Get money to people in recessions, high inflation or not

Inflation is high and a global recession looms. In times of crisis, policymakers must provide relief. It is possible even when inflation is high.

The global economy is headed toward a recession next year. Even if the United States largely weathers the storm, millions of workers would lose their jobs, and for even more workers, the opportunities from a strong labor market will disappear. A mild recession is still a recession, and with it comes hardship.

In a recession, people need income support. It is important to reduce the immediate hardship and long-lasting damage. Even with high inflation, getting money to many families in a recession is necessary. Research and experience tell us how to do it without undermining current efforts to lower inflation.

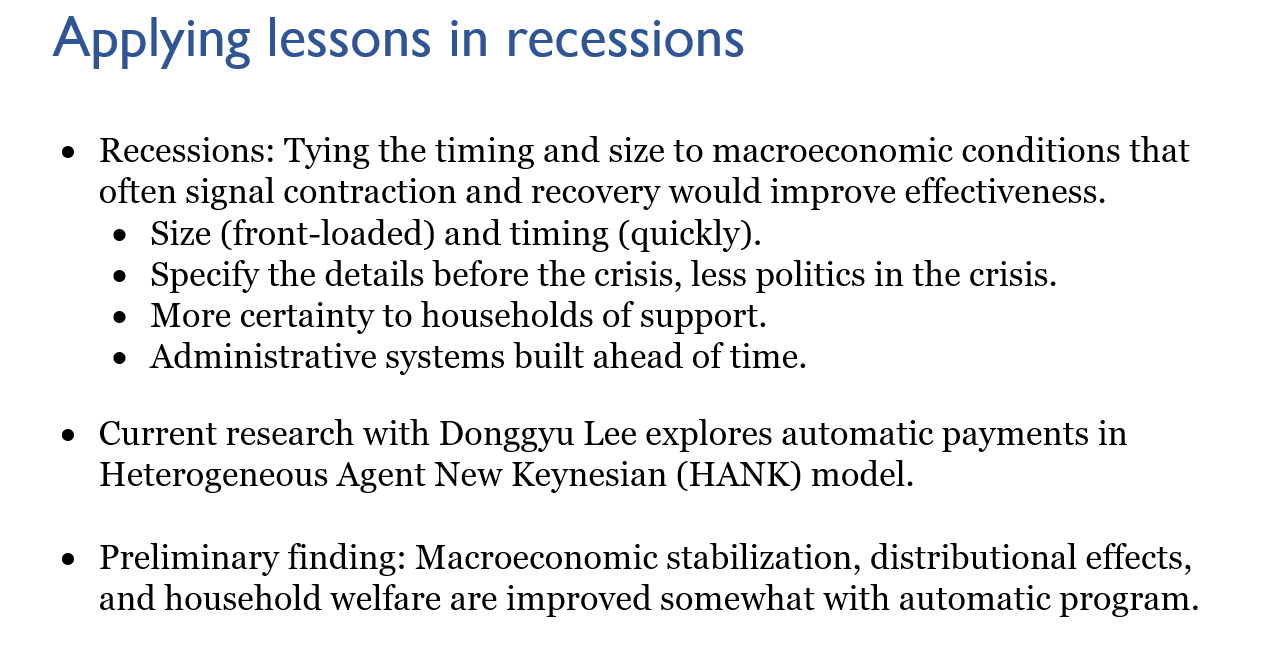

When inflation is high, small repeated payments to families in recession, instead of a big one-time payment are best. That design would provide relief but be less stimulative and thus less inflationary.

And in this moment, let’s get real. Let’s get ready.

We need think really hard about this balance between relief and stimulus … Inflation is not the only hardship we are dealing with. And if we are in a recession, it absolutely is not the only hardship. Help people!

Here’s the one-minute conclusion of my talk.

Here is the full video; directly below are my main points, and at the end are my slides.

