What's wrong with being confident?

Inflation hawks and doves are at it again. The hawks warn we've done too much and risk inflation. The doves counter that doing too little will scar people.

“Uh, huh, huh

What's wrong with being

What's wrong with being

What's wrong with being confident?”

Nothing wrong with being confident, if you're right. I am, and I am exhausted from debating the inflation fearmongers. Every interview of Larry Summers makes my blood boil. His remarks this week caused me to yell uncontrollably at my screen. That’s my version of “overheating.” In addition, I have done and watched countless interviews in which Larry is invoked, forcing us to engage with him as the ‘Oracle of Macro.’ If he had been right about economic policy more often than wrong during the past quarter century, I might be more sympathetic. He was not, and I am not.

Here’s me on Friday, in a debate with Doug Holtz-Eakin on Bloomberg TV. Before it began, they ran a sound bite of Larry, of course. Doug—one of the signers of open letter warning of inflation in 2010—doesn’t think it’s a big risk now. Think about that!!

If Larry were not enough, there’s his crew. One of the most vocal is Olivier Blanchard, a former chief economist at the International Monetary Fund. We have been butting heads on his inflation hawkishness since last spring. Note, our ‘styles’ on Twitter some differ too. Just a bit.

But setting personalities aside, the inflation debate has gone off the rails. I offer here three principles for hawks and doves alike to follow:

1) Use the best available data and the highest quality research to make your case.

Stick to the facts. The cardinal sin of a policy adviser is to offer advice based on a hunch. Every staff economist at the Federal Reserve Board is told never to do this. Never. In fact, it’s a central lesson at ‘briefer’s school,’ which every new economist attends to learn public speaking before their first time at the Boardroom table. I attended briefer’s school in 2008. I briefed in the Governors several times and done countless ‘pop ups,’ that is, when the staff stand up in the packed Board room to answer a question that the briefer passes on. (See above: do not make shit up.)

A memorable ‘pop up’ was when then-Governor Kevin Warsh asked when the next retail sales release was. That was mine to answer—not a problem, except I was also eight months pregnant, so my ‘popping up’ was not so simple. On the way up, I was muttering under my breath, “there’s a thing called Google.” I answered and sat down. That was our job to we come prepared with binders on our laps and facts in our heads.

As a result, I have ZERO patience for economists—often academic macro men who are the gatekeepers in the profession and thus have massive platforms—who sling around numbers from data they do not understand and use fancy-sounding jargon that they do not explain. What the hell is “overheating”? What the hell is “potential output”? The Governors at the Fed are sometimes non-economists. I learned that to do my job, I have to convey economics to policymakers and the public in ways they can understand. Translating jargon into people words is my job not theirs. If talk over anyone’s head, I have failed and might as well as have kept my mouth shut. Try it, guys.

I did a press call last week to explain what “overheating” was. (I also did an interview on: “What’s wrong with Larry Summers?” Hoo boy!) To help explain “potential output,” and why it should not be used to undermine the rescue package, I wrote a 3600-word policy brief on inflation risks. Here is a snapshot:

“So, what is potential output and why is it so prominent in this debate? It’s the level of GDP beyond which inflation would pick up: the point at which demand outstrips supply and prices in general begin to rise. Once inflation picks up the fear is then that it would quickly become uncontrollable.

Conceptually, the hawks’ focus on the difference between GDP and potential output—the so-called output gap—is sensible. But they breeze past the commanding fact that similar calculations during the Great Recession understated the shortfall in demand and led to policy responses that were far too small.”

I should not have to define terms for these people. I should not see them abusing estimates from the Congressional Budget Office. My inner Fed forecaster is horrified by what counts as economic policy advice on the outside. I have increasingly thought about returning to ‘The Mother Ship’ to escape. It’s exhausting, but it’s fun too.

2) Engage on merits. Keep politics out of it and encourage exchange of ideas.

I could write a book on the failing of macroeconomists on this principle and someday will. My ‘overheating’ last week came after I read ‘Anonymous’ in Politico:

“The fact that Powell is exuding all this utter serenity is hihgly [sic] problematic. And I don’t think anyone did any real economic analysis on the size of the stimulus. This is taking us into substantial risk and people don’t seem to remember that when inflation really does take hold, the Fed has to act, and that usually drives us into recession.”

