The Fed should hit pause and give us a chance to catch up

In one year, the Fed has hiked its policy rate by 4.75 percentage points -- the fastest pace in forty years. To continue pushing would needlessly imperil the recovery.

Yesterday, I was a guest on Bloomberg Surveillance (starts at 1:57:50), following an interview with Cleveland Fed President Loretta Mester. She views two more rate increases this spring and then holding the federal funds rate above 5% through the end of the year as the most appropriate policy. I disagree:

Keene: What would be the effect, Dr. Sahm, of a pause? Would the world fall apart?

Me: No. I think it would give the world a chance to catch up with what the Fed has been doing. Jay Powell has been clear we have started into a disinflationary cycle. Let everybody catch up. Speed is the issue.

The Fed went really fast. There is an argument for that. Let it work.

Have some faith in what you did!

Speed can kill (the recovery).

Federal Reserve officials and macroeconomists often talk about the level of the inflation-adjusted federal funds rate and the goal of getting it in “restrictive” territory. (Translation the real rate above r-star.) The ‘optimal’ policy rules and the standard thinking at the Fed do not focus on the speed of rate increases.

That’s a problem. The Fed is moving fast. You must return to the 1970s and 80s to see such a pedal-to-the-medal approach to monetary policy.

But that kind of speed is not necessary now. We are not living in the 1970s. The Volcker Fed fought a decade of high inflation and an inflationary mentality. That is different from what the Powell Fed faces. And the evidence is everywhere.

Let’s focus on one: inflation expectations. Here Fed Chair Powell explains the worry after the FOMC meeting in March after they raised rates to 4.75%:

And if you read your history, as I’m sure you have, you can see that if the central bank doesn’t get inflation back in place, get inflation—make sure that inflation expectations remain anchored, you can have a long series of years where inflation is high and volatile, and it’s hard to invest capital; it’s hard for an economy to perform well. And we’re looking to avoid that and, you know, to get back to where we need to be—back to where we were for a quarter century and get there as quickly as we can.

Consumers’ inflation expectations—which loom large in macroeconomic models—look fine. They were bad in the 1970s. It’s not even close to that bad in 2023. Pause.

Inflation expectations of businesses are improving too. The year-ahead inflation expected by CEOs in a survey from Olivier Coibion and Yuriy Gorodnichenko stepped down notably in January, though it remains elevated.

A survey from the Atlanta Fed shows no sign of expectations de-anchoring and no sign that the Fed is losing credibility as an inflation fighter. Consumers and businesses expect inflation to come back down.

Yes, there is always a danger of inflation expectations shooting up. But there are other dangers we face. Last month we learned that interest rate risks are real. Recession risks are too. The speed of the Fed’s hikes is a critical factor in both risks. Pause.

The economy is slowing down; the Fed should too.

The crux of the argument for a pause is that the Fed has already done a lot and should let the effects of its rate hikes work through the economy. Inflation is one of the last places the Fed’s efforts show up. Using inflation as the guide for setting rates now is risky, especially since we already see signs of the higher rates having an effect on demand, and we know more is coming due to the lags.

One example: is credit conditions. Even before the failure of Silicon Valley Bank kicked off a wave of banking turmoil, banks were already tightening their standards (making it hard to get loans). That’s evident across a wide range of business loans.

