Connecting the dots: March FOMC edition

The Fed won't do anything to its policy interest rate this week. But its 'words and dots' could raise interest rates for consumers and businesses, possibly substantially.

More than ever, markets will grasp for any scrap of certainty at the FOMC meeting. At the start of the year, markets expected the Fed to start easing the brakes on the economy this month and cut the federal funds rate by 25 basis points. Early on, the Fed pushed back and basically said that March would be too soon, and then we got two disappointing, though not alarming, reads on inflation for January and February. That took March completely off the table and made May quite unlikely, too.

Going into this week’s meeting, market expectations are almost split between June and July, with a touch more on June. My current baseline is that the Fed will most likely cut first in July, but unlike others expecting July, I expect three cuts (75 basis points in total) for the year. Here are my thoughts on this week’s meeting and the recent economic data on Bloomberg Surveillance.

It’s amazing (and deeply disconcerting) that a few months of data can shift market expectations that much. That shows the downsides of the Fed’s hyper-data-driven approach. The mixed bag of incoming data, which also included some disappointing retail sales, almost certainly did little to move the Fed’s thinking, so the markets have caught up with a very cautious Fed. However, if the Fed has changed its thinking since January, then it will use Wednesday to move market expectations on the first cuts out further; to do so, it has two powerful, albeit unruly tools: words (Chair Powell’s press conference and the statement) and dots (the Summary of Economic Projections).

I have confidence in Chair Powell’s command over the words—at least more than any Fed Chair I have known—to deliver a shift in the Fed’s thinking with the smallest amount of disruption possible. I have zero confidence in the dot plot. Zero.

Connect the dots.

The wild card, as always, is the so-called “dot plot,” in which each of the 19 participants provides what they think is the most “appropriate” path for the federal funds rate given or their baseline forecast for the economy, including inflation, unemployment, and GDP.

Whereas the statement from the FOMC meeting is a consensus document, and Powell speaks for the FOMC at the press conference, not his personal opinion, the Summary of Economic Projections is each FOMC participant for themselves. It’s like being the Fed Chair for the day—actually, it’s like being the entire FOMC for the day—since there is no need to build a consensus on the appropriate path of the fed funds rate.

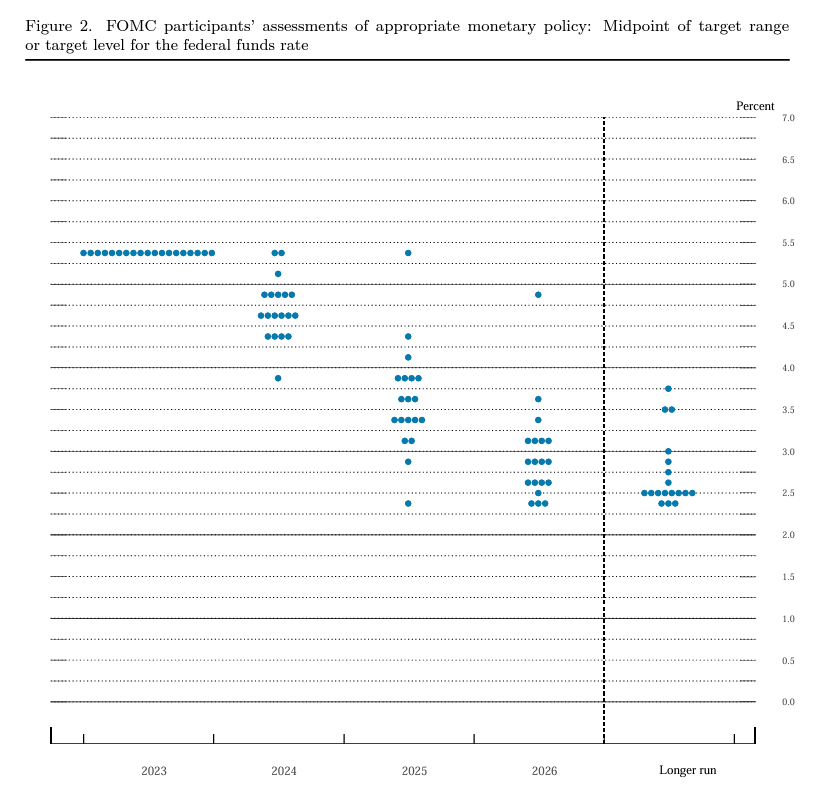

Here is the latest dot plot from December 2023:

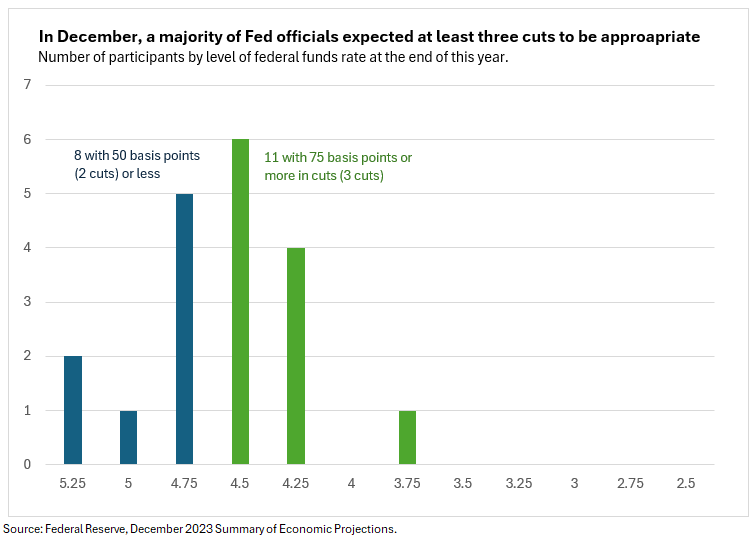

That’s a lot of important information to process in a rather hard-to-read chart. The key dots will be the column over 2024 and the column over the longer run. Here is a simpler visualization of the “appropriate” rates at the end of 2024 from 19 FOMC participants:

Currently, the median for the end of 2024 across participants is 4.5%. The current funds rate is 5.25%, so it is consistent with three cuts of 25 basis points. (Unless something big happens, an increment of 25 at a meeting is most likely.)

For the “median” dot to shift from 3 cuts to 2 cuts—which would keep the federal funds rate higher for longer than markets expect and immediately push up market rates—it would take two participants to defect from green to blue and the median from 4.5% to 4.75%. It seems unlikely, and it would be disruptive on Wednesday. However, even one or two participants moving toward the 2 cuts (green to blue) would be seen as more hawkish than in December and could push up market interest rates and likely push down stock prices.

Basically, we are set up for another example of why I hate the dots. A handful of people anonymously, with no review of their thinking, no accountability, and possibly not even voting this year, could increase the interest rates to buy a home or open a business almost immediately via the market reaction to the dots. And who knows what the “appropriate” fed funds rate will be this summer at the vote because who knows now what inflation or unemployment will be then?

In closing.

What should the Fed do with the dots? Nothing.

Why? Powell and other Fed officials have repeatedly told us that in this cycle, the first rate cut hinges on more good data on inflation, and that alone. It’s not about the Fed’s forecast for inflation with the good data they already have.

The current hyper-data-driven approach is not standard practice in monetary policy, and it was certainly not the approach when the dot plot was created. Normally, the Fed uses forecasts based on the available data to make rate decisions. That standard approach is consonant with the dot plot but not the current one. Words and dots are in conflict in concept, and the dots risk unnecessary volatility.

If anything meaningful changes for 2024 dots, it will be a wild afternoon. We have had more than enough wild rides. Here’s to a snoozer of a meeting!