Come on Larry, sign your name. This argument is identical to your recent interviews. I listen to them all. What a low blow: “I don’t think anyone did any real economic analysis on the size of the stimulus.” Stop projecting. An ‘esteemed’ economist accusing other policy economists of playing politics and not doing analysis is inexcusable. It’s an accusation common among political wonks, it is a very low blow among economists.

It’s ridiculous. One of the members of Team Larry told me Janet Yellen was becoming a political hack. He’s a very lucky that I could not reach through email and smack him. She’s a not hack. If she is, then sign me up. You think I have done a lot of economic analysis this year? Janet has done more and better.

Questioning someone’s intellectual honestly is basically telling them they do not belong in the economics profession. It’s a stunt you pull, when you know your economic arguments are paper thin and you want to divert attention. It’s also when the person who beat you out for Fed Chair and is a life-long, evidence- and research-based dove is sitting in the President’s office every day, and you are not.

Sucks to be an outsider. Here’s Larry’s ‘lecture’ to Elizabeth Warren before she was elected a U.S. Senator:

“Larry leaned back in his chair and offered me some advice,” Ms. Warren writes. “I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want. But people on the inside don’t listen to them. Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say. But insiders also understand one unbreakable rule: They don’t criticize other insiders.

I had been warned,” Ms. Warren concluded.”

I knew the story and re-read it after I was pushed out of progressive think tank last summer after my “economics is a disgrace” blog post. Yes, Larry makes a cameo and it’s not complimentary. Senator Warren is not making this up. Others have recounted a nearly identical speech. What’s adorable is that Larry’s an outsider now. Warren is not.

3) Bring your best game then scrutinize it mercilessly as more data rolls in.

Chatting with some Fed friends, I bemoaned my plight as a Fed forecaster ‘out in the wild’ with these goofballs. They agree it came down to a skills gap. Hah! In contrast, I know how to forecast. I know how to systematically assess risks. I am not going to be gaslit by Larry’s mumbo jumbo:

“I think there’s a one-third chance that inflation expectations meaningfully above the Fed’s 2 percent target will become entrenched, a one-third chance that the Fed will bring about substantial financial instability or recession in order to contain inflation, and a one-third chance that this will work out as policymakers hope.”

That is a word salad, not a forecast. Here’s a forecast. Mine is the second to last line below and my best guess for the hawks is the last line. (Note, Larry is putting two thirds chance on inflation taking off, so that’s his baseline.) Those two forecasts are alongside the Federal Open Market Committee’s median forecast:

How the hell are you freaking out over inflation? The typical Federal Reserve official and we know Powell leading them does not expect an average of 2% inflation by the end of 2023. We need some inflation to get us back on track. Yes, it’s a risk. But it is a small risk. Moreover, it is a manageable risks. The Fed know how to do its job. It is doing it now. I wrote about that in the New York Times this week. Does this look like someone you want to bet against? No, it is not. Do not bet against the Fed.

But don’t take my word for it, or theirs. Go dig through the data and update your forecasts. Every morning, as new data come out, staff at the Fed update their forecasts. The inflation forecast is done to the basis point and bottom up from very detailed categories.

