Stimmies Work: Relief and Recovery!

Three big stimulus checks -- totaling $11,400 for a family of four -- were a crucial source of economic relief during the Covid crisis and a boost to the recovery.

I recently published a research brief, “They Worked: The effects of $1,400 stimulus checks on families and the economy," with support from the Jain Family Institute. The new module at the Surveys of Consumers that I helped design on the $1,400 checks shows clearly that the $1,400 stimulus checks provided relief to millions of families and helped restart the economic recovery we are living now. The American people deserved both after over a year of suffering due to the pandemic. The stimulus checks cannot claim all the credit for the turn for the better this year. The roll out of the vaccines, people feeling safe to go out and spend again, workers coming back to work, some even getting a raise: each of those all played a role. But getting $2,000 to nearly every woman, man, and child in early 2021—$600 checks in January and $1,400 in March — was real money and real helpful.

More below on what I found in the survey and how to design better stimulus checks for the next time. Sadly, there will be a next time. Economic downturns will come again. We can hope for the best, but we must always prepare for the worst.

But first, a bit on why these checks are so important to me. You may have watched my head explode on Twitter, in the press, and in an earlier research brief, every time the policy comes under attack by economists. Worst to me was when Raj Chetty and his co-authors at Opportunity Insights tried to insert themselves into a live debate over who should get the $1,400 stimulus checks. I do not pull punches and probably was too colorful a few times. (Larry started it.) I was scolded and professionally punished recently for criticizing Raj’s and Larry’s work in public, though the senior economist who did admitted their work was shoddy. As I said, economics is a disgrace.

No regrets here. 50 million people, including children, would have been denied their $1,400 checks if policymakers had listened to Raj. And I knew that too many people in the White House think Raj is a superstar and all he proclaims is beyond question. Give me a break. The value of our research is never determined by our reputation or our past publications. It’s determined by the quality of that piece of research. Full stop.

So in a jumped. Yes, I was colorful on Twitter, but my research brief was straight up professional. I even wrote an appendix of past studies. Raj’s was a one pager. Whatever, we each have a choice on how to bring research to the world

All I cared about was getting the $1,400 stimulus checks to people. My expert opinion from over a decade of research, including my own, was stimulus checks were the best we could do for people. Congress delivered. In the Rescue Plan package, they did not follow Raj’s advice to lower the income level for eligibility. They kept it the same as in the past two checks. I played a small role in that (people, I have sources too) and am immensely proud. Now, I still ran a survey on the $1,400. Asked people what they meant to them. I wanted to see what the effects were this time. That’s how science works. That’s how solid policy advice works. We study the outcomes in many different contexts, so we can support evidence-based policy in the future.

One last point before sharing more on the results. It is always a privilege to study the stimulus checks with surveys of people, as I have since the stimulus checks in 2008. To the people who participated: I am grateful you took the time and shared how you used the relief. Money is a very personal thing and sharing what you do with it is not always easy. (Economists, we too often take for granted how sensitive a topic money is to most people.) I have learned so much from you. I have tried my best to let you speak, as a group and sometimes individually. Your free responses are gold and listening to the tapes from the earlier phone interviews was eye opening.

My latest research brief had two goals. First, was to share the findings from our survey. Let the people speak and then interpret their responses in the context of other research and data during this crisis. Again, context often matters. Details matter.

Second, was to give advice on how to make future rounds of stimulus checks better, largely by improving how and when we get them to people. Don’t mistake my push for stimulus checks during the Covid crisis and something to do automatically in every recessions, as saying they were perfect. We must not let the perfect be the enemy of the good. And we must not pretend that the good is perfect. We can always do better. And, above all, we must do. Waiting creates suffering. Covid was not waiting. Poor administration means some people do not get benefits they were promised. They often the ones who need it most. Do better.

And now, to my results on the $1,400 checks. It’s an excerpt. Much more in the brief!

Executive Summary

Over the course of the COVID-19 economic crisis, Congress has enacted about $5 trillion—one quarter of annual GDP—in fiscal relief. At the heart of this bold policy response was “economic impact payments”, often referred to as “stimulus checks”, to most families. My research brief argues—contrary to several prominent critics—that the stimulus checks, including the most recent $1,400 payments under the American Rescue Plan (the “Rescue Plan”), provided much-needed relief to millions of families and helped bolster the economy at a critical juncture in the recovery.

My evidence-based brief draws on newly available data from the Surveys of Consumers at the University of Michigan, known as the “Michigan Survey”, to assess the effect of the final round of stimulus checks. I find that most families needed the checks and many—even those with higher incomes—spent them quickly, helping reignite the economic recovery after it stalled in the winter.

The stimulus checks represented real money for Americans—money that millions of Americans needed as they grappled with the pandemic’s economic fallout. A family of four (with two adults and two young children) received up to $11,400 from April 2020 to March 2021, equal to 17% of median household income in 2019 for all Americans and 25% for Black and Hispanic families.

Figure 1.

