All the rumors are true, yeah. We can afford it!

Recent events ignited a fierce arguments among economists about the federal debt. It's a critical debate, and it's critical the U.S. government invests more in our people and our planet immediately.

On Sunday, Jeanna Smialek at the New York Times threw the debate among economists about the federal debt into a five-alarm dumpster fire.

Source: My words, partly. Link.

I dive right into the debate, featuring Paul Samuelson, Joan Robinson, and Lizzo. If you prefer the #EconTwitter version, here’s my inspiration thread.

A peek into Harvard Ec10

Thanks to Jason Furman for trying to divert our attention from the dumpster fire—see my post on what that is—and turn our attention back to economics.

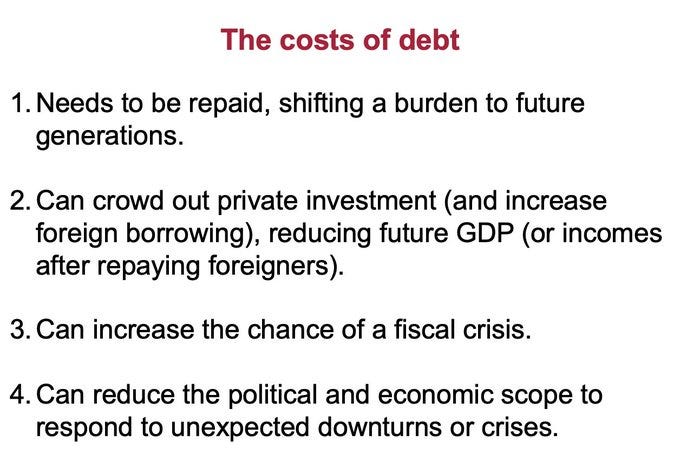

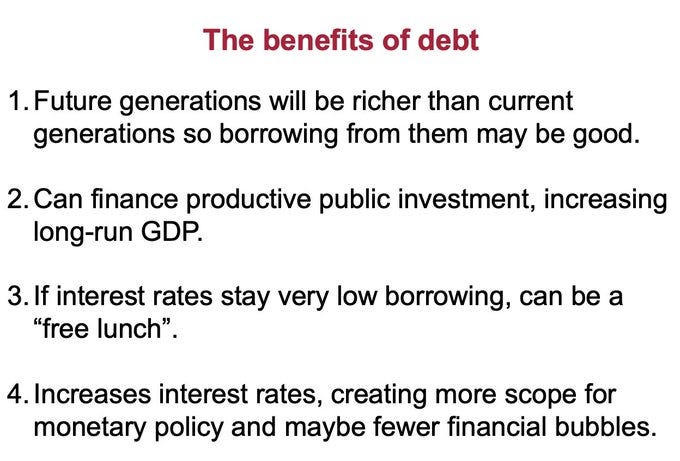

Yesterday Furman posted slides from his Harvard Ec10 class. (Before him and David Laibson, the intro econ class, one of the largest undergraduate courses at Harvard, was taught by Greg Mankiw and Marty Feldstein before him. Think about that.)

Here are Furman’s slides, which he tweeted with an invitation to discuss! Yes, let’s.

Someone DMed me the slides, and my quick reaction was largely neutral. Most of the bullet points have “can” in them. Given the dumpster fire on #EconTwitter, I was thrilled to see Jason trying to get us back to work.

But then someone else, a few hours later, DMed me this tweet. Oh my.

No sir. The federal debt of the United States does not ever be “need to be repaid.” Not by this generation and not, God willing, by ours a million years from now.

That ‘Zombie of Macro’ is killing our future.

Many prominent people spout this nonsense about that the federal government, that is, the American taxpayers, in the future will have to pay back what Congress borrows today. The powerful wail the federal debt will ruin the lives of our children and grandchildren and so on.

You can find the misinformed everywhere from the local diner (Hardees to French Laundry) to the C-suite ( J.P. Morgan Chase to The Dollar Store); the halls of Congress (Republican and Democrat). Sadly, too many hold degrees from Harvard and were students of Marty and Greg back in the day.

Worst of all, this falsehood is holding America back. The proof is clear. Congress for generations has used the “we can’t afford it” trope as an excuse not to invest in our people, our infrastructure, and our planet. That’s the bill that we should fear.

Uncle Sam is not your uncle.

The most problematic form of the trope about the federal debt—which many policymakers and the 1% weaponize—is the metaphor of a family that needs to live within its means. The federal government is NOT like a family, a small business, a corporation, or a state/local government.

Uncle Sam can borrow. He does not have a 'credit limit.' his loans cannot be called.

