Don't make the Fed go it alone on inflation

The Fed is raising interest rates to cool off demand and bring inflation down. That's trading one hardship for another. The White House and Congress must get in the game and fight inflation too.

Today’s post shares some of my recent press on the Fed, inflation, jobs, and stimulus checks.

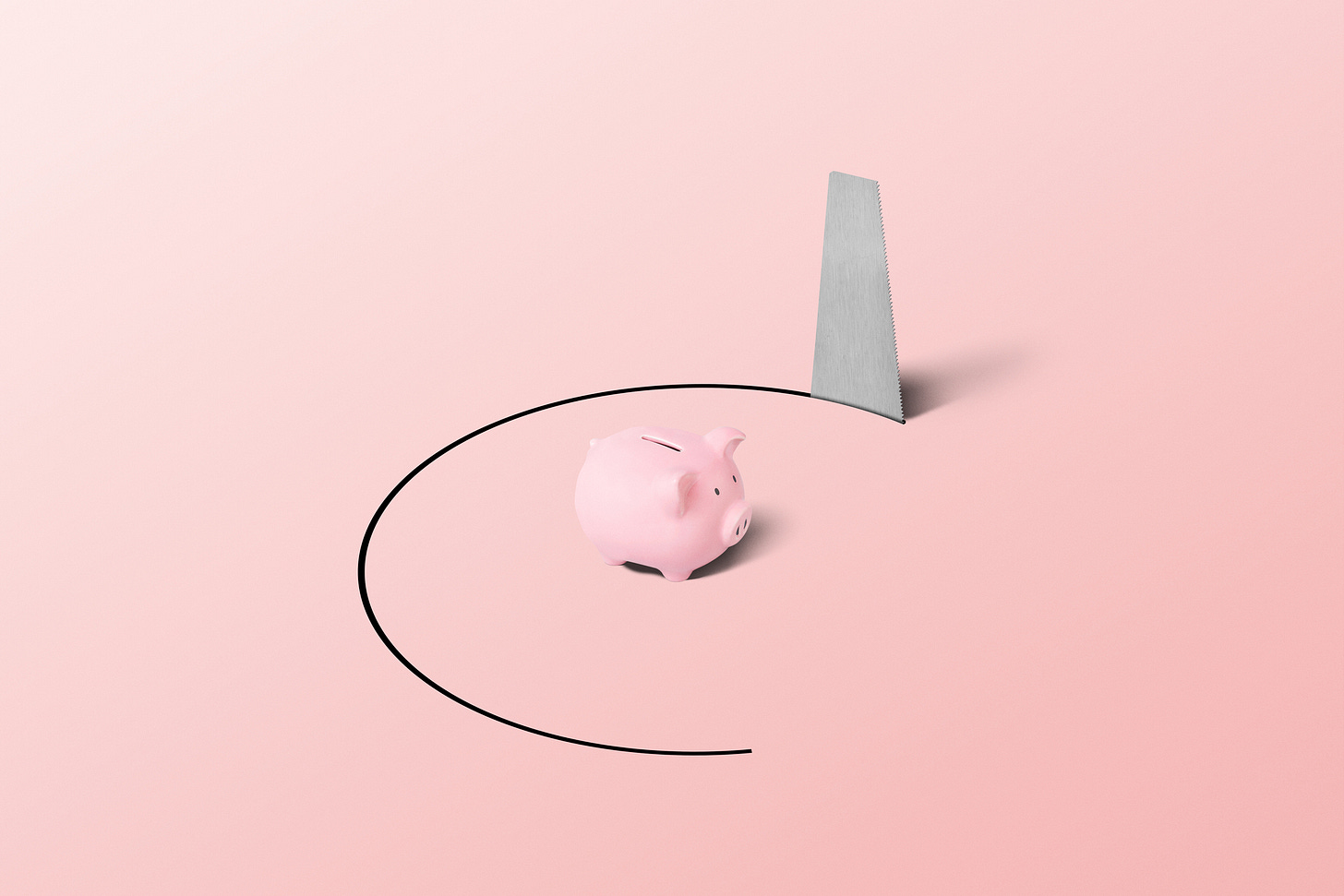

Source: Getty Images.

The White House and Congress must fight inflation too

The drumbeat of pessimism on the economy is nearly overwhelming. A recession is “inevitable;” a recession is “necessary.” No. That's misreading the Fed and, more importantly, missing how other policymakers should be acting.

To get inflation down, the Fed is using the one tool it’s called: interest rates. It is increasing interest rates to cool demand and, by doing so, lower inflation. But demand is not driving all the inflation. And according to a new analysis from the San Francisco Fed, demand is less than half of the inflation now.

The White House and Congress can help bring inflation down. Their tools are more plentiful and precise than the Fed’s. An urgent example is high gas prices. They are a hardship for many Americans, and the Fed cannot fix them even with a recession.

We don’t need a recession; we need action. We need action from Congress, the White House, and businesses. We need it now.

Read the entire piece. Here. (Click the X on the upper right corner of the paywall pop-up.) Or read my thread. I offer some ideas to lower gas prices and the consequences of making the Fed go it alone on inflation. Spoiler: they’re not good.

Those who have the least suffer the most from bad policy

And let’s get real. The Fed is trying to slow the economy to get inflation down. The pain of a slowing economy, even if we avoid a recession, will not be evenly felt. That is another reason why the White House and Congress must act too. Increasing supply to keep up with increasing demand is the best way to get inflation down.

The rapid recovery in the labor market—low unemployment, switching to better jobs, and higher wages, especially at the bottom—are the big wins of the recovery. Now, it’s time to protect that progress. And to get inflation down.

The entire segment is worth a listen. Here.

Prepare for the worst and fight for the best

Eventually, we will have a recession again.

We must be better prepared whenever the next recession comes—whether it’s next year or in ten years. The biggest lesson from the economic programs during the Covid crisis is not about their size but how poorly we administer relief programs. Our safety net, like unemployment insurance, is tattered and innovative policies in theory like the Payroll Protection Program were a complete mess in reality. It would be super if our current doomsayers would turn their energy toward preparation. With 12 to 18 months before the recession, as they expect, we could make meaningful improvements in programs.

I was asked recently if the stimulus checks would be used next time, given how controversial they are now. Without a doubt. Not because they are the best policy. The two above, if done correctly, would make stimulus checks largely unnecessary. We will have checks again because Congress in a crisis (not before or after) always does something, and sending out money to families is the only thing we do well.

Let’s channel all the fears about recession into action: Avoid it and prepare for it.

Barron’s has a paywall. Wanted to read your article.