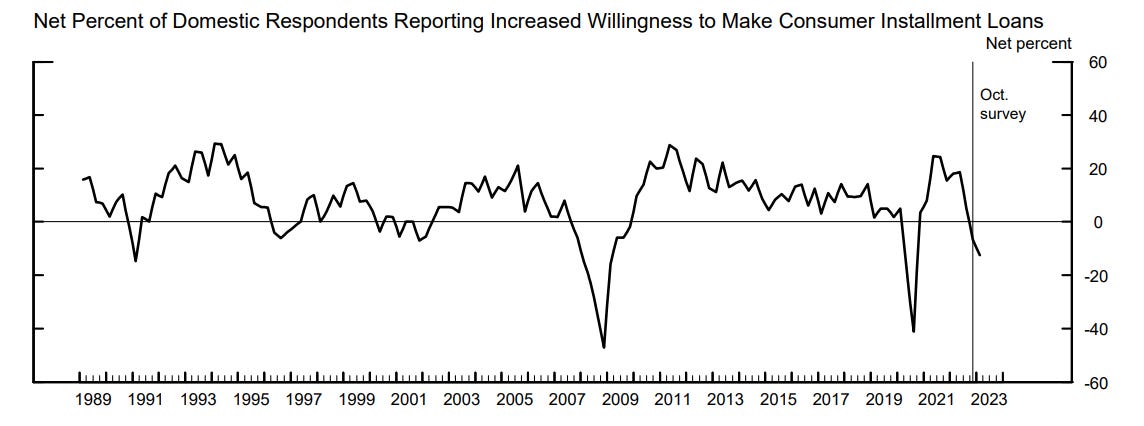

The effects show up in consumer loans too. The willingness to lend has fallen. (Note that while installment loans are less common now than in the past, the series is useful in forecasting consumer spending (aka 70% of the economy).

The survey also shows demand for loans falling off, with a lag to the higher standards (and higher interest rates). These developments will eventually feed through to prices via weaker demand. The Fed must pause or risk doing too much.

The markets and the Fed will both be partly correct, and that’s a problem.

Listen to any Fed official, and they will say they will not cut rates this year. Markets disagree and currently expect four rate cuts by next January. 100 basis points is a good bit of sunlight. So what’s behind the difference? Who will be right?

Why do markets expect rate cuts?

Markets also expect a recession, possibly a severe one. The thinking is that the Fed will not stand by and do nothing as the economy tanks. Inflation should soften in a recession, giving the Fed cover to cut some.

Why does the Fed expect no cuts?

The Fed thinks that inflation, especially ‘super core,’ will be very persistent, and bringing it down will require high rates for some time. It also does not expect a recession. The Fed’s latest projection is that the unemployment rate will rise a percentage point this year but then hold there for two years. So, no recession.

What do I expect?

The Fed will not cut. And there will be a recession starting in the second half.

The Fed’s unemployment rate forecast is highly unlikely, given the aggressive policy stance. Here’s what the path of unemployment has looked like in the past recessions. The Fed forecast does not look like that.

This time could be different, but the Fed has yet to explain the mechanism by which they think it’s possible. And all the while, they are playing from a historical playbook that got us back-to-back severe recessions.

But even if we get a recession, the Fed will not cut. It raised rates in a banking crisis. It won’t cut in a recession. It’s part of the canon from the 1970s and 1980s: easing up when unemployment rises and inflation is high will make the problem even worse.

In closing.

Nothing is carved in stone. There is a good path too:

Abramowicz: Have you been surprised by how resilient the economic data has been up to this point?

Me: I have been very thankful.

The Fed is trying to get a slow path to get inflation down. No severe recession. That’s where the markets disagree with them. The only way the Fed gets that is if the consumers keep coming back and the jobs remain there. Even if it slows down, we are starting from a position of strength that has never been the case going into one of these cycles.

It’s no longer the most likely path. And it will be even less likely without a pause.

Pause.

Addendum: Listen to this Bloomberg Surveillance interview with Luigi Zingales. He agrees that the speed is disrupting the banking sector.

What we need is better policy out of congress to help combat inflation rather than to just sit there and let the fed do the handy work. The rate hikes have done little to bring down inflation while actually boosting demand regressive stimulus to those with money by adding to deficit spending. I like to think easing supply chains have been more of a factor in the declining factor of inflation than the feds rate hikes.

Thank you, great article! I think I've read a bit of research about optimal monetary policy rules, but I've never seen and thought about the rate of changes as something crucial. Your article made me thinking about it. While I still need some time to process it through, I agree that it not only matters what is the terminal rate, but it also matters how we get there and how we communicate this. I guess it may depend on environment: leverage, labor market strength etc.