By comparison, stimulus checks in 2008 for a family of four represented only 3% of median income before COVID-19, and arrived as a single check. This time, Congress acted aggressively—first with the CARES Act and then two further large relief packages, all within the first year of the crisis and each authorizing a separate stimulus check. Given the faster recovery compared to 2008-9, we should conclude that larger amounts of direct stimulus, provided to a higher percentage of Americans, are an effective, reliable way to fight recessions. See Sahm (2019) for a summary of other supporting research. Still, it is imperative that policymakers learn from the problems encountered in this year of extraordinary economic intervention in order to deploy cash assistance even more effectively during future downturns.

My brief is divided into three parts:

An analysis of my new survey investigating the third round of direct cash assistance, that is: the $1,400 stimulus check. I find that the checks provided a sizable boost to overall spending this spring and helped millions of families in need. In short, stimulus checks worked. Nearly one quarter of families said they “mostly” used their checks to increase their spending, and many other families spent some portion of their checks. Taken together, more than half of the $400 billion disbursed was spent within a few months of receipt. Families who did not use this assistance to increase their spending instead used it mostly to pay down debt (45%) or increase their savings (31%). While those latter two uses did not directly boost the aggregate demand, they did create a financial buffer and reduced debt burdens. In addition, another 12% of families who initially saved or paid off debt with their checks said they expected to spend the extra money at a later date.

An analysis of the effects of all three rounds of stimulus on the larger economy. The $826 billion in total stimulus received by families through May 2021 boosted spending growth, especially in each month of receipt. My results reveal that the $1,200 CARES Act checks added over 2 percentage points to the monthly percent change in consumer spending in April 2020. In that month, inclusive of the stimulus checks, spending plummeted nearly 13%—the largest monthly decline during the COVID-19 recession. In addition to providing substantial support, the checks came at exactly the right time to buffer the contraction and help stabilize the economy. During the recovery, the $600 checks added 1 percentage points to aggregate spending growth in January 2021, and the $1,400 checks added over 3 percentage points in March 2021.

An inventory of key lessons from the overall stimulus effort. Congress spent considerable time debating the size, scope, and timing of the stimulus checks, time that might have been saved had there existed legislation, before the recession, that tied checks to economic conditions. Before the pandemic, I provided (2019) one such proposal in which the rise and then recovery in the unemployment rate determines the timing and size of stimulus. Detaching this cash relief from short-term political calculus would free up time for other urgent policies and ensure money reaches families quickly and predictably.

In addition, Congress needs to improve its systems to deliver cash assistance to families. They must learn from Treasury’s administrative failures, particularly in reaching families who do not file taxes and for whom the federal government does not normally have payment information.

Finally, policymakers must recognize, and embrace, the fact that people across the political spectrum, according to multiple opinion polls, strongly favored the $1,400 checks. Only one fifth of families said in the survey that they would have preferred that the total cash assistance had been spread out in twelve equal payments, instead of the large, irregular checks that Congress enacted. My prior research (Sahm, Shapiro, and Slemrod, 2012) from the Great Recession also shows that large one-time payments were more effective at boosting spending than smaller, recurring payments.

And a bit more below. Pictures are worth a thousand words, so here are the rest of them in the brief. And the tables too. We all love numbers! My commentary below differs some from the brief. Trying to keep it simple here. It’s a blog post.

Figure 2. shows how the checks came at various points in the Covid crisis. Previous surveys I ran on the CARES Acts and the 2008 checks show overall results similar to the $1,400 checks. The composition of spending shifted during Covid. Not surprising in spring 2020 people spent less on vacations and other leisure activities than in 2008.

Paying down debt was the most common use of the $1,400 stimulus checks. (See Table 1.) With the 2008 checks, my co-authors, Matthew Shapiro and Joel Slemrod, and I found the same, as did they with the 2001 checks. Paying down debt is not much of a boost to current spending, but it is a key form of relief to families. Many American are always living on the edge financially, even in ‘good times.’ Interest payments on credit cards and payday loans add up. Stimulus checks helped reduced debt burdens. A great thing about the checks is they let people decide how to use the money. As you can see, it varies: paying off debt, saving, and spending.

Note, some people who said they mostly paid down debt or mostly saved, also spent some now and other plan to later. Using past research by Jonathan Parker and Nick Souleles, we estimate that about 60% of the stimulus checks were spent early on. That’s referred to as a Marginal Propensity to Consume of 0.64 and is a key number in calculating the effects on macroeconomic effects.

