Signs of spring. Signs of hope. Let's get inflation down and nurture our garden.

Consumer Price Index for March finally showed a break in the storm clouds. It's far too soon to tell if they will pass soon. Even so, there are some signs of spring.

I want to be very clear. Inflation is too high. Inflation is a hardship. I will not tell people how to feel about it. I will not tell the press how to write about it. It sucks.

I will tell you about the hopeful signs I see, as a macroeconomist. I will share my expertise in the clearest, most accessible way I know how to. Storytime.

Out of the winter.

It’s that time of year, when my yard comes out of its winter slumber. Winter is not usually harsh around Washington D.C.—unlike Michigan #goblue—even so, my flowers disappear and trees lose their leaves. Around the world, we have gone through a dark, cruel, long winter. We tragically lost many of our most beautiful flowers.

Life goes on. Spring comes again. And off I go to the garden store I go to pick out some seeds, flowers, and vegetable plants. Seeds are tough to start outside. Luckily, my engineer brother sent my daughter a hydroponic system years ago for Christmas. She used it for her science fair project. The experiment was growing basil plants from seeds. Some under the light, some not. Light helps!1

Relief from policymakers during the Covid crisis is like that light. It can’t replace the sunshine of the summer, but it’s brighter than the winter light and warmer. We now have so many empty spaces in our garden, so I put many seeds under the light. I kept it on until I could see the plants had grown a good bit. It took time. I was patient.

Congress, the White House, and the Fed have been patient and helped us grow.

The gardener can only do so much.

Even with the extra light, the grow light is not in control. Every seed is different and they don’t all grow the same. Often that’s good, sometimes it’s not. That’s life.

Repeat after me the Fed is not in control of the economy. The President and Congress are not in control of the economy. The economy is not a thing. It’s people—their opportunities, their challenges, and their choices.

Right now policymakers are trying cool inflation without workers losing their jobs. The White House opened up the strategic reserve for more oil; Congress brought in oil execs to grill them about prices, and the Fed is raising interest rates.

It’s time to take our seedlings out from under the grow lamp and plant outside. It’s always a tough call. I prefer to let my plants grow as strong as possible before planting. Some Scrooge McDucks throw them outside when they are small.

But again, at the end of the day, it’s the plant that does the work. It’s the people who do the work. The gardener is simply helping them along. The better the gardener is the less the plants have to work.

Some like it hot. But not too hot.

Ok, here’s the thing about D.C. In the summer, it’s like living in a greenhouse.

So you have to keep an eye on a few things. If it gets too hot, then the plants must be watered. They can get too hot and dry out. Good gardeners pay attention. I am pretty good at it, but I admit sometimes I forget and have to revive them.

And there are the weeds. They will choke out the plants if you don’t keep on top of it.

As summer goes on and the plants grow strong, my enemy is the damn birds. I rented a house once that had a raised bed with a netting tent over it. It was full of fruits and veggies when I moved in. The net fell down in the winter, I was too lazy to fix it, and the next summer my garden was under attack. I have never gotten to eat one of my home-grown tomatoes. Damn birds swoop in and eat them first.

This year I am building a netting tent. I am planting a Victory Garden. (Bury Putin and feed the world.) Again, being a gardener is tough. I have to make decisions about how much care the plants need. I mess up sometimes. (One year I bought collards when I thought it was kale. Lesson? I love collards! Best mistake.)

Oh and then there’s always some self-appointed Master Gardners who lecture the rest of us gardeners on the neighborhood listerv. I think you can figure out that allegory.

All the work. It’s worth it.

Whew. Gardening is a lot of work. For the plants, growing and bearing fruit is even more. Totally worth it! Ok, my kids are not convinced that my garden is a win. I am.

Are we ready to harvest the bounty? Absolutely not. It’s time to take the seedlings outside and let them flourish. There are many risks between now and the feast.

But I am seeing signs of hope. The weather is beautiful this week. Spring is here.

Back to reality.

Now, what about inflation? And what the hell does that have to do with a garden? Inflation is a big risk. It’s the days when it gets cold overnight. It’s the days when the rain pours down so hard it could drown the seedlings. It’s, god forbid, hail.

Yes, inflation in March 2022 compared to March 2021 is way too high. It hit a 40-year record of 8.6%. Bad news. Even so, March 2022 compared to February 2022 slowed to a 0.3% increase overall, if you exclude food and energy prices. The price of gasoline in ONE month rose 20%. Putin is evil and Putin is the reason gas spiked. Covid-related pressures on prices—and there have been many—are starting to show signs of easing.

