Big fiscal is a big win for Americans

The past four years have been a mix of tragedy, fear, anger, and recovery. We're so close to the other side of it, and most families are even better off financially. How? A big reason is big fiscal.

In the first year of the pandemic, Congress—from the CARES Act to the American Rescue Plan—sent out about $5 trillion (almost 25% of GDP) in relief to families, the unemployed, businesses, and states.

The three rounds of stimulus checks alone for a family of four totaled $11,400—almost one-fifth of the median family income or one-quarter of the Black median family income. It was a massive ‘swing for the fences’ relief and stimulus that met the massive upheaval due to Covid in people’s lives and the economy head-on. Soon after Congress enacted CARES in the spring of 2020, the unemployment rate peaked at nearly 15%. At the time of the Rescue Plan, in the spring of 2021, the unemployment rate was over 6%. That’s bad. Going big, fast, and broad was critical.

As with any program enacted during a crisis, CARES through the Rescue Plan could have been better designed and administered. However, Larry Summers’ criticism in March 2021 of the Rescue Plan as “the least responsible fiscal macroeconomic policy we have had for the last 40 years” was way off base, particularly given the shortfalls of the American Recovery and Reinvestment Act in 2009 that he oversaw as the Director of the National Economic Council in the Obama administration.

In today’s post, I focus on the wins of the big fiscal, especially the Rescue Plan, in the Biden administration. (Fiscal policies in the Trump administration, including CARES, were also important.) Why? Comparable big fiscal programs, as under Biden, were entirely missing after the Great Recession and among our peer countries this time.

Some themes here are also in my Bloomberg Opinion piece, “Bidenomics Is an Easy Sell If Presented Broadly Enough," last week. Maddeningly, the Biden White House has not forcefully defended its big fiscal, especially the Rescue Plan. It’s as if when inflation surged in 2022, the White House bought into Larry Summers’ story and went dark on the Rescue Plan. Nothing could be further from the truth than Larry. Yes, the Rescue Plan contributed modestly to inflation, but Covid and then Putin did the most harm. Above all, and as is clear now, the relief and stimulus were crucial. Regardless of one’s politics or prior views, we must learn the right lessons and identify the actual mistakes in fiscal policy so we do better in the next recession.

Big fiscal was a big win for workers.

Undeniably, workers and their families are the big winners from big fiscal, especially those at the bottom. That’s the exact opposite of the Great Recession and its long, slow recovery. But there are many other differences between the two crises, so let’s look at this time on its own merits. Noting also that big fiscal was a big contributor to the strong labor market recovery, but not the only one.

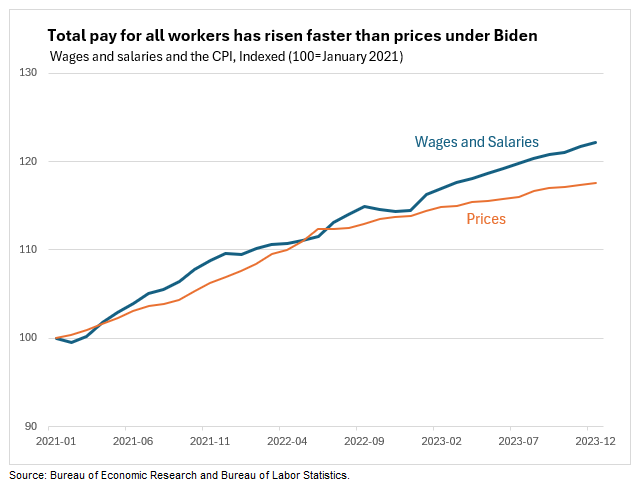

When considering the labor market, it's important to use a wide lens. There is a ‘cottage industry’ arguing whether the increase in hourly wages since Biden took office is larger than the increase in overall consumer prices. Many (myself included) argue that the unemployment rate below 4% for almost two years—the longest stretch since the 1960s—is a win for big fiscal.

That’s all true, but it’s too narrow. You didn’t have to get a bump to your hourly wage or narrowly avoid unemployment to benefit from this labor market. If we look at all 160 million workers, the total value of their paychecks is up 22% under Biden — almost five percentage points more than overall price increases. That reflects pay increases, better jobs, more hours worked, and more jobs. That’s not every worker’s paycheck, but it is many millions, and that’s extremely important for families.

Far more people now have paychecks and are typically stranded on the sidelines of the labor market. For example, the highest share of women in their prime working years, or 75%, now have jobs. Black men and people with disabilities also made historic gains. In total, there are 11 million more people with jobs under Biden.

Some of the progress puts us in an even better place than before Covid.

