Looking local for early signs of trouble

Too often, we stop at national data to spin our story about the economy. Even though it's the local economy where workers and small businesses live. Plus, it might be the early warning of a recession.

Before I begin my post, I want to honor Bill Spriggs—an economics professor at Howard University and the chief economist at the AFL-CIO—who passed away last week. Bill knew that the unemployment rate is not an abstract concept; it is real people, often Black people, losing their livelihoods. Bill pushed the Fed (more than anyone I know), the White House, Congress, and the economics profession to think harder about race and to do better.

Today’s post is about recessions, but with a twist: does rising unemployment in local labor markets tell us when a national recession might start? I wrote recently for Bloomberg Opinion on the varied economic recovery across the county.

A highly uneven labor market has emerged depending on what part of the country you consider, but that's ignored in the “Jobs Day” conversation. Employment hit its pre-pandemic level last summer nationally, but 40% of states remain well below where they were. ~ Claudia Sahm

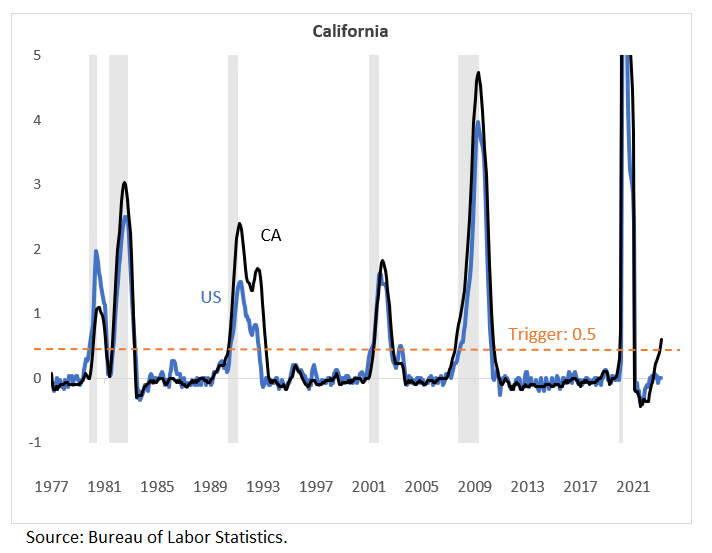

In this post, I look at recession indicators using state-level unemployment. As a starting point, I apply the logic of the national Sahm rule:

Take a 3-month moving average of the unemployment rate.

Subtract the current value to the lowest readings in the prior 12 months.

If that value is 0.5 percentage point or more, we’re a few months into a recession.

Caveat: the 0.5 is from the national data and could be the wrong trigger for state and local data. And smaller population states will be more volatile.

What do the local contractions tell us about a recession?

Most analyses of national data, including the Sahm rule, make a strong case that we are not in a recession. Here are the criteria that the NBER Recession Dating Committee use:

The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions.

Two measures that are very important in the determination of quarterly peaks and troughs but that are not available monthly are the expenditure-side and income-side estimates of real gross domestic product (GDP) and real gross domestic income (GDI). ~ NBER Business Cycle Dating.

The level of the Sahm rule is not part of the data that the committee considers, but you can see employment in the mix and an emphasis on consumers. The Sahm rule and NBER decisions are not forecasts. They both indicate whether we are in a recession when it ended and when it started. But maybe state-level Sahm rules could be a way to identify local contractions that might spread or stay local.

The inspiration for today’s post is Julia Pollak, noting that the Sahm rule applied to California’s unemployment rate is 0.6 percentage point, above the Sahm rule trigger. So I pulled the state-level unemployment rates and made 51 state-level Sahm rules. Here’s where we are. The level of the US Sahm rule is zero, but some states, like California, are above 0.5.

You can see Pollak pointed out the level for California is high. My chart orders the states alphabetically, after the US. Another way would be to order them by geography or by industry.

Let’s dig deeper into local vs. national comparisons.

But one moment in time offers limited information. So, for the four largest states by population: California, Texas, Florida, and New York, I will discuss how the Sahm rules change in more detail.

Pollak is correct to flag the rise in California’s unemployment rate. The current divergence is the largest since the series began in 1977. The level of California’s Sahm rule could be due to the tech industry going through a rebalancing after Covid. Or it could signal weakness that could spread.

Texas shows that local contractions do not always spread. The oil and gas industry is vital to the Texan economy and tied more to global commodity markets than local conditions. It is worth noting the Sahm rule for Texas has increased more than nationally.

Florida’s Sahm rule shows a few recessions in which Florida led the nation a few months ahead. Currently, it’s in line with the national Sahm rule.

And New York, in the late 1980s, led the national recession. Then after the Great Recession, New York’s Sahm rule went above the trigger, but no national recession occurred. The current level is slightly above the national level but well below the trigger.

What does a recession mean for people?

I made the Sahm rule to solve a problem: I needed a reliable indicator of recessions for triggering fiscal relief automatically, such as stimulus checks, early in a recession.