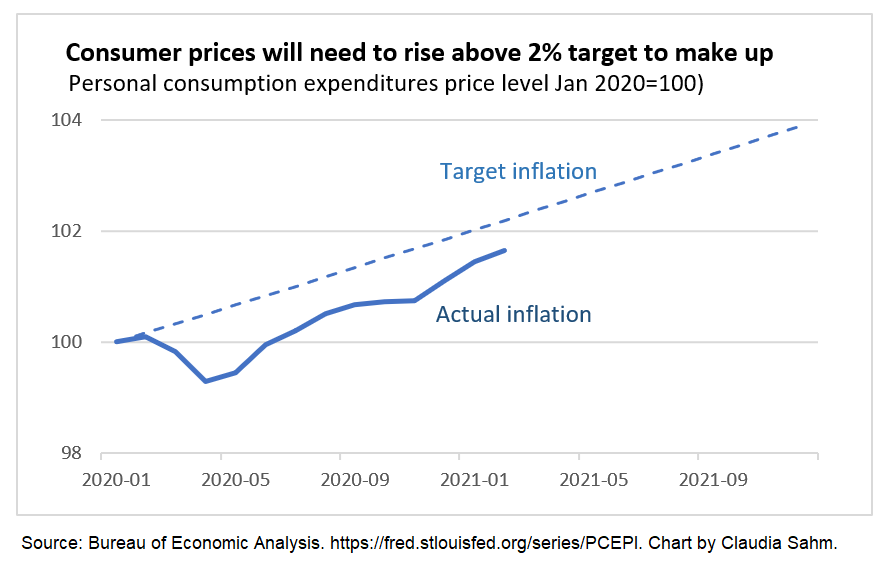

I updated forecasts there too, serving as the lead on consumer spending and business investment, as well as the GDP Coordinator. I did a year at the Council of Economic Advisers working under Steve Braun on the Administration’s macro forecast. What’s the secret? I question my assumptions and my forecast mercilessly and nearly every day. I have gone to sleep many nights fighting with my thinking. I had a nightmare about potential output before my inflation piece went up. Here’s a chart I updated this week with the new, measly inflation print:

I ask myself constantly, “What if I am wrong?” I was wrong about employment early last summer. We made up 10 million of the 20 million lost jobs much faster than we expected, but then things slowed, and we are still down 9.5 million jobs. But the world can change quickly, and we are in uncharted territory for fiscal and monetary policy. I am not afraid to be wrong—I am afraid to be sloppy.

I ask myself, “What are the changes in reality that would lead me to change my thinking?” I was trained to do that. I was also trained to seek out expertise that I do not have. Remember: don’t make shit up. I read and critically evaluate all the research I can find on macroeconomic models and findings related to the policy question. Compare the number of citations in my two policy briefs by anything Team Larry has put out. Anything.

Now, I don’t defer to experts. Shocker. I engage critically with their work and with them as researchers. Sadly, I do not see that approach among most of Team Larry. Jason Furman—my mentor on fiscal policy—is a stellar exception. I would have gone ballistic by now if not for him. We talk regularly about our different opinions on economic policies, and it helps me critically evaluate my own thinking. And it’s respectful.

We disagreed on the $1.9 trillion relief package and we disagree on the magnitude of the inflation risks. Reasonable people can disagree. They can learn from each other too. I have learned from Jason. I wrote another 3600-word policy brief on the $1,400 checks to answer questions he raised on a call. Oh, and to avoid 50 million people not getting their checks due to dubious analysis from Raj Chetty at Harvard.

I respect Jason’s views and he mine. It is not always easy to hear a mentor—or anyone who’s been a Democratic establishment economist—warn against going big for the people now. But good policy is about bringing the best arguments to policymakers, not about holding hands.

Finally, we need to hit pause on the inflation debate. We will have plenty of time in the fall when inflation likely picks up to debate monetary policy. The $1.9 trillion package passed. Hundreds of billions are in people’s pockets already. See the Daily Treasury Statement from March 25. OMG. $276 BILLION dollars in checks this month!

Yes, inflation risks exist, and while higher now, they remain low. Team Larry and Team Janet both agree on that. An infrastructure package measured in trillions will be coming to the floor of the House and Senate soon. For the love of god, let’s debate how to make that package as effective as possible.

We have urgent matters to work on together and should not be off in la-la-land.

I totally agree with your analysis that we are unlikely to see significant demand pull inflation. I am more worried we might see cost push from our over-monopolized, incredibly fragile, just-in-time supply chain collapsing in key sectors. Which I fully expect everyone to blame on too much spending anyways (just like in the 70's) dooming us to austerity and high unemployment until we elect a competent fascist.

e.g. https://mattstoller.substack.com/p/what-we-can-learn-from-a-big-boat

A more recent take on the inflation fear:

https://marcusnunes.substack.com/p/inflation-mongering-is-back