Repeat, after me, CONGRESS IS NOT A FAMILY. Whew. Could you imagine Thanksgiving dinner? Again, it’s a good thing it’s not family. The federal government can borrow and invest in our future, AND you don’t have to pass the gravy.

Yes, the government pays interest. It services its debt. That's it. If we want it, we can pay for it. Again, Congress must invest in our people and our planet.

How does the government borrow? It sells U.S. Treasury bonds. Some buyers are Americans, some from other countries, some pension funds, some university endowments, etc. Regardless, these investors are currently willing TO PAY (after inflation) TO LEND from the U.S. government. Give 'em what they want.

Listen to Larry’s uncle. Srsly!

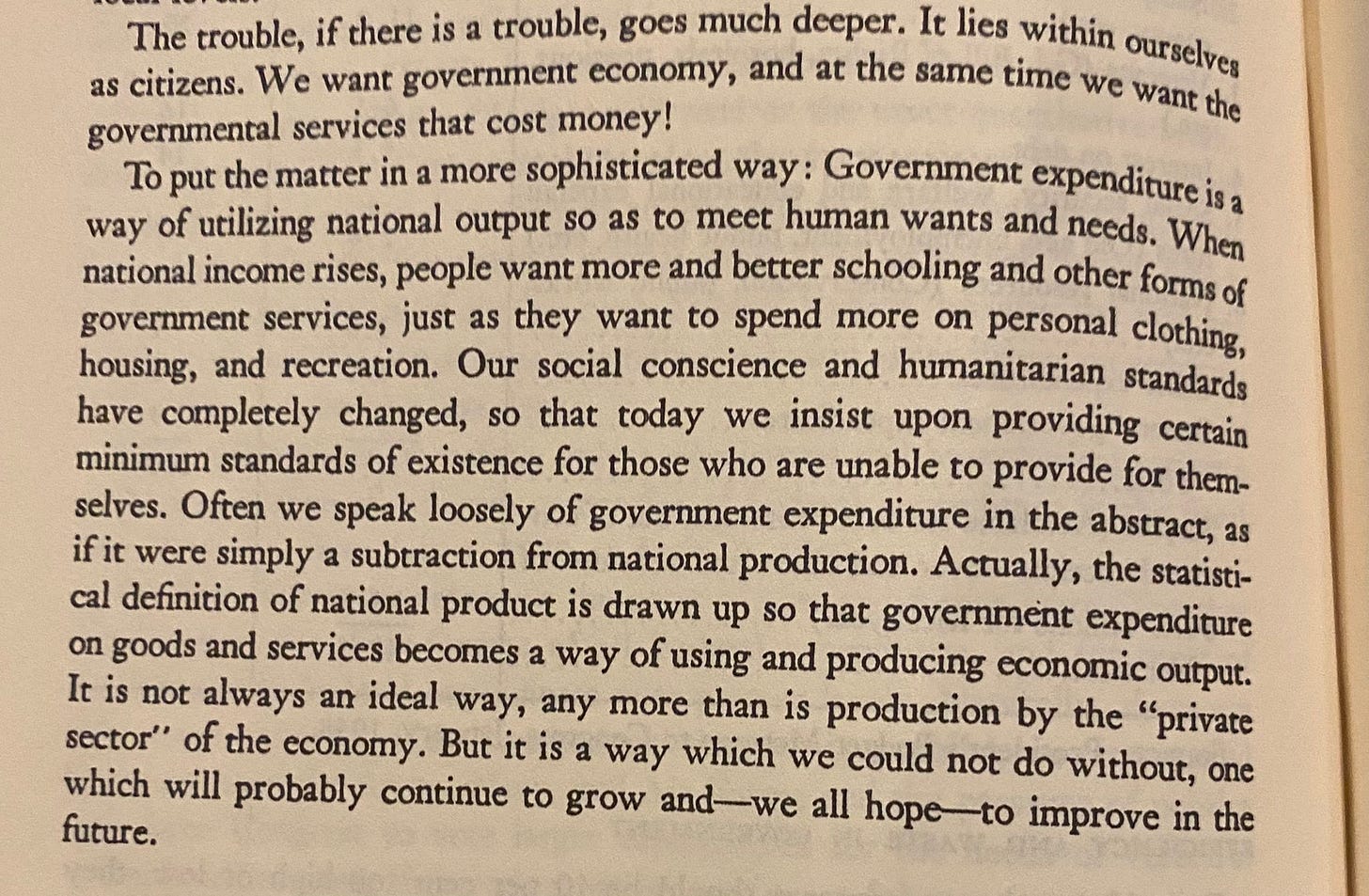

I PICK UP A BOOK when I wake up exhausted from yesterday’s #EconTwitter battles. Today’s was Economics, the 1948 edition of Paul Samuelson’s textbook. Samuelson is a giant in economics and Larry Summers’ uncle. (Ken Arrow is another. Imagine their Thanksgiving!) tl;dr Paul S. agrees with me.