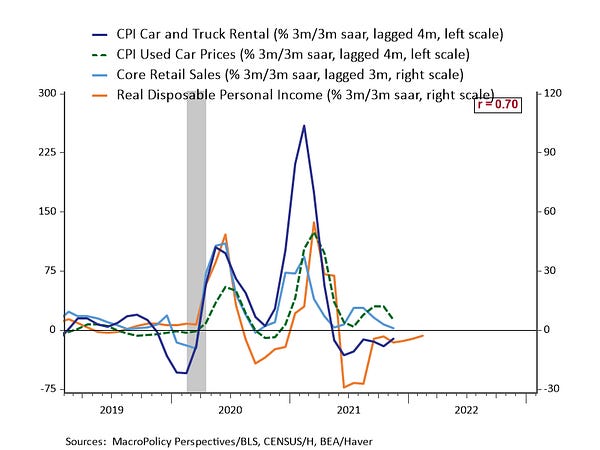

For example, used car and truck prices fell 4% in March on a monthly basis. Even with that decrease, they rose 35%, on an annual basis. If you did not buy a used vehicle last year, your inflation is likely 1.5 percentage points lower than the national rate. (Of course, your cost of living may have gone up more than the national rate for other reasons. It’s all about what we buy and often where we live.)

Another encouraging sign for getting inflation down? Forward guidance—that is, the Fed telling us that’s going to raise rates in the future—seems to be working. The Fed has only raised its interest rate 1/4 percentage point, but mortgages increased 2 percentage points. That should cool off house prices. Jay Powell can’t print gasoline or wheat, but he can help slow demand in interest-rate sensitive areas like housing.

Then, that relief from Congress from last year, it’s over. A mixed blessing, but it will help get inflation down too. You can only spend those stimmies once. My research—and other studies—suggest that people spent, on average, about half of the relief money and saved or paid down debt with the other half.

Doomsays say that “excess savings” will keep demand too high and inflation too high. Guess what? People who have had shitty jobs and nothing in their bank accounts forever like some cushion too, It comes in handy for high inflation now and Covid disruptions to life. I am heartened that millions of families have some cushion now.

Finally, as with the garden, it’s the plants that grow not the gardener. Likewise, it’s people not the policymakers who will determine what happens next in the economy. Prices affect people’s decisions. That decrease in used car prices was about demand, not about lots more supply, as Julia Coronado explained:

Supply chains are still a mess. So, it was people saying “hey, those prices are too damn high, and they will come down. I am going to wait.” Fewer customers buying cars means dealers lower the prices. Selling no cars is worse than selling for a bit less.

The retail sales for March underscore Julia’s argument. Demand shows signs of cooling in some areas where inflation’s been really high. Even with some cooling, demand overall is holding up. The goal is to get inflation down and keep the recovery.

Beware of angry birds.

I am not getting into it with the hawks here. (Or on Twitter.) They get enough attention. And you know how I feel about their views during the crisis.

Source: Portland Audubon.

There’s been a lot of recession talk lately. Some of it is dire. Hey, anything could happen; nuclear winter would be inflationary. But let’s assume that the world is getting better. Or at least we know the enemies now: Covid and Putin.

A recession is not impossible. Inflation could stay high. Even with my netting tent this year, I bet those damn birds will figure out a way to get some of my tomatoes. We must prepare for the worst. Goldman is on track here with its forecast. Even so, I would discourage using history. See my post on the Sahm Rule.

I also discourage making forecasts when moody. I have trouble following that advice, so last weekend, while in a grumpy mood, I wrote in my Sahm Rule post that a mild recession next year was my “most likely” (as in at least 50%) forecast. After a restless night of sleep—yes, I have macro nightmares, I deleted it. Chances are not that high.

After the CPI release, I downgraded my “mild recession” to a 30% chance. (Severe recession was always a 10% chance. Come on, dudes, it’s spring) The encouraging signs are encouraging. As is the Fed’s response. They know what they are doing.

Wrapping up.

So much despair and death in the world during the past two years. It’s hard for me to concentrate on the macro data. It’s hard for me to feel hopeful again. But when I look at the data, I see signs of spring. I see a path forward to a bountiful garden by the fall. I am pulling for us and I know the path ahead is tough. I know we can do it!

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economic policy. You will also receive some paid-only posts.

The views here are my own and do not represent the Jain Family Institute or my colleagues.

Mom protip: Encourage science fair projects in which the results are totally obvious And no, as some on Twitter suggested, she did not grow weed with it. Sigh. This year my son’s experiment was to see if yeast grows fast if you feed it pizza. Hmmm.

Those self-appointed Master Gardeners you refer to ... are they more active in the springtime or in the Summers?

The inflation question has "2 faces". A supply constraint "face" and a demand provoking "face". That is made clear when you contrast the US with European countries. There, there´s only the "supply face". Here, some more "make-up" was added. But Fed seems to be taking off some of the excess make-up! Even before the mistake was made, the US had recovered much faster than Europe.

https://marcusnunes.substack.com/p/the-age-of-inflation-again?s=w