Universal cash for kids pays off

Children are our best investment. They are the future. Congress must use its once-in-a-generation opportunity to do more for all our kids.

Congress and the White House are mired in a policy debate that could shape the future of the United States. From the outside, it looks like a mess. It is. And it’s our best shot at sustainable growth and an economy that works for all Americans.

I urge Congress to center its efforts on children.1 It would be the ‘biggest bang for the buck,’ supporting families now and investing in our next generation. Done well, it would lift long-run economic growth, benefiting all Americans. It’s a moral imperative too. The richest country in the world should not have children living in poverty. Finally, it’s about dignity. Helping families is empowering them.

The kids are not alright

The United States lags behind other wealthy countries in its investments in our children and young adults. And it shows. We have the highest child poverty, nearly the lowest test scores, and the sky-high college tuition to name a few. Gone are the days of America’s kids consistently earning more as adults than their parents. Instead, it’s student loans that are rising across generations. Moreover, these burdens fall most on children of color and those who are born into families without financial security. This troubling reality holds back millions of children, and it costs our country as a whole. But it is not our destiny. Well-designed policies would make a big difference. They would amplify the investments already made by parents, teachers, community groups, and businesses. Congress must do more now and do it better.

Solutions exist, and cash support is one of the best. Congress should start by extending the new Child Child Tax Credit through 2025. It would cost about $400 billion, which is less than 0.5% of GDP during the next four years. Our kids are worth it.

Universal transfers are best

The extension of the Child Tax Credit appears to be the most likely to be in the reconciliation package. However, the details are uncertain. The devil is in the detail.

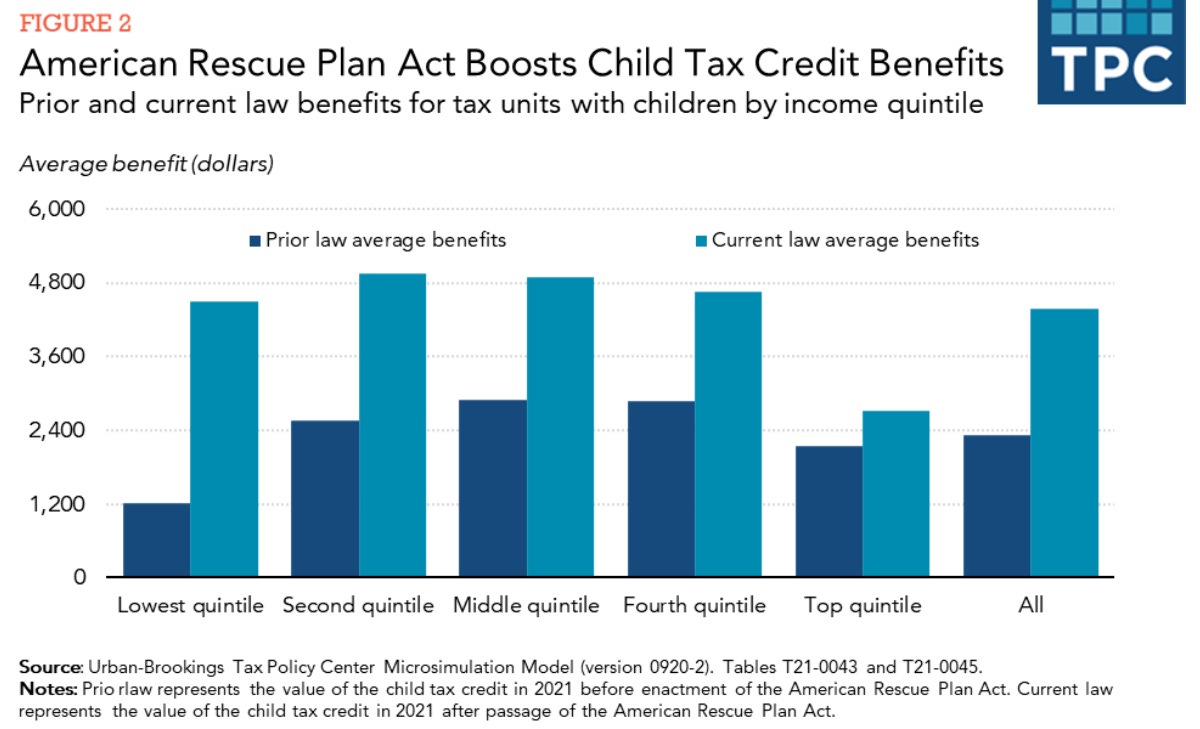

The near universal program is working and should be extended. Elaine Maag and Nikhita Airi at the Urban-Brookings Tax Policy Center wrote an excellent piece how the enhanced Child Tax Credit in the American Rescue Plan was a big improvement in the federal support to families with children.

The new program increased the amount of the money to families and the widened the eligibility among the lowest income families, who have no tax liabilities. All but the top 20% of families by income receive the credit—same as with the stimulus checks.

The new program added to the existing Child Tax Credit and made the distribution of the support by family income more equitable. Previously, families in the top 20% by income received nearly twice the money as families in the bottom 20%. The new program almost quadruples the total dollars to the lowest income families, lifting millions of children out of poverty.

The enhanced Child Tax Credit increases equity. Children of color are disproportionately been excluded from tax credits in the past. For example, work requirements of the Child Tax Credit (and the Earned Income Tax Credit) in terms of income minimums reinforced the inequities in the labor market, where Black unemployment is nearly always twice White unemployment.