It's not the size that matters; it's what you do with it.

Above all else, we must center debates about the U.S. federal debt in terms of what we will do with the money that the government borrows.

Government expenditure is a way of utilizing national output so as to meet human wants and needs … Our social conscience and humanitarian standards have completely changed, so that today we insist upon providing certain miniumum standards of existence for those who are unable to provide for themselves.

Paul Samuelson, 1948

LISTEN TO PAUL SAMUELSON! LISTEN TO SENATOR BENNET! LISTEN TO THE MILLIONS OF CHILDREN WHO WENT HUNGRY LAST NIGHT!

Costs exist to spending. Need to pay back is not one.

Paul Samuelson discusses three ways the country can finance government spending:

Raise taxes.

Print money.

Borrow.

Each comes with pros and cons. Paul correctly sets the discussion of costs within a full-employment economy. It’s ONLY when all our resources, people, and capital, are fully utilized costs arise. That’s when financing more government spending may cause costs, whether inflation or allocation of resources away from the private sector.

Newsflash: the U.S. economy has not been at full employment. EVER. Even so, let’s look at what the costs of deficit financing are when we reach nirvana.

Here’s what Samuelson says about deficit financing at full employment.

People with savings are GLAD to subscribe for government bonds rather than have to hold their wealth all idle or in the form of private securities.

Paul Samuelson, 1948

Equally, important, there is NEVER any possibility that the [U.S.] government—which has complete powers to issue new currency would ever be unable to pay off the holders of government bonds IN FULL.

Paul Samuelson, 1948

Okay, Paul S. agrees that Jason should edit that first bullet point. Reverse it. “Does not need to pay back.” or at least “Can always pay back in full, if needed.”

Macro men are from Mars. Macro women are from Venus.

Believe it or not, debates over macroeconomics have included women and men fighting since time immemorial. Paul S. correspondence with Joan Robinson, a legend of economics then, are LIT. Paul Samuelson was no exception. Bob Solow same.

Stephanie Kelton is carrying the torch. I love Robinson’s style too! Back then, it was not all in private. Same now. Macro men (and women) are worse in private.

In public back then, there was some seriously sexist shit in Samuelson’s 1948 textbook (reflecting the times and his biases). This one is WOW! Read by generations of could-be economists, women, and men.

Progress is very slow. Ask Greg Mankiw about Paulina Volcker. Or see my post yesterday. And progress DOES happen. Samuelson’s “Ruefully yours” is the classiest. sign off I have ever seen from a macro man. Ok, it would be if I had ever seen any.

Even #PuffiSays got mad. Smart kitty.

Wrapping Up.

Listen to Stephanie Kelton. Listen to me. Listen to Lizzo. Most of all, listen to the people. All the rumors are true, yeah. We can afford to invest in our people, all of them, and our planet. We must, or we will all be poorer for it.

BREAKING GREAT NEWS!!!!!

Susan Collins (the economist) will be the next President of the Chicago Fed. So, two amazing economists, she and Lisa Cook, who also happen to be Black women, will with a very high likelihood be voting at the FOMC in July.

And Jay Shambaugh is rumored to (he WILL be) the nominee for Under Secretary of International Affairs at Treasury. An excellent pick. Excellent.

They all have devoted their careers to the best policy and, lucky me, are mentors. Jay was one of the best bosses I have ever had. You know how I feel about Lisa. Amazing. Susan gave me the best advice when I was a research assistant over twenty years ago.

It’s been a rough week, but it’s Wednesday, quitting time. Celebrate and rest up tomorrow is the CPI. Ugh. We have more work to do. Let’s do it.

Please consider financially supporting my Substack with a paid subscription. You will help me to write regularly about economic policy. You will also receive some paid-only posts.

The views here are my own and do not represent Jain Family Institute or my colleagues.

Love your discussion of Joan Robinson and Samuelson. I studied econ at Cambridge (Eng) in the early 70s and had the privilege of meeting her a few times. Loved her writing - for the most part not formally mathematical in the sense of equations but absolutely rigorous, reading it was like trying to solve a puzzle. Great injustice she never got the Nobel

Typo: "CHILDREN WHO WENT TO BE HUNGRY"