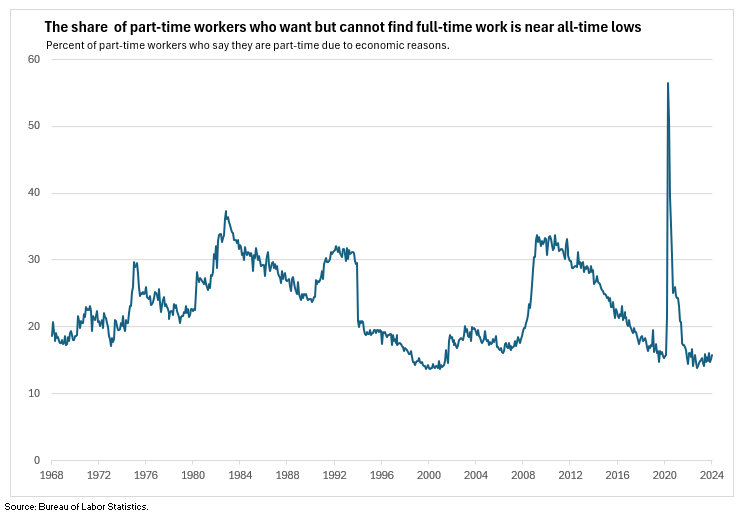

and coauthors have research showing the current full-employment economy has reversed a substantial portion of the decades-long rise in wage inequality; see also (and subscribe to) Arin’s new Substack:Finally, some point to the recent increases in part-time jobs as a sign that the labor market is faltering. Not at all. Yes, the part-time jobs are catching up with the rapid gains in full-time jobs earlier in the recovery, but it’s almost entirely by choice. The fraction of people working part-time who say they are doing it because they can’t find a full-time job or due to bad economic conditions is near all-time lows.

This is not a horserace between jobs and inflation to score political points; the labor market has been (and always is) crucial for Americans trying to make ends meet. They are. Even after subtracting out the higher prices, the ongoing strength in consumer spending in recent years backs up the claim that—despite the frustration—most families are handling higher prices with bigger paychecks. Other forms of relief, like stimulus checks, also have supported spending. (People on Social Security always have cost-of-living adjustments to their benefits.) Big fiscal helped kickstart the labor market recovery, and now the virtuous cycle between workers and consumers has us on the path to a ‘soft landing’ of low inflation and low unemployment.

Big fiscal has put us ahead of our peers.

We (thankfully) will never see the US without the big fiscal during the Covid recession and recovery, so we will never be sure how important fiscal policy was, both as a cause of inflation and a cause of jobs. Put in technical jargon: we never see the counterfactual. For years to come, macroeconomists will use every tool we can dream up to try to answer these critical questions.

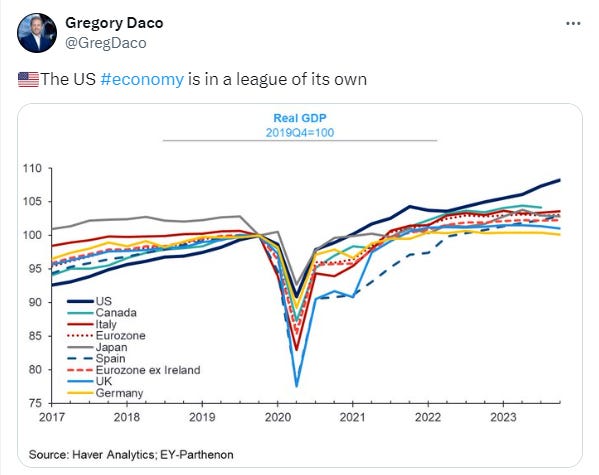

A straightforward comparison we can make is our recovery relative to our peer economies. Of course, cross-country comparisons are tricky. The pandemic was global, but energy shocks due to Putin invading Ukraine differed across countries. And, structurally, the economies differed before the pandemic.

All that said, Greg Daco nails it: “The US economy is in a league of its own.” The US recovery is far ahead of other countries. The fact that the US is the only one that had a Rescue Plan and then three investment packages is almost certainly playing a role.

Looking at inflation in other countries also suggests that we would have had high inflation in the US without the Rescue Plan, too, though likely somewhat less. However, the growth in GDP and, as we saw above, total paychecks more than outpaced inflation. In contrast, other countries, like Germany and the UK, are on the edge of or possibly already in a recession. The US is decidedly not in a recession, and while that’s no guarantee for the future, strength now offers some protection.

Big fiscal is powerful and must do better.

A key lesson from this crisis is that fiscal policy is much more powerful than monetary policy. With great power comes great responsibility. It’s a lesson that macroeconomists must learn and devote more time to the nuts and bolts of fiscal policy, even though it’s inherently more tied to politics than the Fed.

One area that I continue to work on is making direct payments (stimulus checks) automatic in recessions by tying them to economic conditions. Many standard programs in recessions, like stimulus checks or enhanced jobless benefits, could become automatic stabilizers, with Congress agreeing ahead of time on the size, administration, and triggers on/off. Our experience during the pandemic showed how politics and a lack of preparation can diminish the quality of fiscal policies. Here, I discuss the issue for the Institute of New Economic Thinking.

In closing.

Big fiscal was absolutely central to the strength of the US economy now, especially in the labor market. Putting it all together, most Americans got through the pandemic in a better place financially, especially those on the margins. That’s a stunning victory. There is more work to do, and it is important to take the win.

PS: Apologies for the lack of posts in the past two weeks. I had short weeks with the National Association of Business Ecnomics Policy conference and then my youngest brother’s wedding. I will make it up in the coming weeks.

Big fiscal in the face of fierce Monetary winds too.

You rock, Claudia! Awesome piece!