1973, an entry level software engineer today would on average have a salary of 141k with equivalent benefits. Instead the average entry level salary is only about 85k at most in the same upstate NY area, which is about the same nationally. That gap of 56k annually (and likely fewer benefits and no pension) is why workers are angry (in my humble opinion), even ones with above-median wage earning power. Even worse, educated workers today are seriously burdened with student debt in amounts that my generation cannot fathom (and, yes I took out student loans for my undergrad, and later a graduate degree, which was mildly burdensome but paid off when I turned 50). I remember thinking, as a working class person, first in my family to graduate from college, that the future looked rosy as compared to my parents. My mom was an actual stay at home mom, and my dad worked for the postal service making less than I made in 1973 at my first job. So yes, workers are angry. Wage labor is getting a smaller and smaller share of the economic pie, even educated workers like myself. More tax cuts for the wealthy if tRump is elected will only exacerbate economic inequality. Workers will be even more angry. Especially if economists keep telling us the economy is good.

I think you are looking in the wrong place for answers. Most people don't care what the definition of inflation is, and as far as that goes, the Austrian school would say it is entirely the increase in the money supply, not the general level of prices. so, smart people can differ on that. However, people respond viscerally to their own lived experiences, and given that the inflation price index is higher by ~20% since prior to the pandemic, and all adults remember what prices were like just a few years ago, they continue to consider them very high. I just saw on Twitter that Taco Bell and Chick Fil-A prices have risen more than 65% since that time. so, the fact that the statistics that are calculated by the BLS indicate that the rate of change of price rises has slowed from its worst levels in 2021-2022 hardly means that inflation has been solved, at least to most people's minds.

Add to that the ongoing diatribe by the mainstream media regarding the absolute terror if Donald Trump is re-elected president and how the world is going to end despite the facts that during his presidency from 2016-2020, growth was faster, inflation was lower and there were no wars in which the US was involved, has many people panicking that the world is going to end, as they've been instructed. Of course, this could be seen as a cynical ploy by the current administration and its allies in the media to try to ensure that Biden wins reelection, but regardless, if you continue to tell people that the prospect of an election will result in the end of the world, after a while, people assume the world is ending.

I get that you are one of those desperate to prevent Trump from being reelected and so will write whatever you can to try to sway people's views in your favor, but your voice is limited compared to the fear-mongering that occurs nonstop on CNN, MSNCB, NYT and WaPo as well as the broadcast networks. If they continue to fear monger, it seems highly unlikely that the general population will start to believe that things are better absent an extraordinary series of events.