This recovery is worth fighting for

Turn off the TV, put down the newspaper, and stop doomscrolling. During the past three years, we've made progress on some of our most intractable economic problems. Protect it and push forward.

We can lower child poverty and food insecurity; the disadvantaged can get jobs and health insurance, people without a bank account can get one, and people with debt can pay it down. Not only can we do these things, we did them. If you had told me in March 2020 or even March 2021, when the CARES Act and American Rescue Plan, respectively, passed, all that we would accomplish, I would have looked at you in disbelief.

Let’s talk about what’s good in the recovery; there is much to talk about in that respect. Yes, inflation is a problem, but it’s coming down. If we don’t talk about the good from the recovery, it could slip through our fingers, and that’s a real danger now. Fighting inflation is important, but so is fighting for the progress in this recovery.

Wow, we did that!

The Covid recession created a unique set of disruptions, such as broken supply chains, labor shortages, pent-up demand from shutting the economy down, and a rapid services-to-goods shift. The robust policy response led to remarkable safety net programs and contributed to the strong labor market recovery.

I write about inequality at Bloomberg Opinion. Again and again, in my pieces, the progress during the past three years has struck me. Some examples:

1. Black men are as active in the labor force as White men for the first time since records began in 1972.

The 70% labor force participation rate of Black men aged 20 or older is basically the same for White men, reflecting a remarkable four percentage-point jump in the rate the past three years. Wage gains have been largest at the bottom of the distribution — jobs where Blacks disproportionately work. As a result, these higher wages are likely a stronger incentive for Black men to be in the labor force than for White men.

Closing that gap that persisted for over fifty years is a major accomplishment. When I pulled the data and made the chart, I said, “Wow.” out loud.1 Too often in policy circles, we hear that certain groups like Black men simply cannot be ‘saved.’ The argument is: some deficit of theirs, like a lack of education, will keep them always on the sidelines. Not so—it almost never is—Black men did come out in search of work. Even so, their unemployment rate still exceeds that of White men and Black women, albeit with a narrowing gap. Another important milestone: Black employment hit a record high of over 60% in March. Something to celebrate!

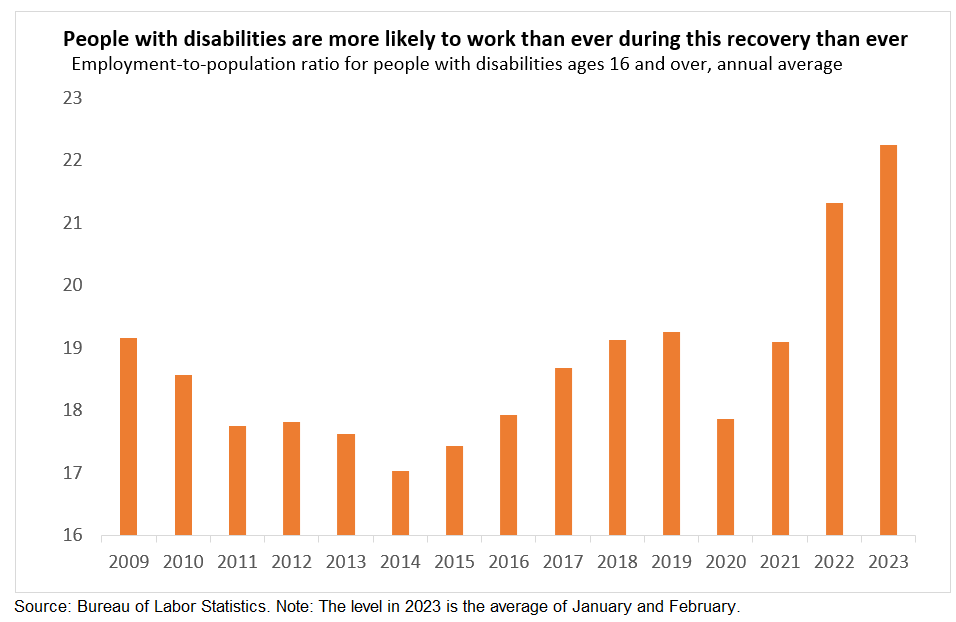

2. People with disabilities are far more likely to be working now than before the pandemic.

Above all else, the best thing for individuals with disabilities who want to work is a strong labor market. When employers are short of workers, as they are now, they will be more flexible in hiring and retention. And the pandemic showed that’s possible, as many employers made previously unthinkable changes to accommodate their workers’ needs, including working from home.