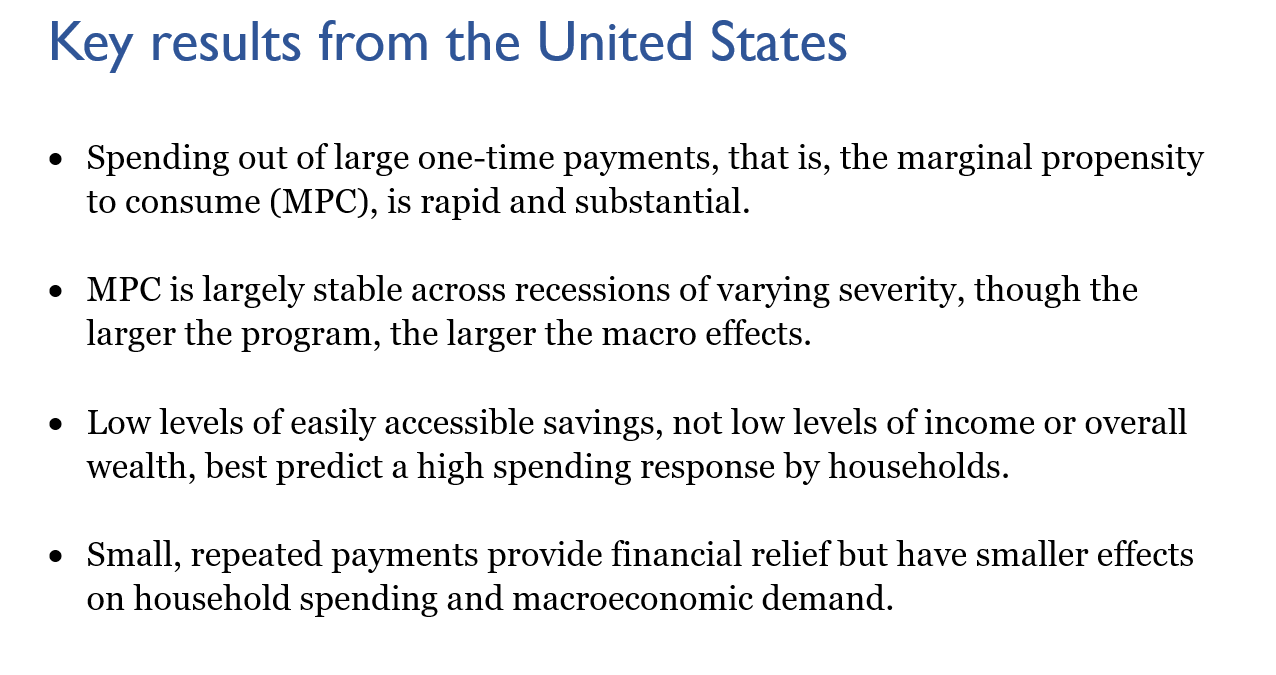

Income support to households, workers, and businesses in the prior three recessions in the United States provides lessons applicable to other economic crises. The specifics of the crisis, both the economic shock and the administrative systems, should inform the design and delivery.

The design of direct payments affects the balance between stimulus and relief.

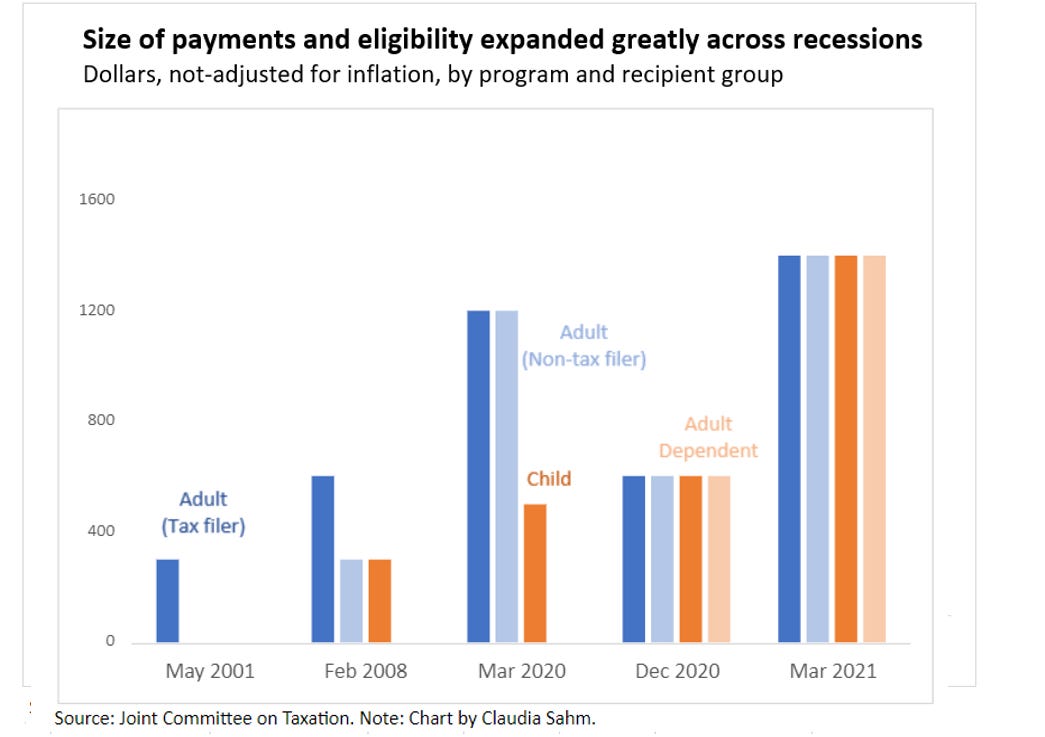

Large, one-time payments: The spending response by households in 2001, 2008, and 2020-21 was substantial and rapid.1 This approach is more stimulative and more inflationary.

