Don't tell people how to feel about inflation.

Everyone is worried about inflation. Of course, they are. We should never tell people how to feel, and that's true now more than ever. Policymakers must act.

Inflation is too high. People are angry when they pump their hard-earned paychecks into their gas tanks. Others are scared inflation will stay high, and they’ll have to cut back more and more. Maybe the stimulus checks and lower interest rates made them happy before, but that’s cold comfort now. Most of all, It’s insulting to tell people to buck up and smile.

Yesterday, I was a guest on the Colorado KOA News radio show. We talked about inflation, all about inflation. Here’s the five-minute clip:

One question I was asked is

Even if there are signs, and the data shows it’s getting better … Peope don’t feel it psychologically. How do you bridge that gap and tell them it’s better than you feel? … Even though this is tough right now, it’s still better than it could be could be?

My reply was blunt:

I will not tell people how to feel. Everybody looks at the world and they draw their own opinion. I talked wih policymakers recently and said very clearly. Yes, many poeple are back to work which is very different than past recessions. I told them no victory dance. This recovery is halfway done. Policymakers have got to do everything they can to get inflation down.

For over a decade, consumer sentiment surveys of people have shaped my thinking about the economy. I will never forget the economy is people. It’s the decisions that hundreds of millions of Americans and billions of people worldwide make every day, how they feel about their finances, how they think about where the economy matters. Listen to people, especially when they are angry.

People are not happy now. Not at all.

The mood is grim. The Surveys of Consumers, run by the University of Michigan, is the longest-running sentiment survey, started after World War II. When inflation picked up last year, sentiment took a nosedive.

Consumers are downbeat about their finances and the economy.

Source: Surveys of Consumers. The University of Michigan.

It’s not the worst—the 1981 recession when the Fed slammed on the brakes holds that dismal record—but it’s terrible now, and it’s much worse than before the pandemic, and it’s consistent with a recession. (We are not in a recession now! See my recent post.)

A big part of the decline in how people feel about the economy is higher gas prices. That’s always true. Of course, other prices are higher now, especially goods. The part of the survey about big purchases is at a record low:

About the big things people buy for their homes — such as furniture, a refrigerator, a stove, television, and things like that. Generally, speaking do you think, now is a good time or a bad time for people to buy major household items?

Consumers see higher prices and say now is not the time to buy

Source: Surveys of Consumers. The University of Michigan.

Consumers are not happy about how much it costs to buy things around the house. And some people have had to buy, even though they’d like to wait. That hurts.

Even so, as an economist, these views about buying are comforting. Price-sensitive patient consumers should short circuit an inflationary spiral. Back in the 1970s, when inflation was higher than now, people thought it was an excellent time to buy. An inflation mentality means that you should buy now if you believe prices will go even higher. That pushes inflation higher and higher. That’s not the mentality of consumers today. They see the prices and would like to wait until they come down.

It is not time for a victory dance.

I recently spoke to a large group of Democratic members of Congress. I was asked how they should tell their story; how to say to people to be happy about all the relief they got. The stimulus checks, the eviction moratorium, the pause on the mortgage and student loan payments, the extra money for the unemployed, and infrastructure.

I was steadfast. The Rescue Plan was a godsend, and it’s over. Now is not time for a victory lap. Half of Americans think you cannot govern the economy, no matter what story you spin. Yes, I said that! It’s time to do something. Move heaven and earth to get gas prices down, get the pandemic under control, and bury Putin.

And to those economists doing a victory lap because inflation is high like you said. Those who are trashing the Rescue Plan that you said was bad. Stop.

It’s disgusting to see you dance on the grave of the millions of loved ones we lost to Covid and Ukrainians being slaughtered. Show some respect. It is not about you.

At the Fed, I was taught, Never to brag when my forecasts are correct. Why? You could be lucky—as in, you got it right for the wrong reason. And even if you were suitable for the right reason, everyone knows, and you do not need to brag.

What to do instead? Roll up your sleeves and give the best advice you have on the long-term legislation that Congress must pass before the midterms. We must make investments in children, caregivers, the elderly, affordable housing, and the planet. Design and administer them well. And everyone must pay their fair share in taxes.

Economists are better at crunching numbers and suggesting policies than dancing.

Real people do not think like economists. Listen!

Why must economists listen to people? One reason is that economists do not think about inflation the way people do. I recommend reading this study, “Why do people dislike inflation?” by Bob Shiller in 1997. (Hat tip to Barry Ritholtz.)