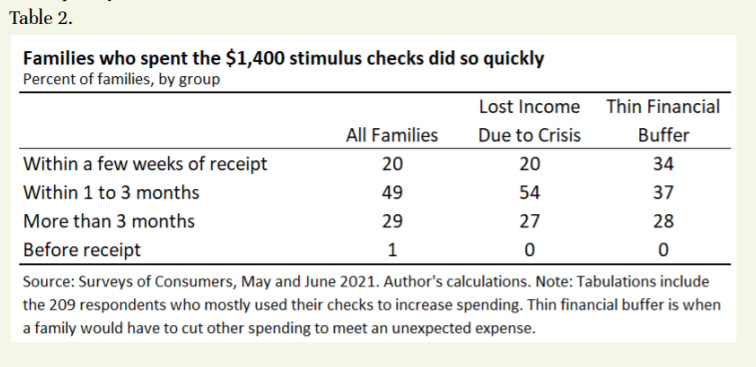

More on that spending: Table 2. shows that when people spent they did it quickly. So the checks create a burst of spending, and it comes fast. Sound familiar? The economy is really cooking now and it got there fast this spring. But you can only spend a stimulus check once, so don’t expect that white-hot demand from them to continue. (Please get vaccinated. The delta variant could cool things down, and kill people.)

We also asked people how Covid had affected their family financially. We have heard a million times that some people have suffered more than others. I say it again. (See Figure 3.) They have and it’s inexcusable when we cut off aid early like jobless benefits. 26 Republican Governors walking away from the unemployed and the Administration not using it bully pulpit to call them out was racist policy. I am not talking about intentions. I am talking about outcome. Stimulus checks—for millions of people who got them—were better policy in their outcomes, much better. For the people who did not get them, same racist outcomes. Do better, people.

Those in more dire financial situations were more likely to payoff debt. (See Table 3.) Many who suffered in the crisis most had been struggling before Covid. Stimulus checks were a relief now and helped build a cushion they had not had before. So when you hear people say the poor and those with little savings are irresponsible and spendthrifts? It’s not moral fortitude, it’s shitty paychecks that do not provide a living wage. If you give people money who don’t have enough, many will use it pay off debt, many will save it. The fact that some people got a ‘raise’ when they went on jobless benefits is an indictment of our labor market that pays so little. I welcome the wage raises now, though I doubt they will stick. Covid as life changing as it was is not enough to change inequities with us for generations. (Pass the Families and Jobs Plans now!)

And on to the macro effects. (See Figure 4.) It is very intentional that I put relief to people first and the boost to macroeconomy second in my brief. That’s how economic policy should be. Centered on individual people. Then add it up. GDP is not the goal. But hey, I am a macro forecaster with over a decade of training at the Fed. I know how to add it up. And policymakers do want to know. The effects of the stimulus were impressive. A big boost to growth in the month of receipt. The level stays higher for several months, but the pace of increases in spending wanes. (See Appendix B in the brief for more explanation.)

One goal of stimulus checks is to give some oomph to the recovery. One-time payments to people will not get us to the finish line on their own. The second, third, etc. round effects—checks spent, businesses make money, workers get hired, new workers spend, and on and on—do help. But the overall economy and the many factors that drive it has to carry us home. Checks help. Checks are not enough. Keep pushing!!

One important caveat on the macroeconomic effects. The goal, instead, is to get an approximate sense of how the size and timing of three rounds of stimulus checks affected the macroeconomy. They are not precise. I translated my survey results using others/ research and my judgment. I stayed true to the survey responses. But add up the estimates and I know 0.64 and anything number in Figure 4 is not the truth. It’s an evidence-based, thoughtfully considered estimate. If I were advising policy makers I would probably use 0.5 as my rule of thumb for the marginal propensity to consume.

Finally, Table 4 is for Raj Chetty and fellow Team Targeting. Families making $100,000 to $150,000—the ones Raj claimed would spend nothing of their checks and do nothing for the economic recovery—they were more likely to spend most of their checks than families with less than $50,000. I explained in my earlier brief why income is not a reliable way to target stimulus checks. I collected the data again and show those past findings held up with the $1,400 checks. Now, one study is not definitive. Mine is the first on the $1,400 checks, as best I know. Others will certainly follow. Good. When the government sends out hundreds of billions of dollars we should do it well. Researchers help inform that effort. The Rescue Plan package was good. The stimulus checks went to people up into the middle class. (Families in the top 20% by income did not get $1,400), The checks are good policy!

As I said, there is much more in the brief, including more about these tables and charts. The stimulus checks are one of many ways that Congress got help to people in the recession. The evidence shows and public opinion reaffirms the checks should be used to fight economic crises. They are not the only relief we need.

During the past year, Congress got trillions of dollars to the unemployed, families dealing with food insecurity, small businesses, some industries hit hardest by Covid restrictions, and communities. Each of the programs helped. Each of them can be done better next time. The Covid economic crisis was immense and it required an immense response. We got it. We are not out of the woods yet. We are not safe from the pandemic and we are not at full employment. Keep pushing!

PS My thanks on the research brief: The Jain Family Institute and the University of Michigan funded the survey module. Matthew Shapiro and Joel Slemrod contributed to the survey design. Alexander Jacobs, Stephen Nuñez, Sidhya Balakrishnan, and Halah Ahmad provided excellent comments. Molly Dektar helped with the design of the web version. All opinions are mine.

I have read and heard about Raj Chetty's work in various places. He is definitely one of the people that gets media attention and focus. What are the problems with his work? I understand that just because someone is popular doesn't mean they are deserving. But it is not always easy for a layperson to understand, especially if they are not tapped in to academia.