Congress and the White House must 'move heaven and earth' to get gasoline prices down!

Gas is $5 a gallon. That's a dollar and half more than before Putin invaded Ukraine and two and half more than when the pandemic began. It's time to act, not make excuses.

Source: Getty Images.

In early March, only weeks after the war in Ukraine began, I spoke to a large group of House Democrats and implored them to take action to get prices at the pump down. It’s possible, and it’s urgent. I wrote a post at the time with some ideas. My thoughts on how to get gas prices down have evolved since then, mainly from listening to other experts. Here’s my new post.

In a crisis, there’s a saying, “Throw everything at the wall and see what sticks.” Ok, everything is too broad. Some policies should be thrown in the trash, not at the wall. Here’s the good, the bad, and the ugly for getting gas prices down.

The paths to lowering gas prices are increasing supply and lowering demand.

More supply comes from oil producers and refineries and less demand from fewer gallons pumped. Congress and the White House, especially Congress, which has the power of the purse, can help. The Fed cannot lower the demand for gas without creating a lot of hardship. It cannot print gasoline. It’s as simple as that.

The Good

Set a future price floor for oil producers to encourage production today.

The Biden Administration wisely opened up the Strategic Petroleum Reserve after Putin invaded Ukarine, releasing 1 million barrels a day. That helped push prices down, but ongoing turmoil overrode it. The Administration could now write contracts with domestic producers to refill the reserve in the future and guarantee paying a minimum price. As a result, with that certainty, domestic producers and their shareholders would have an incentive to expand supply now.

See Skanda Amarnath’s entire thread on ways to fight inflation. The actions that Congress and the White House could take go well beyond gasoline prices.

Encourage companies and instruct the government to allow work from home.

Getting Americans to drive less is really hard. Supposedly, during past efforts at rationing, it was the one thing that people worked hardest to cheat on. But there’s a good, popular way now: keep the Work from Home. Adam Ozimek is the first person I heard suggest it. The idea is spreading!

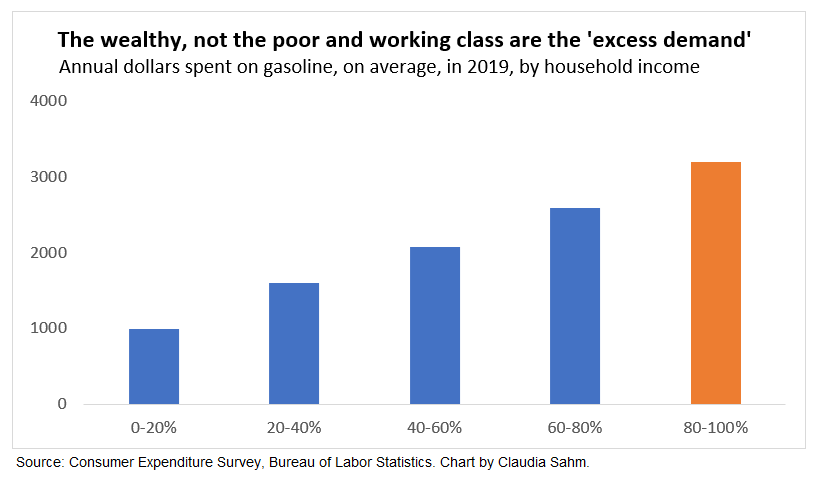

This one is somewhat inequitable. It would be a direct benefit for, often, higher-income workers who can work from home. Even so, it would indirectly benefit people who must commute to work by lowering the gasoline prices. Plus, higher-income people buy more than their fair share of gas so that they might ease demand noticeably.

Use this crisis as an opportunity to pass long-term energy legislation.

I am not an energy expert, so I won’t propose specific policies. Even so, as a human being, I know the planet is worth fighting for, and we need a sensible, sustainable path. We will end up in a mess again if we don't learn.

If not now, then when is Congress going to get a plan? Note, if this is a bad hurricane season like experts predict, we ain’t seen nothin’ yet with gas prices.

The Good-ish (Bad if Done Poorly)

Gas tax holidays or giving gas rebates to people.

It’s mostly a bad idea in the economics, but I am not entirely opposed to it as long as measures are also taken to increase supply and decrease demand. Lower-income families pay a higher share of their income on gas, so these prices at the pump hit them hardest. Plus, they are the least likely to have savings to get them through it.

It is somewhat gimmicky, would have a limited effect on gas prices, and would increase demand some. But at least the holiday would push down prices on the gas station signs some, and every ten cents count. Just don’t promise the moon. And if you send out gas rebates [like the stimulus checks], do not send them to the top 20%.

Tax the exceptional profits of energy companies now.

No surprise that with the sky-high oil prices, energy producers are making big profits, more than enough to make up for the dismal earnings in 2020. Taxing the profits now, which will likely be temporary, is popular with some in Congress. Olivier Blanchard, while disagreeing with the standard framing of price gouging, agrees that the taxes could be appropriate. (Note, is speaking more generally than energy.)

Theoretically, this approach could be good on various fronts, including lower demand more broadly among the shareholder class. But as Kyle Pomerleau points out, it’s unlikely we could pull off a sensible version in practice. See the thread.

The Ugly

Export bans would harm our allies and discourage U.S. production.

Part of the mess now with gasoline prices is due to Putin. Even though Russia is the second largest oil producer in the world, it was a relatively small portion of our imports. It is a massive share of Europe’s. (Natural gas is an even bigger emergency for them now.) Europe is cutting itself off from Russian oil in an attempt to punish Putin.

Source: Tyler Hicks, New York Times.

Europeans, our allies in this war, are enduring a lot of pain. DO NOT MAKE IT WORSE by reducing the U.S. oil and gas supply on global markets.

Deals with bad actors like Saudi Arabia, Iran, and Venezuela are dangerous.

A strong economy is important. Democracy and human rights are more important.

Source: Getty Images.

Giving up is the ugliest path of all.

The defeatism from some policymakers and advisers is crushing. I don’t get it. They fought hard against the freefall in 2020. That was not that long ago. Inflation is a big problem now and getting it down is essential to keeping all the progress with jobs.

Wrapping Up

Gasoline at $5 a gallon is too damn high. Gas prices have shot up two and a half dollars within two and a half years. We cannot expect Americans to cut their spending on gas that fast and buy electric cars. We need a sustainable long-term plan, and we need emergency measures now. There are good options. No magic wands and nothing perfect, but Congress and the White House can do more. They must do more!

Your financial support would be valuable and help me write here regularly. As a paid subscriber you will also receive a biweekly, deeper-dive post on the Fed and the economy.

most of these proposals would do very little for inflation in the short run and perhaps not even in the long run. so we are back to monetary policy as a blunt instrument.

1. Except for the price floor, you haven't mentioned the policies that would increase the domestic oil supply. Also, no mention of the policies that reduced the oil supply and caused the price hike before the war. There is a conflicting political goal of wanting less fossil energy. There were other conflicting political goals as well. Something has to give, and it did.

2. What makes you think that increasing taxes on oil profits wouldn't simply mean further price hikes to compensate for the extra tax cost?