Buckle up: the worst is yet to come

The global economy is deteriorating. It's time for the Fed to do the right thing: slow down or even better pause its interest rate hikes. It's going too big, too fast.

Today’s post is an investor talk I gave on October 13, 2022. Warning: it’s a dark one, as it should be. The world is moving rapidly to a dangerous place.

Source: Getty Images.

Key Takeaways

Downward pressure on future U.S. inflation is mounting from many sources.

The U.S. recession will likely be mild; Europe’s severe; China’s growth stagnant.

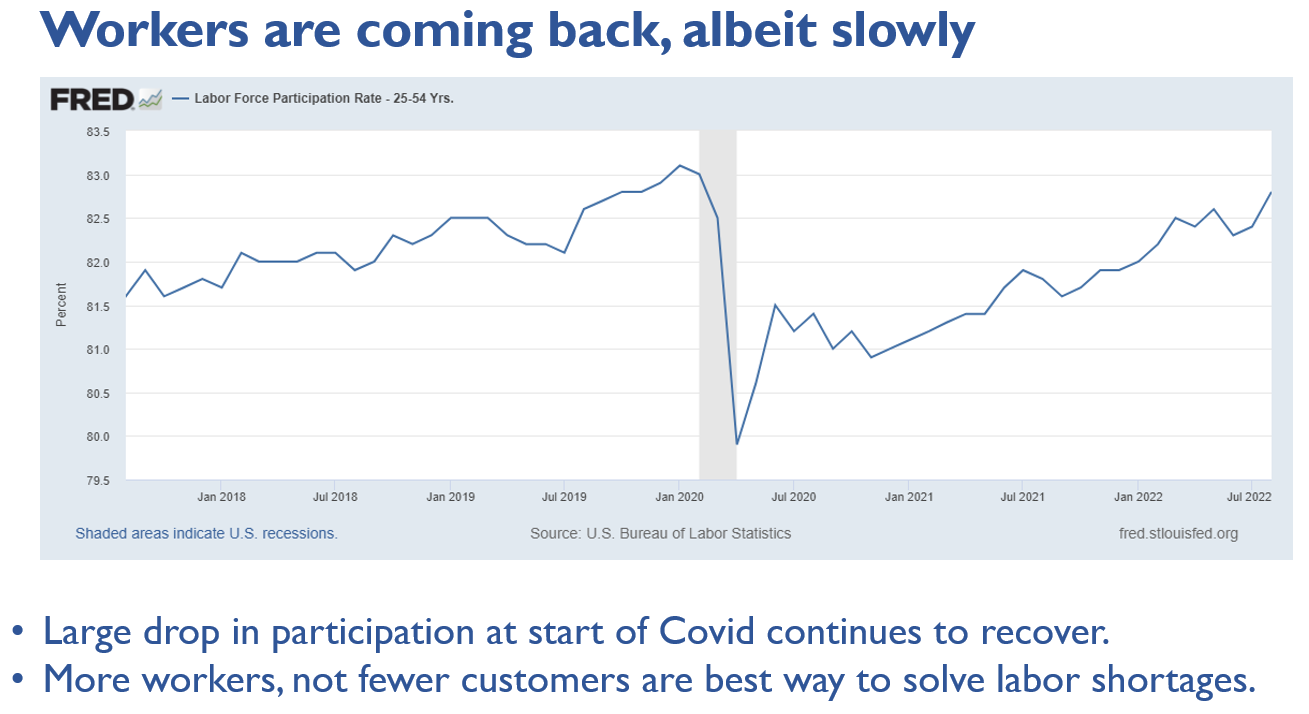

Why will it likely be milder in the United States? The strong labor market.

Fedspeak is starting, albeit too slowly, to be open about the global risks.

Here’s a 15-minute video of the introduction.