Smaller, repeated payments: The spending response by households was smaller out of the payments in 2009-10 and 2011-12, each comparable in aggregate dollars as in 2008 but spread out over two years.2 This approach is less stimulative and thus less inflationary.

Income support in general: The use varies across households. In addition to spending, some families paid down debt and/or increased their savings. A larger financial buffer, especially among those with the least resources, provides relief from future unexpected shocks.

Inadequate support for businesses and workers causes medium- and long-term economic damage.

Businesses: The supply chain disruptions and current labor shortages in the recovery from the Covid crisis demonstrate that shutting down production is easier than restoring it. The inability of supply to keep up with the return in demand is inflationary.

Workers: The long-term unemployed and new entrants to the labor market during the Great Recession experienced lower earnings for several years, similar to mass layoffs outside recessions.3

Tying programs automatically to economic conditions would make them more effective.

Duration: Agreeing on the economic indicators like the Sahm Rule that signal the start of the recession would begin programs quickly, then other indicators would signal recovery from the crisis and phase out of the programs.4

Certainty: Committing to program duration based on economic conditions would reassure households and businesses that support will continue as long as the crisis continues.

Administration: To deliver support reliably to all those who are eligible, it is necessary to build and improve the administrative systems.

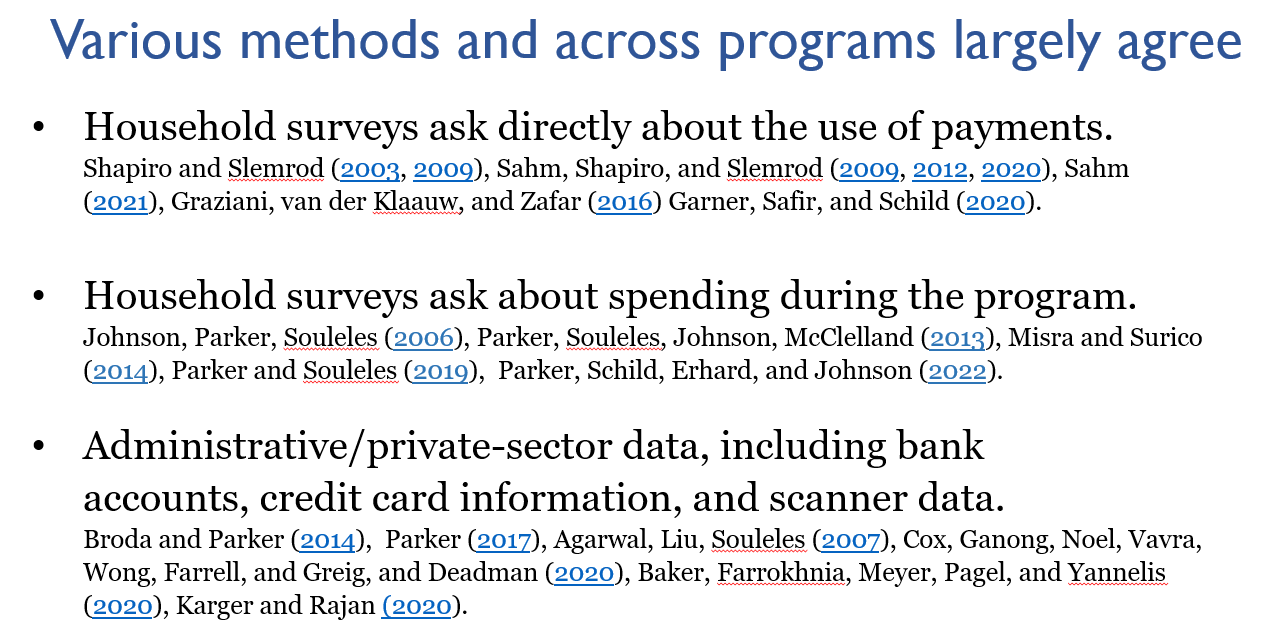

Johnson, Parker, Souleles (2006), Parker, Souleles, Johnson, McClelland (2013), Misra and Surico (2014), Shapiro and Slemrod (2003, 2009), Sahm, Shapiro, and Slemrod (2009, 2012, 2020), Sahm (2021), Graziani, van der Klaauw, and Zafar (2016) Garner, Safir, and Schild (2020). Broda and Parker (2014), Parker (2017), Agarwal, Liu, Souleles (2007), Cox, Ganong, Noel, Vavra, Wong, Farrell, and Greig, and Deadman (2020), Baker, Farrokhnia, Meyer, Pagel, and Yannelis (2020)

I enjoyed the topic and presentation. Thank you.

The idea of pre-design of relief/stimulus payment program is needed in current uncertain economic conditions and divided politics.

Great stuff. Thanks again

It's absurd that people don't realize this. It's so absurd, that I can't help but think that they do realize it; they simply choose to continue 'austerity' in relation to real people but largess in relation to corporations and the already rich. They know they can get away with it.