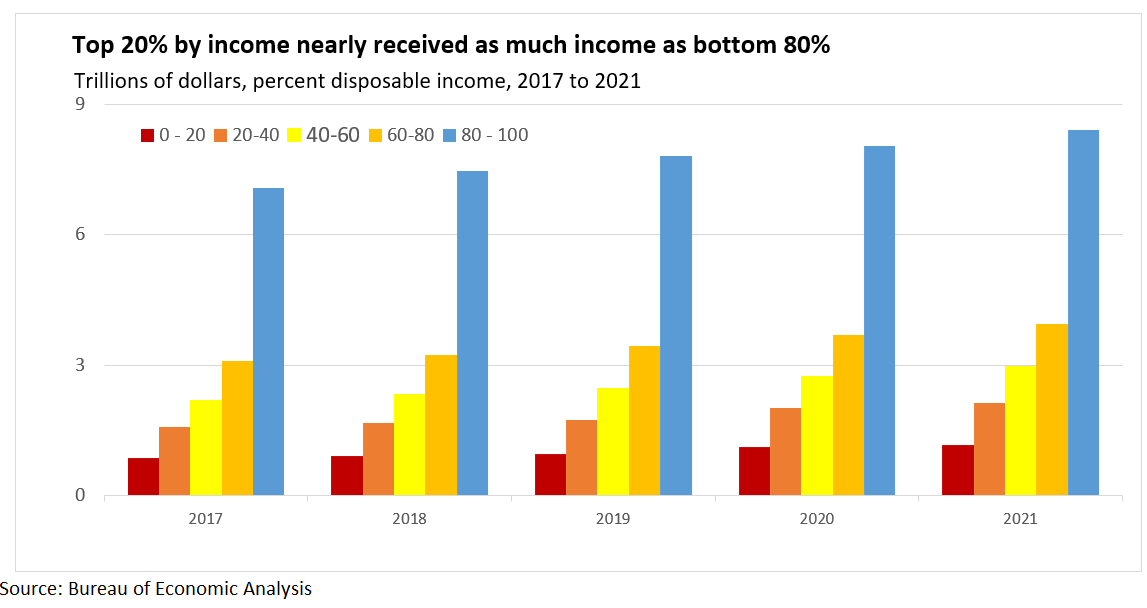

I do not hear my peers—who say we “need” an unemployment rate of 6 percent or more—offering ways to break inflation without harming the working class and people experiencing poverty. Let’s not make inequality worse. Bloomberg Opinion piece by me:

How would you design policies for fiscal relief in a recession now? What should regular people and small business owners do if a recession is coming? Those are important questions, especially if you think a recession is coming. The Sahm rule exists to help people in a recession. Some of the time we spend arguing about recession or not should be spent on the policies we will need in one.

“The problem is when we get to the point where the interest rate does change behavior, if the Fed has done too much too fast, it’ll be too late,” says Claudia Sahm, a former economist at the US central bank, who developed the Sahm rule.

“People on the margins will be hit first, whether it’s a minority-owned business or its Black or Hispanic workers, who typically have been on the sidelines but have jobs right now. [Sahm said].” ~ Claudia Sahm

“We’ve been hearing ‘A recession is coming, a recession is coming’ for so long, but we’re finally getting to the moment of truth,” said Claudia Sahm. “It’s clear things are slowing. The Fed has done a lot, government stimulus is over. Basically, all pandemic relief programs are done. Are we going to pull this off? Or is the slowdown going to turn into something worse?”

“If we do go into recession,” she added, “it would be the most forecasted recession, ever.”

In closing

Knowing whether a recession is coming is useful for people, business owners, and policymakers. It allows us to plan. Some signals from states like California are worrisome, though the labor market is strong in the country as a whole. Where we are headed is unclear, but regardless, we should be ready to help people.

Related reading:

The Sahm rule: I created a monster

The Sahm rule is simple: When the three-month moving average of the national unemployment rate is 0.5 percentage point or more above its low over the prior twelve months, we are in the early months of recession. Get relief to families fast in recessions.

Rules are made to be broken

The Sahm Rule is a historical pattern, not a law of nature. The past few years are unlike anything in living memory. Celebrate the wins, prepare for the worst, and fight like hell to get us to the other side of the pandemic and defend democracy. Don’t bet on the rules.

There is a problem here, not with the analysis which is economic science at its best, but with the assumption that it will be used to effect fiscal stimulus at the time when it is needed.

We have just gone through a major political debate in which our Congress decided that depriving some very poor people of food stamps is the way to reduce the fact that the US cannot raise enough revenue to pay for its expenditures. (Suffice it to say that the deal preserves the ability of the State to bond its debts.)

What the deal also says is that faced with evidence that a recession is upon us Congress will demand that the poor suffer through it. It will not do a direct deposit into their bank accounts.

What history shows us is that our ruling class can agree on one form of economic stimulus, military Keynesianism. War with China or Russia seems the more logical option for our brilliant politicians or at the very least privatization of Medicare and means tested social security along with further tax cuts to “stimulate investment”.

I’m only trying to be a realist here.

FYI: In person, on the ground economic forecasting: I was in San Francisco last weekend. (1) Personal experience - I crossed the Bay Bridge at 5pm on Friday evening unimpeded at 50 mph, an experience impossible for more than the last 10 years. (2) The WaPo reports the Hilton, Union Square and a major office building have stopped making mortgage payments, dumping the properties on their banks. (3) The largest shopping mall in downtown San Francisco is still open with fewer merchants and has stopped paying its mortgage. Sure, there is more working from home, but the magnitude of these facts makes the center of the powerhouse California (driving the USA) economy look like a house of cards.