Fed could help fight climate change.

Jay Powell's in the hot seat for his lack of action on climate change. It might even cost him Fed Chair. Who had that on their Bingo Card? Welcome to 2021.

Sometime in the coming weeks, President Biden will appoint the next Fed Chair. Anonymous sources at the White House, politicians, and pundits--including ones who know less than nothing about the Fed--are everywhere spouting their views. None of that surprises me. It’s a dance we do every four years.

What’s interesting this time? CLIMATE!

Recently, Representatives Ocasio-Cortez, Tlaib, Pressley, Jones, and García released a statement:

“As news of the possible reappointment of Federal Reserve Chair Jerome Powell circulates, we urge President Biden to re-imagine a Federal Reserve focused on eliminating climate risk and advancing racial and economic justice … Under his leadership the Federal Reserve has taken very little action to mitigate the risk climate change poses to our financial system … To move forward with a whole of government approach that eliminates climate risk while making our financial system safer, we need a Chair who is committed to these objectives. We urge the Biden Administration to use this opportunity to appoint a new Federal Reserve Chair.” August 31, 2021

Brilliant.

I disagree with their statement, and it’s unlikely push Powell off the leader board. (Others in the Admin might Grrrr.) But hats off to these members of Congress for making us think again about climate. Hurricane Ida and Tahoe on fire weren’t enough. Big fiscal packages moving through Congress aren’t either. So, fine, let’s talk Fed.

My press calls on the Fed and climate change picked up since that announcement. The more I think about it the more I think the Fed could do something. That said, the Fed should only purse the bold efforts if new legislation says do it! Climate change is an all-hands-on-deck existential problem. The Fed could help.

What could the Fed do?

Here is my list from the doable now to the blue sky with Congress:

Support cutting-edge research on the economic and financial market effects of climate change, as well as policies (from Congress and the Fed) that could fight it.

Make climate-change disasters a regular scenario in the bank stress tests for financial stability and in the staff’s long-run forecasts for the FOMC.

Run permanent lending facilities for state and local governments and small- to medium-sized business that invest in climate change mitigation.

Let’s walk through how these three could work.

Cutting-Edge Research.

Doing. The Fed is on it and have been for years. The Fed stays out of politics as much as humanly possible. The Trump Admin made it uncomfortable for the Fed to talk externally about the climate change. They did so internally and within the international community of central banks. The Fed has got the intellectual firepower, and they are on the scene, albeit quietly at first.

Now it’s more out in the open. As one example, the San Francisco Fed now runs a weekly, virtual research seminar series. It covers a range of topics from carbon pricing to financial market risks to wildfire and flooding economic effects. Check it out.

Scenarios in Stress Tests and Long-Run Forecasts.

Doable: Before the Fed starts regulating or changing monetary policy in reaction to climate change, we need to assess the preparedness of financial institutions and quantify the possible economic/financial effects of climate change. This step will take some time and thought. In stress tests and staff forecasts, it’s probably best to focus first on concrete events like natural disasters and their increasing frequency not abstract scenarios of rising temperatures or sea levels. That said, we can’t rely only on these tools. It’s hard to forecast risks. See this swing and miss on the house price bubble before the financial crisis. (Charts from a talk I’m giving later this month.)

But we must start somewhere. Attaching numbers to climate scenarios is important and something the Fed does better than anyone (even if that’s a woefully low bar).

Lending Facilities for Climate Investments.

Blue Sky: This is one the Fed must do only with new legislation from Congress. During the Covid-19 crisis, Congress told the Fed to set up two emergency lending facilities for state and local governments and medium-sized businesses. They helped stabilize those lending markets, but very few loans were made. (I wrote two pieces on the Municipal Liquidity Facility, here and here.) The programs were a proof of concept and first time the Fed lent directly to Main Street. They must be administered better next time, but we now know that it is possible. Good!

So, what would a permanent facility for climate-change related lending look like? Alex Yablon wrote an interesting piece, “Could Banking Magic Save Cities From Climate Disaster?” Here is a snippet:

“One way to avoid this circular debate on deficits, taxes and spending, while still undertaking a green transformation, is to provide states and cities with cheap, reliable low-cost loans that are easy to pay back. Fortunately, America’s central bank — the Federal Reserve — gave us a model of how this could work during the coronavirus crisis.”

Read the whole thing. He sketches out the proposal in more detail. My two cents on why the Fed could be a home for such a lending program:

“There’s an overarching reason a pilot program pushing the boundaries of federal financing could plausibly be pulled off. And it’s very simple. “It’s boring if it’s at the Fed,” Claudia Sahm told me. The central bank’s perceived nonpartisan super-competence would generate buy-in from Wall Street and insurers — something crucial, she said, for getting approval from Congress and maintaining any program’s permanence through election cycles.”