Families need the extra money

It is important for the program to be universal.2 Means testing is penny wise and pound foolish. Moreover, it could undo many economic benefits of the program. The cost of raising children is large, even among upper-middle class families and those in high cost (and high income) areas. Lower income thresholds would limit the economic benefits of the program in scope and magnitude. They would also increase its stigma.

The program is already paying off. It’s clear that families are using the new credit in many different ways to shore up their financial security and invest in their children.

No work requirements allows more parents to work

Finally, universal cash transfers are a way to increase the employment of women with young children. Recent research by Anne Hannusch—using countries in Europe as a comparison—argues that the cash transfers for families would close much of the employment gap between women with children and those without. Here’s an example that compares the United States and Denmark which has child transfers.

Source: Anne Hannusch. “Taxing Families: The Impact of Child-related Transfers and Maternal Labor Supply.”

More support to families would allow some parents who cannot currently afford child care or other work expenses to join the labor force. An increase in employment rates would boost economic growth and benefit even people not receiving the credit. Contrary to the logic touted by many in Congress, work requirements are the path to less work not more.

Get the cash to families

The signing ceremonies for the American Rescue Plan and the creation of the new Child Tax Credit are an insult to families who are eligible but do not get the money. It was outrageous that Gene Sperling, a senior official at the White House, basically blamed these families who had not already signing with the IRS:

“The hard news is this population of parents let three stimulus payments sit on the ground. This is a hard population to reach; in the worst of times, you’ve offered thousands of dollars, and they have not signed up.”

You have to be kidding me. That’s on you, not struggling parents.

We knew the Child Tax Credit would be hard to get to millions of children—often those most in need. As Stephen Nuñez, Lead Researcher on Guaranteed Income at the Jain Family Institute explained:

“The IRS is not set up currently to provide regular monthly payments or regular quarterly payments. It’s just not something that they’ve done historically. There’s also been at least a decade of underfunding. So they’re also fairly poorly funded at this point.”

Charles Rettig, the current commissioner of the Internal Revenue Service, was clear about the challenges, when he testified before Congress in March 2021:

“We’re focused on trying to get these payments out to people in a meaningful manner, in a meaningful time frame,” he said. “And if that time frame might change in some manner, I commit to getting back to you and letting you know.”

After administering three rounds of stimulus payments, running two tax seasons during a pandemic, being underfunded for several years, and with no connection to non-filers, it was unsurprising that the IRS would struggle.

It did struggle. Matt Bruenig, the president of the People’s Policy Project, has written extensively on the Child Tax Credit, including its troubled roll out. According to information from the IRS, he estimates that about 13 million children— 18% of those eligible—are not, as of September, receiving the credit.

Source: People’s Policy Project.

The uneven start was as predicted. The Internal Revenue Service did not have the resources or experience to administer the program. The Child Tax Credit has the potential to dramatically cut child poverty but only if the money reaches families.

When renewing the program, Congress must allocate additional resources for its delivery. It must get money to all kids. In fact, they should consider moving the program to the Social Security Administration which already has offices across the country and experience with monthly payments to beneficiaries, including children.

Cash for kids is only the start

Extending the new, near universal Child Tax Credit is popular and for good reason. History shows us that universal programs like Social Security and Medicare are extremely effective and popular with the public. Moreover, children are the most sympathetic group in our country. Children do not choose the family and economic circumstances into which they are born. They depend on their parents to raise them and everyone know it’s not easy to raise kids, and it’s expensive. Congress can help.

Cash transfers are the start. Congress should make other big investments in our young people. In fact, they are weighing other programs like universal, free education from pre-school to community college with an estimated cost of $250 billion and $100 billion, respectively. In addition, building more child care centers and boosting pay for childcare workers (at a cost of $250 billion) would reduce the financial burden on parents, improve education of children, and ensure that the women and men who help care for our next generation are paid a living wage.3 All are investments in our future.

Wrapping Up

The enhanced Child Tax Credit is a sea change in how the federal government supports our children and should be permanent. Near universal cash transfers empower parents to decide what their children need most to thrive. As is clear from the early months of the program, the needs vary widely across families. To be fully effective and equitable, the Child Tax Credit must not have means testing by family income or work requirements for parents. It also must be administered well, so all eligible children get the money. Our country has failed millions of children for decades. Now is the time for Congress to boldly step in and fix the problem.

Investments in our children are the best investments.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economic policy. You will also receive some paid-only posts.

Many have written in favor of the extending the Child Tax Credit. I share insights from several experts in my post. It’s a lively debate on Substack too. For example, Matt Yglesias wrote recently at Slow Boring about extending the Child Tax Credit, though he did not defend keeping it nearly universal. David Shor wrote a guest post explaining why it should have an income means test. I disagree, as explained in my post.

Currently—as with the prior stimulus checks—the top 20% of families by income are excluded from the new Child Tax Credit. I am against targeting (also referred to as means testing) which increases that administrative burden. That said, it appears to be necessary politically. Tradeoffs always exist in economic policy, and I can accept the current program eligibly, but I would not reduce the income threshold any further. In February 2021, I wrote about how the stimulus checks should not be narrowly targeted on income.

Paid family and medical leave is another program that would support families, though it is not limited to caring for children. It would include sick leave and caregiving for older individuals. The administrative burden and complexity of creating a new employer-run system would be substantial. I exclude it in my piece for these reasons, but it is popular among some policymakers (cost of $300 billion).