People with disabilities—whether looking for work with a pre-existing condition or employed at the onset of the disability—are another group who often struggle to find or keep work, despite being legally guaranteed reasonable accommodations under the Americans with Disabilities Act. When there is a labor shortage and employers desperately need workers, their definition of “reasonable” becomes more reasonable. That’s another win.

3. Food insecurity edged down, and poverty fell during the Covid crisis.

Unlike in the Great Recession, according to USDA analysis, food insecurity did not rise during the pandemic. The Urban Institute estimates that extra benefits reduced the poverty rate by 9.6% and the child poverty rate by 14%.

Being able to put food on the table is a basic need, and 86% of the recipients of food stamps are families with children, the elderly, or disabled members. The standard benefits, on average, in 2019 were $1.40 per meal per person. Could you imagine feeding your family on that amount? (Note the program is meant to supplement food budgets.) During the pandemic, the benefit rose to $1.75, on average, per person. As with the Child Tax Credit, we showed during the past three years that poverty is a policy choice. We can choose to fight poverty. We did for a while; then, we gave up.

4. Fewer people lack health insurance now.

A federal program expired [at the end of March] that had kept Americans on Medicaid during the pandemic, regardless of changes in their circumstances that would have normally made them lose their insurance. The practice, referred to as continuous enrollment, was a key driver of the two percentage point decline in the fraction of people without health insurance since the pandemic began.

The health insurance market involves a complicated web of program requirements, especially for lower-income people. There are multiple programs to navigate: Medicaid, Medicare, exchanges from the Affordable Care Act, and state insurance programs too. Of all the pieces I have written, this one was the hardest to do the background research and understand the program rules. I have a Ph.D. in economics—imagine what it’s like for many others. No wonder almost half of the 15 million expected to lose Medicaid this year will lose it only because of administrative problems. Health care is a basic need, and we are cutting off millions. Pandemic programs kept health insurance for beneficiaries, and the uninsured rate fell. With the end of the program, the uninsured rate will almost certainly rise this year.

5. Fewer people are unbanked than since surveys began in 2009.

The most common reason in the FDIC survey for being unbanked was “Don’t have enough money to meet minimum balance requirements.” The extra income from stimulus checks and unemployment insurance and the strong labor market loosened that constraint: there were 1.2 million fewer unbanked households in 2021 than in 2019. And there are five million fewer relative to 2011 during the sluggish economic recovery from the Great Recession.

Repeatedly in the weeks following the meltdown and bailout of Silicon Valley Bank, policymakers told us that our bank deposits were safe. That was cold comfort for the millions of Americans without a bank account (unbanked) or the ones whose bank accounts don’t meet their needs, who must go to non-traditional, uninsured, and much higher-fee places like check cashers or payday and title loan lenders. Not having enough money to meet the deposit requirements was the main reason families gave for being unbanked in 2021. Here is another long-standing problem where a strong labor market and generous cash relief made a difference. The percentage of unbanked households reached its lowest level ever. The safety of bank accounts and their lower fees relative to nontraditional financial services helps families.

The progress took effort, and it benefits everyone.

The progress was not a stroke of good luck. We have had little of that in recent years. It was the big and bold efforts from Congress—about five trillion dollars in total— to get everyone to the other side of the pandemic and back to some semblance of normal. Many Americans made it back better than normal, and those who benefited the most from the relief were often the ones who had been left behind before the pandemic.

We all won. Making progress on reducing inequalities is making progress on our economy reaching its full potential. For example, Shelby Buckman, Laura Choi, Mary Daly, and Lily Seitelman estimated that GDP would have been $500 billion higher in 2019 (2% of GDP) if there had been no Black-White gap in labor compensation. The progress toward closing that gap since 2019 is progress toward our full potential.

Yes, inflation is comparatively high now, but it is very costly over the long term to downplay the benefits of a strong labor market now. That’s not the standard narrative today. Here’s a comment on my last Bloomberg piece, one that I hear often:

Have you considered the numbers? The US population is 331 million people, all suffering from inflation. Unemployed are about 5 million, and maybe with the recession, they will be 10 million. So you will have 5 million workers losing their jobs to benefit 331 million people.

[The] "math" favors the idea of fighting inflation first and, after that (after inflation is down), taking care of workers. That´s how it works the double mandate in an inflationary environment.

I have considered the numbers, and I disagree with him. There’s more at stake than millions who could lose their jobs:

Most workers suffer in a recession with smaller wage increases and fewer options for career advancement. That can have adverse effects for years. Some have their hours cut or lose overtime, thus getting smaller paychecks.

Plus, in a recession, employers have the upper hand and are less likely to accommodate a wide range of requests and needs of workers. Also, remember the children and other family members who depend on the income of the to-be un/underemployed. Add it all up, and you have hundreds of millions negatively affected by a sole focus on fighting inflation.