INFLATION! INFLATION! INFLATION

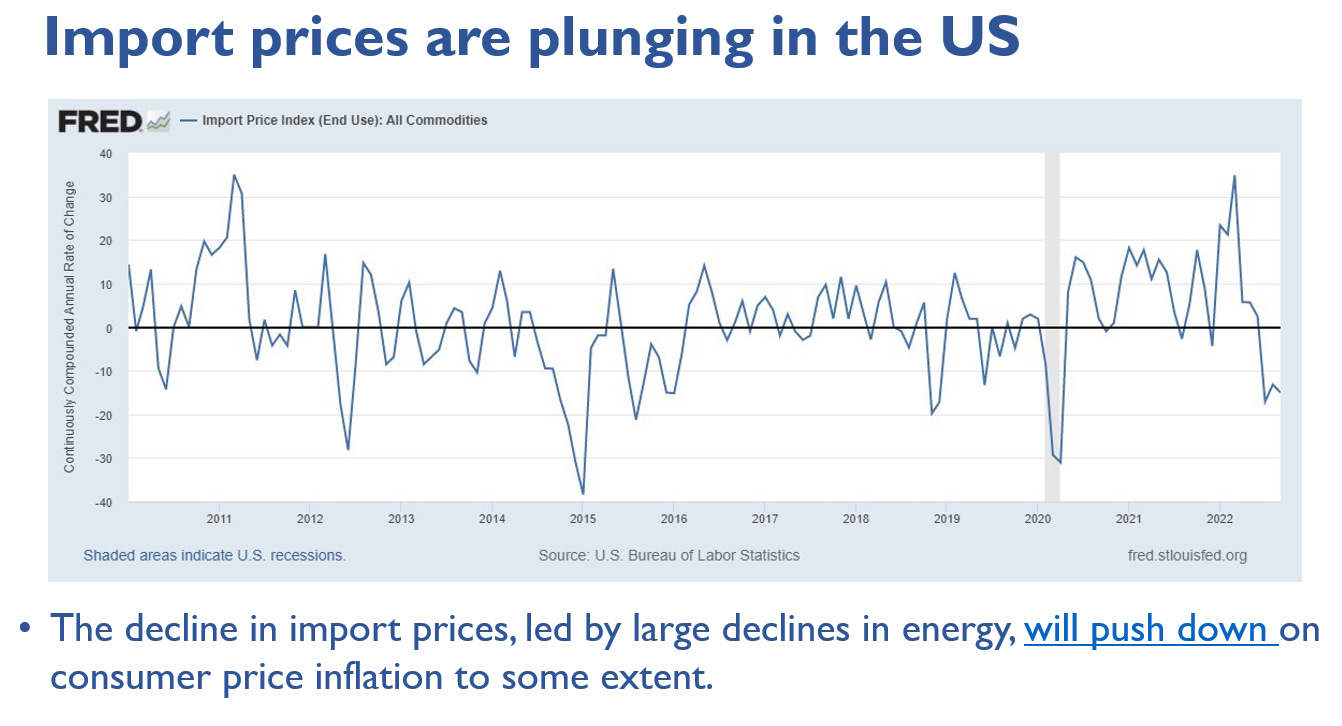

Consumer price inflation will come down in the United States, but it may not be soon enough to stop the Fed. The Fed must pick its head up and look at the data! Unlike last summer when a false hope that the vaccines would kill Covid—then came delta, Omicron, and a mind-numbing string of variants—and glimmers of supply chain easing caused a head fake on transitory inflation. Now we see a myriad of forces that will push down inflation. Taken together, they will be a lot of downward pressure. It’s uncertain how long it will take, but it will happen.

First, let’s level set the sources of inflation. Repeat after me: Covid and Putin are the roots of all evil. Today is not like the 1970s; it’s more like 1918. A pandemic and a war in Europe are calamities beyond living memory.

Central banks worldwide are justifying reckless tightening—fast and large increases in interest rates—with the specter of inflation expectations becoming “unanchored,” that is, people expecting inflation to be persistently high. It’s insane, especially in Europe. Central banks are on track to tank the global economy in the United States and abroad, causing immense human suffering and potentially undermining the war efforts on a fear that is nowhere in sight.

Now here are many sources of disinflation coming toward the U.S. economy.

RECESSION WATCH

We’re not in a recession but may get there. Two-quarters of a decline in GDP this year is not enough, especially given its drivers. The labor market is strong. No recession!

JOBS! JOBS! JOBS!

The bright spot is the U.S. labor market. Despite the Fed’s best efforts to cool it off in its ‘war on workers,’ we are adding jobs every month, people are getting raises, and there are opportunities for workers to get ahead in their careers. Now, it is not invincible. We sure better hope the labor market is as strong as the Fed complains it is when the full effect of the rate hikes hits the economy next year.

Faint glimmers of a pause at the Fed

I am a hopeful person. I believe the Fed will do the right thing, though the window is closing fast for it to matter. They must slow down, if not stop now. The U.S. economy will not withstand a severe European recession and stagnant growth in China. It will take time to come back to the United States, but it will. The Fed knows it will.

We finally see the Fed start to plant the seeds of a pause. The most encouraging was Vice-Chair Lael Brainard's speech last Monday, and it’s important to hear it come from her. Read the entire speech.

Hopeful-me expects 50 basis points at the Fed’s next meeting in early November. Realistic-me expects 75. Even so, big, new trouble overseas and any seizing up in U.S. financial markets will get you 50 or maybe even 0. I want the Fed to stop and be patient, but I don’t want to see the world events that would make it happen.

Wrapping up

The world is bad and will worsen at home and abroad before it gets better. I am not panicking. That is never productive. I am very worried, as are many economists I know, including former Fed officials, skilled real-world business economists, and several top academics. It’s time for the Fed to do the right thing and slow down too much is on the line if it doesn’t.

If you found my post helpful, please subscribe. I also greatly appreciate financial support for my Substack. In doing so, you will also allow me to pursue my unpaid policy advising and student talks. I am also writing posts on the Fed for paid subscribers, though admittedly, those are not coming out as regularly as I hope. I promise more soon.

Only the US government can stop inflation because it’s policies are what caused it. Want to stop inflation? Then it’s necessary to remove the friction in the global economic system. Putin and and covid aren’t the seeds of inflation, the government policy response to them are.

It remains more than worrisome that economists will name the two largest recent disruptions in the worlds economy, COVID and the war in Ukraine, yet not outright advocate for peace as the sane solution. The US knows Ukraine cannot win a war against Russia, and should be facilitating peace, not arming them further. Only peace will bring the stability needed.

Just as the Fed is using the wrong tools to address inflation, the US is using the wrong tools to address the conflict in Europe.