Q&A: macro wars and overheating

Here's a new format where I answer some questions I got this week. Hope it's helpful. If so, send me more questions and let's talk macro.

Today’s post is an experiment with a Q&A. I will keep my answers short but longer than 280 characters. I love #EconTwitter and blogs, but they are frustrating if you don’t know the jargon or the context for the debates. Or if you find macroeconomists insufferable. I feel your pain! So here are a few Q&A’s.

Why are macroeconomists fighting (more)?

I will write a longer post on “wtf macro?,” including some useful history. Basically, you are watching a sea change. The old elites are trying to keep their hold on the orthodoxy AND they are losing that grip. It’s painful to watch some of them sink their own ships—you know who I am talking about—but no one said change would be pretty. It isn’t. Note well, what comes next will be a mix of old and new. We all stand on the shoulders of giants even if they try to throw us off and we stomp on their shoulders. That’s progress for you.

More from me in this 25-minute conversation. I touch on macro disputes as well as potential output, inflation, and infrastructure. It’s casual and there’s an ‘Easter egg’ of me calling some models “dead ass wrong.” Oops, “ass.”

What is overheating?

Ever since Larry Summer’s Christmas Eve Special, I have spent COUNTLESS HOURS talking about inflation. One of my pet peeves with economists is their use of jargon. It is bad in seminars and it is inexcusable on public platforms. Twitter is tough because it’s 280 characters but it’s worth an extra tweet to explain wtf you are talking about. If you don’t, you are either disrespecting your audience or trying to deceive or both. DO NOT DO THAT. HAVE A CONVERSATION NOT A LECTURE.

Inflation is a fairly common term but not that common. Even macroeconomists screw it up. I worked with the world’s best inflation experts at the Fed. WORDS MATTER, INFLATION MATTERS. Inflation is the percent change in prices. More jargon:

Inflation = rising prices

Deflation = falling prices

Disinflation = prices rising more slowly then before

Reflation = prices rising faster to make up for rising more slowly before

Lowflation = prices rising less than 2%

Overheating = prices rising faster and faster

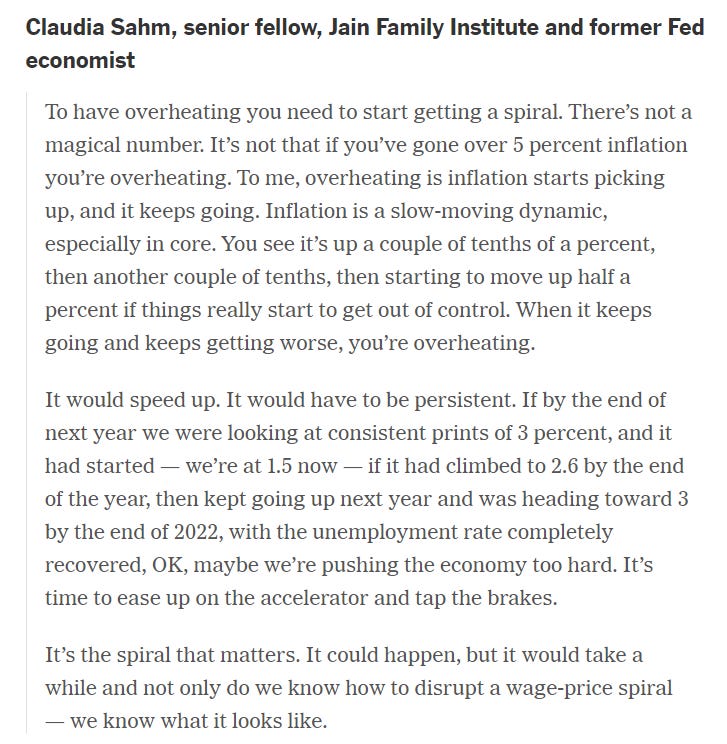

The abuse of the word “overheating” is the BANE OF MY EXISTENCE right now. Here is my longer definition for Neil Irwin at the New York Times, in “How 10 Prominent Economists Think About Overheating:”

See I spent my time explaining what overheating is. Let alone how likely it is. (Not very.) Sadly, it’s jargon but not a technical term, so experts may describe it differently. Which allows them to cover their ass and waste our time. Say what you mean before you start telling us how likely it is. (And before that learn how to forecast. One third - one third - one third is not a forecast. It’s word salad.) Want more on the substance of the debate? See my earlier post in which I argue overheating is very unlikely.

The best entry in the NYT piece is from Julia Coronado — another former Fed economist and a very good forecaster. And the worst is from …

Next up: CORE. “Core inflation” is another important term THAT IS WILDLY MISUNDERSTOOD AMONG ECONOMISTS and thus confuses everyone. Core is a technical term. It is the subset of a series that best forecasts the series. Put differently, it captures the underlying trend of the series reasonably well. Sometimes the series itself fits that definition but often it does not. In the case of consumer prices, food and energy prices move around A LOT MORE than other prices, and that’s why “core inflation” excludes them. If you use total prices to forecast inflation over the next year, it will be a mess. The Fed does not like a mess. None of us do.

The Fed cares about ALL prices, including food and energy. It defines its goal as total personal consumption expenditure prices rising by 2% per year (aka inflation of 2%).

The Fed talks a lot about core because it’s a better guide to what’s coming over the next several months for inflation. They know it’s only part of what consumers pay. I wish the Fed would spend more time explaining why core is a thing. Note, I have a lot more to say about them using price inflation instead of wage or income growth to communicate their goal of stable prices, but that’s a topic for another day. Pro-tip: Do not let economists write Hallmark cards unless you want it to end in divorce.

On that happy note, I will wrap up this Q&A. Please leave more questions in the comments. Or add to my answers. The Q&A posts will be infrequent. I like the longer ones on one topic best, so the basic style in my Substack is not changing.

I learn so much from people joining the macro policy debates, especially those who do not have a PhD in econ. I want to empower you to join the conversation. We need you!

Ok, my question..why is 2% the magic number? I can understand why you wouldn’t want to go lower than 2...but why is 3% for a year a sign to tap the brakes? We seemed to have done reasonably well in the long past with higher rates of inflation.

Thanks. The interview format was quite helpful. Your rent post at INET complemented the interview nicely. Regarding questions... curious what you think of recent book regarding fed reserve role in expanding inequality gap. Karen Petrou is the author.