Boring gets the job done, but that’s not something everyone in Congress would like.

In the end, these financing proposals are all workarounds compared with the preferred option among some progressives: simply having Congress directly spend the money without using the private markets at all. It’s also true that opening the door wide on central-bank financing would provoke considerable opposition. And this defiance wouldn’t come just from top Republicans, like Senator Pat Toomey of Pennsylvania, who demanded the M.L.F.’s death this past winter. Some centrist Democrats would balk as well.

Still, Ms. Sahm, the former Federal Reserve economist, argued, “Toomey and others get exercised because the Fed is competent,” not because it isn’t. “They would get it done.”

So don’t hold your breath. That said, it’s undeniable that the Fed could be an effective set of pipes--better than going through the banking system---for such programs. But, much better would be Congress allocating money directly.

What wouldn’t do much good from the Fed?

The Fed has two primary tools: interest rates and bank oversight. Neither could likely do much to fight climate change.

Interest Rates.

Monetary policy is about the Fed pushing on interest rates. (THE FED DOES NOT CONTROL RATES. It works around the edges of markets.) Long-term interest rates are very low and have been trending down for decades. If we ain’t, as a country, investing enough in climate change (and we are not), it is not about financing costs.

Bank Regulation.

The Fed, along with other bank regulators, is broadly tasked with ensuring that banks meet “safety and soundness” and “fair consumer lending.” Note, these were the tools that the Fed should have used more during the house price bubble. The latter is one of the best they got for fighting inequality. Neither tools are perfect. The non-bank sector--often referred to as shadow banking, which the Fed does not have oversight continues to grow rapidly. Here’s a chart from a Wall Street Journal piece:

The Fed could use its bully pulpit more on non-bank issues and importantly, Congress could expand the regulators purview to include at least some of the larger non-banks. Eventually that could include climate-related regulatory policies--once we know more about which ones would be most effective.

Plus Congress has already charged the Fed and other agencies like Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency, which both need top appointments too, with many responsibilities. Ones that they could do better!

Here’s an infographic on how the regulation and supervision process works:

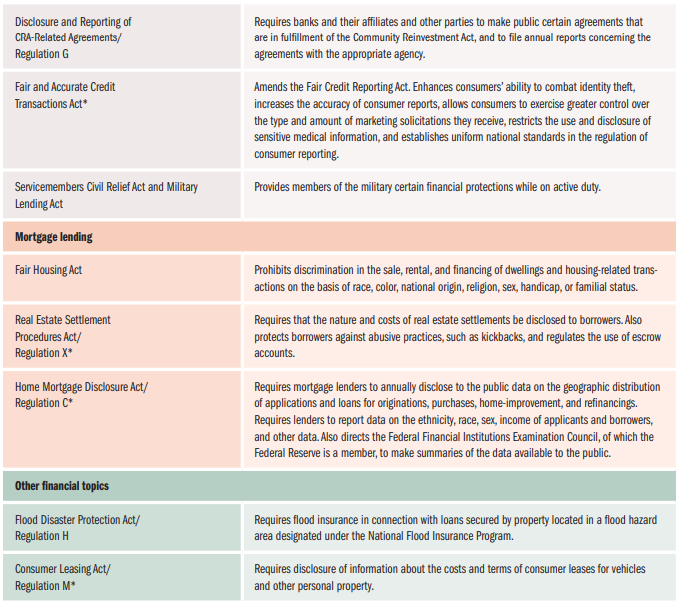

And a table on protection of consumer--one that Wells Fargo really needs to study or remain in regulatory purgatory forever. Disconcertingly, the smallest division at the Board is charged with these responsibilities. Priorities, people.

Adding climate change to the Fed’s regulatory and oversight mix before we know what’s most effective would be a mistake. We could get there but not yet.

Wrapping Up

I do NOT think the Fed should lead on economic policy to fight climate change. Congress should lead, and the Fed should follow as instructed.

Another post is coming soon from me on fiscal climate policy. I saw some super interesting research yesterday, and it’s a live topic on the Hill on how to craft legislation that effectively to fights climate change and supports the workers and communities that those policies might adversely affect.

Reminder: Stay-At-Home Macro now has paid subscriptions. See details here. Your financial support will help me write here regularly. Let’s bring the Fed to the people!

How long does the Fed stay "boring" when it gets wrapped up in climate change politics? The influence might be more likely to run the other direction.

Isn't maximum employment and a steadily increasing price level enough?