Inflation is cooling some, but not all the reasons are good ones.

While inflation stepped down, it's too soon to say whether the higher pace this year will remain or be temporary. It's the underlying causes not the topline numbers that deserve more scrutiny now.

Inflation rose 0.4 percent in July, a clear step down from its red-hot pace in the spring. Even so, the average, annualized pace of inflation since the pandemic began in March 2020 is 3%, which is above the Fed’s target of 2%. Contentious debates about the future path of inflation and what the Fed should do about it are distracting us from investigating its underlying causes. The Good, the Bad, and the Ugly.

The Good

One encouraging sign that economic disruptions from Covid may be easing is that used vehicles prices for consumers were flat in July, after months of large contributions to inflation. A large part of the prior increases traces back to chip shortages and reduced production of new cars due to the pandemic. In early August, wholesale prices of used vehicles have declined some. To the extent that passes through to consumers, used vehicles would push down overall inflation.

Source: Manheim. January 1995 to mid-August 2021.

The level of used vehicle prices is far above trend, so as the pandemic recedes further, deflationary pressures should continue. That would be a welcome development and underscores why a full economic recovery depends on getting the global population vaccinated, since many of our supply chains originate outside the United States.

The Bad

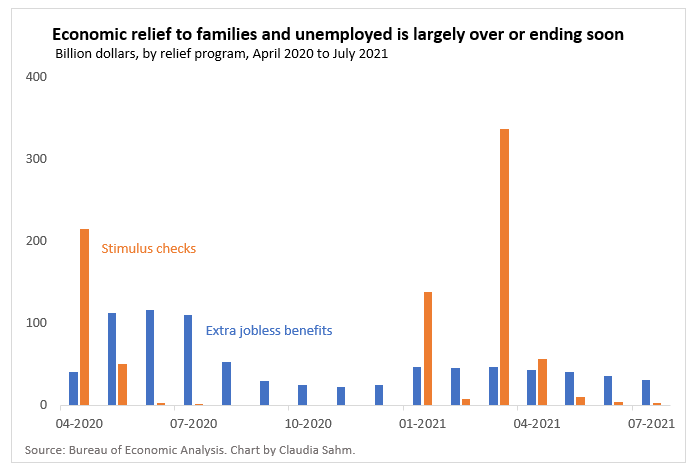

Labor shortages and supply chain problems have gotten a lot of attention lately, but prices are about supply and demand. The economic relief from Congress during the crisis, including over $3/4 trillion each in stimulus checks and extra jobless benefits, has been a considerable boost to consumer spending. The rapid increase in demand also put upward pressure on prices. Unfortunately for families still in need, that support from Congress is over.

Most families received that last stimulus check in March and the extra unemployment benefits expire next week. No further relief is expected. President Biden, according to his press secretary, has “made a decision on where things stand in our economic recovery at this point in time.” So despite the fact that millions fewer are working now than before the pandemic, the support is done. Yes, less relief should take some pressure off inflation but only by shifting it to families and the unemployed.

The Ugly

Early in 2021, the rollout of the vaccine and falling Covid cases raised hopes that we had turned the corner in the pandemic. People started to go out and get together again. As one indicator, by June 2021 the reservations at restaurants were basically back to their 2019 levels. Many businesses struggled to hire enough staff to meet demand, which pushed up wages and prices.

But the arrival of the highly-infectious delta variant and millions of unvaccinated Americans threatens the path back to normal. In fact, in the past two months, reservations have reversed some and are now about 10% below their 2019 levels.

The Common Thread

All three scenarios come back to the same solution: we must get the pandemic under control. People must be safe and must feel safe to go back to their everyday lives.

The recession ended in April 2020, making it the shortest on record, but the pace of the economic recovery has been frustratingly uneven. You can see it everywhere from inflation to jobs to income. It’s not simply wiggles in the macro data, it’s hardship and uncertainty for families, especially those who remain unemployed or unable to return to work. The uneven economic recovery is a direct reflection of our uneven success at containing the pandemic.

Inflation is not our enemy. It’s Covid.

i do wonder how we are determining inflation, if we are comparing 2021 to 2020, as opposed to maybe 2019, would we see the same result? cause 2020 was a big downer for the economy, with shutdown, etc, stopping most economic activity or crashing the economy as bad if not worse than the great depression

Very thoughtful and thought-provoking material using empirical data and social observations. Indeed, I am in want of work in an economy that was deemed to be 'roaring back' and have yet to articulate for myself how that will occur. Worrisome. Covid first. The rest, to follow. Thank you for this piece, SAHM! 👌🏻💜🌈🦄🙏🏻