I want inflation down, and I largely supported the rate hikes until last fall, though I strongly disagreed with the third and fourth 75 basis points hikes. They were too big. The Fed needs to pause now (and should have the last meeting) and let the economy catch up. I am not soft on inflation; I am big on the dual mandate. The Fed is out of balance, and Congress is missing in action. Policymakers are jeopardizing the progress we’ve made.

We are on track to backslide if we don’t act fast.

The pandemic programs from Congress have expired. The Fed has hiked interest rates by nearly five percentage points within a year. But all is not lost: the labor market remains the strongest in fifty years, some families still have savings who have never had savings, and consumers are spending. That’s a formidable buffer, but it’s not unbreakable. An aggressive Fed solely focused on inflation and a turn to austerity in Congress risks breaking the economy.

It’s time to act to protect the progress and to move us forward. In each of my Bloomberg opinion pieces, I offer solutions that the government, non-profits, and the private sector can produce. These ones do not depend on the strong labor market or policies being re-instated. Here is a selection of them:

Solution: Employment of Black men.

Create more government supported technical training and apprentice programs to give Black men and others the skills to help carry out the vision of the Infrastructure Act, Chips Act and Inflation Reduction Act. The need for more labor in manufacturing, construction and the green transition will create bottlenecks for these investment programs. Bloomberg News reported that the need for pipe fitters and electricians to build semiconductor factories far exceeds the supply. Pathways to skilled, well-paid employment that do not require a college degree could especially benefit Black men. It could also further another goal of the Biden administration, which is to diversify the workforce. In 2020, only 5% of construction workers were Black, less than half their population share, so there is considerable room for new workers.

Solution: Workers with disabilities.

During the pandemic, many employers made previously unthinkable changes to accommodate their workers’ needs, including working from home. These adjustments proved beneficial. That’s the same kind of thinking we should extend to disabled workers. Meeting people where they are is critical to a productive, equitable workforce.

Solution: Food security.

Policymakers should also take steps to encourage a greater supply of affordable, nutritious food. In 2021, according to the USDA, 13.5 million Americans lived in a food desert, defined as a low-income community without access to a large grocery store. As a result, they rely on typically higher-cost, less nutritious options like gas stations or convenience stores…One proposal to reduce food deserts is the Healthy Food Access for All Americans Act from Senator Mark Warner. It would combine tax credits and grants to bring grocery stores, food banks, and farmers’ markets into food deserts.

Solution: Health insurance.

The remaining 10 states [North Carolina was the 40th to expand last month] should enact Medicaid expansion. It is the most straightforward way to ensure more people have health insurance and can access affordable health care. It’s also important for the continuity of insurance because, without the expansion, a gap exists between standard Medicaid and subsidized insurance on exchanges…Plus, now is a good time to expand due to even more generous financial incentives from Congress in cost-sharing.

Solution: Bank accounts.

Bank accounts that are tailored to people on the margins of the banking system are essential. Since the pandemic began, the FDIC has led the #GetBanked program to help people open bank accounts…One of the partners in the initiative is Bank On from the non-profit Cities for Financial Empowerment Fund. They certify bank or credit union accounts that have a $25 or less minimum opening balance, $5 or less required monthly fees, and other standard features for free, including FDIC deposit insurance…Participation by more small and regional banks and credit unions would greatly extend the reach of the program.

Each Bloomberg piece has more solutions. We cannot count on a strong labor market to always be there, and some will always need the safety net programs in good economic times and bad. Action is necessary. And it pays off.

In closing.

During the past three years, we have made impressive progress toward a more equitable and productive economy than in generations. We made a choice when Covid came for us to fight for people. It made a difference, as I argued:

Things like the expanded Child Tax Credit, part of the American Rescue Plan, helped many families, particularly those at the bottom. People were able to save money and pay down debt. The title lender closest to my house shut down [and was replaced by a community center]. I was very happy to see that.

We must value our progress, and we must continue the fight.

I am grateful to Professor Bill Spriggs for his ideas for my piece on Black men’s employment. I learned a lot, as always, from him.

Funny thing! The demands by the Republicans for raising the debt ceiling would repeal most of the laws and actions which created such effective public policy and social progress for the whole country.

Great piece--let me quote you: "If we don’t talk about the good from the recovery, it could slip through our fingers...." In very large part the Democrats haven't done it nor have the media and as a result, in part, the Republicans have gotten away with their "Trojan Horse" threats to the American public about the upcoming votes on increasing the debt level. Public good consumption is not costless and the real economic question is "fairness" in how we all share in covering those costs.