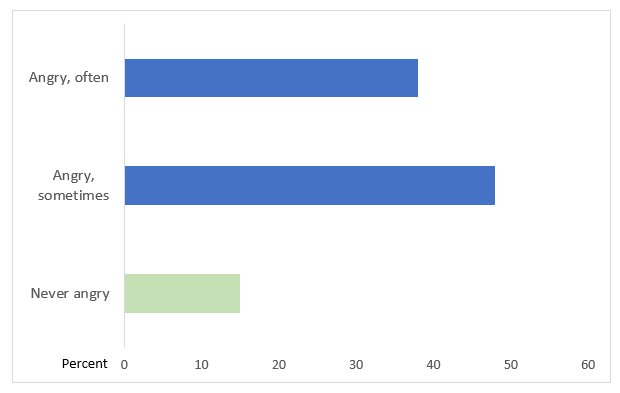

Bob asked people and economists a series of questions about inflation. The whole study is fascinating. First, it’s obvious how people feel about inflation:

When you go to the store and see that prices are higher, do you sometimes feel a little angry at someone?

Inflation makes people angry. Duh.

Source: Robert Shiller, 1997. Chart: Claudia Sahm.

One thing that caught my eye was angry “at someone.” People blame others like policymakers or often business owners for inflation. They do not blame consumers like themselves for buying so much stuff. Not surprising, but not Econ 101.

Here’s one of the interesting divides between people and economists:

Which of the following comes closer to your biggest gripe about inflation:

1. Inflation causes a lot of inconveniences: I find it harder to comparison shop, I feel I have to avoid holding too much cash, etc.

2. Inflation hurts my real buying power, it makes me poorer.

3. Other

People and economists disagree a lot on why inflation is bad.

Source: Robert Shiller, 1997. Chart: Claudia Sahm.

Uh, yeah. Now you could argue that people have it all wrong. Don’t do that. Remember, this post is about how people feel. One of the worst sins of economists and other elites is to project our thinking on people. That’s when we give terrible policy advice. It must stop.

You learn a lot when you listen. I promise.

Here’s my strategy. I listen to many podcasts, read the interviews with people in the press, and talk with people on Twitter. No, anecdotes are not enough, and they can mislead too. So, I hear a story and then look for it in the data. How many people have similar experiences? I also think about the models from my economist training.

Here’s an excellent example. Higher wages are not the only reason workers quit jobs and move to other ones. It’s about predictable hours and better working conditions like bosses who deliver on what they promise. Imagine that!

The predictable hours. That one bears out in the data. We do not have one labor market. You cannot apply for the jobs I involve in and vice versa. We have different skills and different constraints. I can’t imagine balancing being a mother with getting less than a day’s notice on when to show up to work. I cannot imagine paying my mortgage with my paycheck changing from week to week. Many Americans do.

If your employer sets your schedule, you often get little notice when

Source: Survey of Household Economics and Decisionmaking. Federal Reserve, 2018.

Yes, the cost of living is rising faster than wages for many people. For many, the dignity and security of work are increasing. The employment report each month won’t tell you that. There are some less frequent surveys to keep an eye on. It’s a big deal to have a predictable paycheck. A big deal that most elites take for granted.

So on your next walk or commute to work, turn on a pod talking with people, people who are not living a life like yours. Listen. Look around at the businesses and the people walking along the street or in the grocery. Then check the data.

Wrapping Up

The world is on fire. We are into the third year of the pandemic and the second month of the war in Ukraine. Gas prices are through the roof, and food will be in short supply soon in many parts of the world.

A humanitarian crisis on top of a humanitarian crisis is too much for anyone to bear. But we have had to. And then there’s the day-to-day reality of inflation. Do you want to tell people to cheer up and think about all the good things in the past?

Please don’t do it. People are hurt enough. No one needs to see you dancing. Get us out of this mess. Do something to make the world better. Then we will feel better.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economic policy. You will also receive some paid-only posts.

The views here are my own and do not represent the Jain Family Institute or my colleagues.

Good post Claudia. We need much much more of your voice.

A conversation with Tom Keene was phenomenal. And reckon eally impressive perspective!

To understand what you pointed out, I could not help but come to this site.

Whether I support your stand point or not, this viewpoint massively impressed me.

Massive thanks.

From South Korea